- China

- /

- Professional Services

- /

- SZSE:301270

Revenues Tell The Story For Beijing Hanyi Innovation Technology Co., Ltd. (SZSE:301270) As Its Stock Soars 28%

Beijing Hanyi Innovation Technology Co., Ltd. (SZSE:301270) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 45% in the last year.

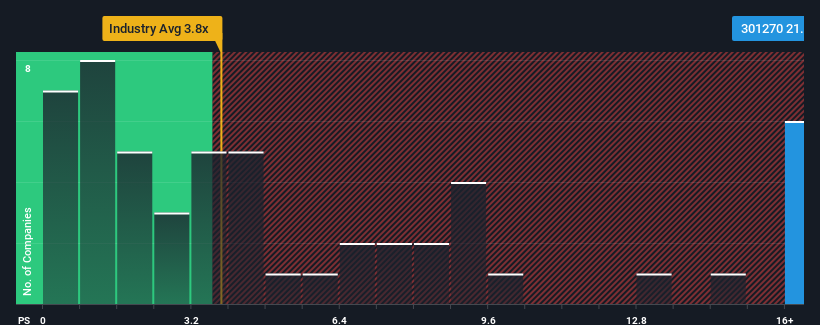

After such a large jump in price, Beijing Hanyi Innovation Technology may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 21.3x, when you consider almost half of the companies in the Professional Services industry in China have P/S ratios under 3.8x and even P/S lower than 1.5x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Beijing Hanyi Innovation Technology

How Has Beijing Hanyi Innovation Technology Performed Recently?

While the industry has experienced revenue growth lately, Beijing Hanyi Innovation Technology's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Beijing Hanyi Innovation Technology will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

Beijing Hanyi Innovation Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 8.8% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 7.5% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 47% as estimated by the sole analyst watching the company. With the industry only predicted to deliver 25%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Beijing Hanyi Innovation Technology's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Beijing Hanyi Innovation Technology's P/S Mean For Investors?

Beijing Hanyi Innovation Technology's P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Beijing Hanyi Innovation Technology maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Professional Services industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You need to take note of risks, for example - Beijing Hanyi Innovation Technology has 5 warning signs (and 3 which are concerning) we think you should know about.

If you're unsure about the strength of Beijing Hanyi Innovation Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Hanyi Innovation Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301270

Beijing Hanyi Innovation Technology

Beijing Hanyi Innovation Technology Co., Ltd.

Flawless balance sheet moderate.

Market Insights

Community Narratives