- China

- /

- Consumer Durables

- /

- SHSE:600983

Discover November 2024's Leading Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed economic signals, including record highs in U.S. indexes and geopolitical tensions, investors are keenly observing the Federal Reserve's upcoming decisions on interest rates. Amidst this backdrop, dividend stocks remain an attractive option for those seeking steady income streams and potential capital appreciation. In light of current market conditions, identifying robust dividend stocks involves assessing companies with strong fundamentals and consistent payout histories that can weather economic uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.31% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.60% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.45% | ★★★★★★ |

Click here to see the full list of 1963 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Whirlpool China (SHSE:600983)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Whirlpool China Co., Ltd. focuses on the research, development, procurement, production, and sale of kitchen appliances both in China and internationally, with a market cap of CN¥7.20 billion.

Operations: The company's revenue primarily comes from the manufacture and sale of consumer electrical appliances, amounting to CN¥3.56 billion.

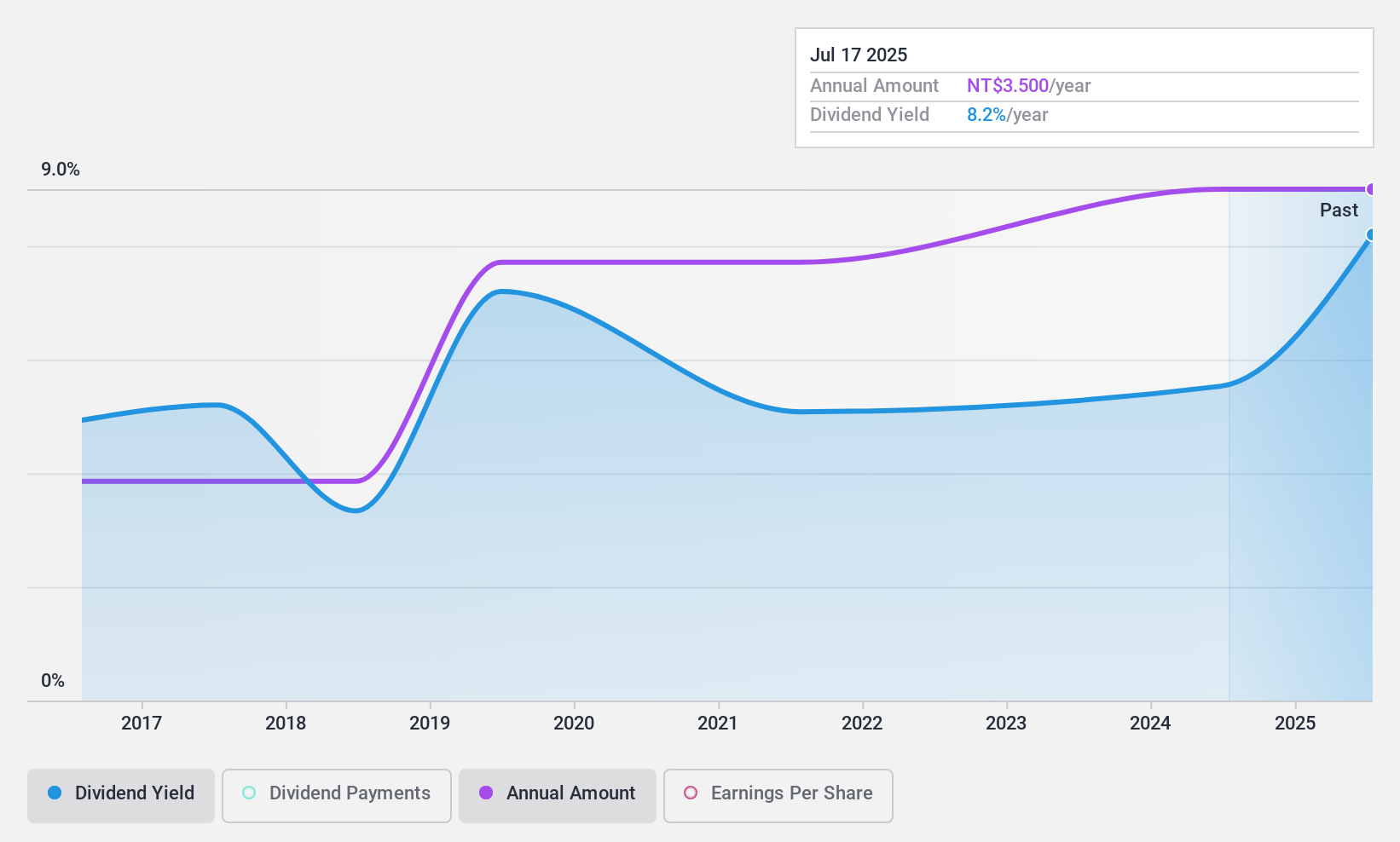

Dividend Yield: 8.4%

Whirlpool China's dividend yield of 8.39% is among the top 25% in the Chinese market, but its sustainability is questionable due to a high cash payout ratio of 306.5%, indicating dividends are not well covered by free cash flows. Despite a reasonable payout ratio of 50.6%, earnings growth remains modest at 2.3%. Dividend payments have been volatile and unreliable over the past decade, with significant fluctuations impacting their stability and reliability for investors seeking consistent returns.

- Unlock comprehensive insights into our analysis of Whirlpool China stock in this dividend report.

- The valuation report we've compiled suggests that Whirlpool China's current price could be inflated.

Li Ming Development Construction (TPEX:6212)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Li Ming Development Construction Co., Ltd. (TPEX:6212) operates in the construction industry with a market cap of NT$5.99 billion.

Operations: Li Ming Development Construction Co., Ltd. generates its revenue primarily from the Real Estate Development segment, which accounts for NT$7.58 billion.

Dividend Yield: 6%

Li Ming Development Construction's dividend yield of 5.96% ranks it in the top 25% of TW market payers, but its reliability is hampered by a volatile nine-year payment history. Despite strong earnings growth of TWD 390.6 million last year, profit margins have declined to 10.4%. The dividends are well-covered by both earnings and cash flows, with payout ratios at 45.4% and a low cash payout ratio of 9.2%, respectively, suggesting sustainability despite past volatility.

- Click to explore a detailed breakdown of our findings in Li Ming Development Construction's dividend report.

- The analysis detailed in our Li Ming Development Construction valuation report hints at an deflated share price compared to its estimated value.

Chugai Ro (TSE:1964)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chugai Ro Co., Ltd., along with its subsidiaries, specializes in developing thermal technology solutions both in Japan and internationally, with a market capitalization of ¥23.64 billion.

Operations: Chugai Ro Co., Ltd.'s revenue is primarily derived from its Heat Treatment Furnace segment at ¥16.28 billion, followed by the Plant segment at ¥9.51 billion and Development segment at ¥2.68 billion.

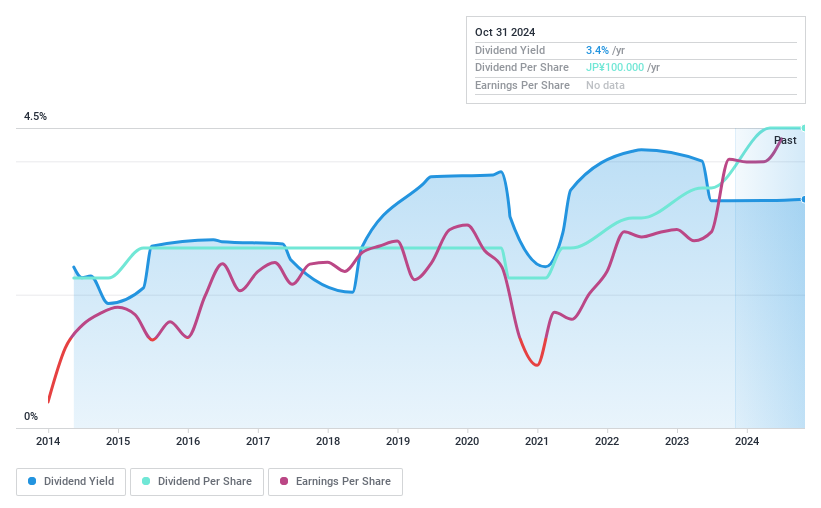

Dividend Yield: 3.7%

Chugai Ro offers a dividend yield of 3.73%, slightly below the top tier in the JP market. While dividends have been stable and growing over the past decade, they are not covered by free cash flows, raising sustainability concerns despite a low payout ratio of 30.1%. Recent news indicates an increase in year-end dividend guidance to ¥120 per share, reflecting management's commitment to maintaining shareholder returns amidst financial challenges from large one-off items.

- Click here and access our complete dividend analysis report to understand the dynamics of Chugai Ro.

- Our valuation report unveils the possibility Chugai Ro's shares may be trading at a premium.

Where To Now?

- Navigate through the entire inventory of 1963 Top Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Whirlpool China might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600983

Whirlpool China

Engages in the research, development, procurement, production, and sale of kitchen appliances in China and internationally.

Flawless balance sheet average dividend payer.