- China

- /

- Consumer Durables

- /

- SHSE:600839

Pinning Down Sichuan Changhong Electric Co.,Ltd.'s (SHSE:600839) P/E Is Difficult Right Now

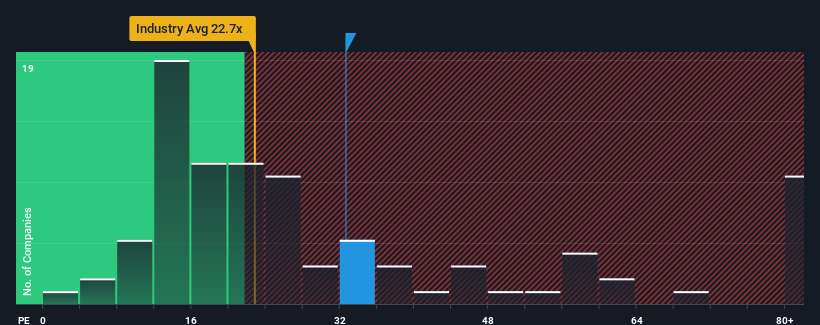

With a median price-to-earnings (or "P/E") ratio of close to 30x in China, you could be forgiven for feeling indifferent about Sichuan Changhong Electric Co.,Ltd.'s (SHSE:600839) P/E ratio of 32.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Sichuan Changhong ElectricLtd certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Sichuan Changhong ElectricLtd

How Is Sichuan Changhong ElectricLtd's Growth Trending?

The only time you'd be comfortable seeing a P/E like Sichuan Changhong ElectricLtd's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 111% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

This is in contrast to the rest of the market, which is expected to grow by 36% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Sichuan Changhong ElectricLtd's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Sichuan Changhong ElectricLtd currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Having said that, be aware Sichuan Changhong ElectricLtd is showing 2 warning signs in our investment analysis, you should know about.

You might be able to find a better investment than Sichuan Changhong ElectricLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600839

Sichuan Changhong ElectricLtd

Researches, develops, manufactures, and sells consumer electronics products in China and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives