- China

- /

- Professional Services

- /

- SZSE:300989

Revenues Not Telling The Story For LAY-OUT Planning Consultants Co. Ltd. (SZSE:300989) After Shares Rise 43%

LAY-OUT Planning Consultants Co. Ltd. (SZSE:300989) shareholders have had their patience rewarded with a 43% share price jump in the last month. Unfortunately, despite the strong performance over the last month, the full year gain of 9.8% isn't as attractive.

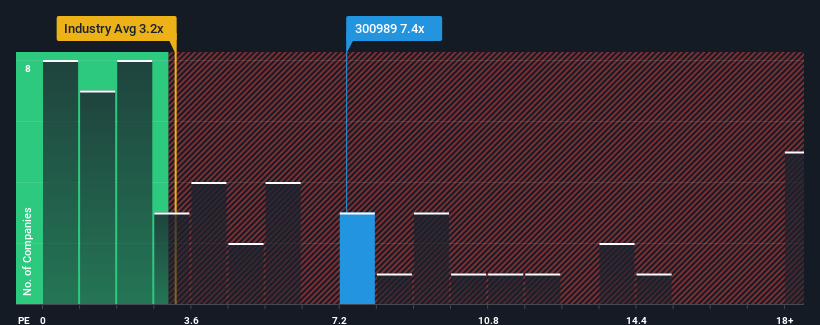

Following the firm bounce in price, you could be forgiven for thinking LAY-OUT Planning Consultants is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 7.4x, considering almost half the companies in China's Professional Services industry have P/S ratios below 3.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for LAY-OUT Planning Consultants

How LAY-OUT Planning Consultants Has Been Performing

We'd have to say that with no tangible growth over the last year, LAY-OUT Planning Consultants' revenue has been unimpressive. One possibility is that the P/S is high because investors think the benign revenue growth will improve to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on LAY-OUT Planning Consultants will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For LAY-OUT Planning Consultants?

The only time you'd be truly comfortable seeing a P/S as steep as LAY-OUT Planning Consultants' is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 10% drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 31% shows it's an unpleasant look.

With this information, we find it concerning that LAY-OUT Planning Consultants is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

The strong share price surge has lead to LAY-OUT Planning Consultants' P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of LAY-OUT Planning Consultants revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

We don't want to rain on the parade too much, but we did also find 3 warning signs for LAY-OUT Planning Consultants (2 are potentially serious!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300989

LAY-OUT Planning Consultants

Operates as a planning and engineering business in China, Pakistan, and Nigeria.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives