- China

- /

- Commercial Services

- /

- SZSE:300864

Three Top Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets continue to navigate through inflationary pressures and geopolitical uncertainties, U.S. stock indexes have been climbing toward record highs, driven by growth stocks outpacing value shares. In this dynamic environment, dividend stocks can offer a compelling opportunity for investors seeking income generation alongside potential capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.92% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.93% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.92% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.68% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.24% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.27% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.29% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.90% | ★★★★★★ |

Click here to see the full list of 1994 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Academy of Environmental Planning and DesignLtd. Nanjing University (SZSE:300864)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Academy of Environmental Planning and Design Co., Ltd. (SZSE:300864) is involved in environmental planning and design services, with a market cap of CN¥3.25 billion.

Operations: Academy of Environmental Planning and Design Co., Ltd. generates its revenue primarily from the service industry, amounting to CN¥815.11 million.

Dividend Yield: 3.9%

Academy of Environmental Planning and Design Ltd. Nanjing University offers a dividend yield of 3.85%, placing it in the top 25% of CN market payers. With a payout ratio of 73.4%, dividends are well-covered by earnings and cash flows, ensuring sustainability. Despite only four years of dividend history, payments have been stable and growing with minimal volatility. The stock trades at a significant discount to its estimated fair value, suggesting potential for capital appreciation alongside income generation.

- Click to explore a detailed breakdown of our findings in Academy of Environmental Planning and DesignLtd. Nanjing University's dividend report.

- Our valuation report here indicates Academy of Environmental Planning and DesignLtd. Nanjing University may be undervalued.

Kerry TJ Logistics (TWSE:2608)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kerry TJ Logistics Company Limited offers integrated logistics services globally and has a market cap of NT$18.17 billion.

Operations: Kerry TJ Logistics Company Limited's revenue is primarily derived from its Route Business Office, which contributes NT$12.13 billion, and its Logistics Division, which adds NT$2.41 billion.

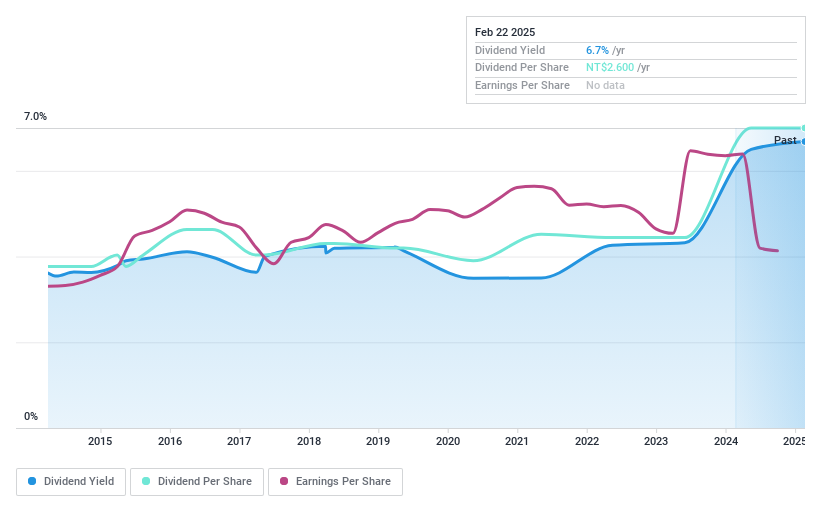

Dividend Yield: 6.7%

Kerry TJ Logistics offers a dividend yield of 6.68%, ranking in the top 25% of TW market payers, yet its dividends are not well-covered by earnings with a payout ratio of 110%. Although cash flows cover the current payout ratio (78%), dividend payments have been volatile and unreliable over the past decade. The stock trades at a significant discount to its estimated fair value, but profit margins have declined recently.

- Unlock comprehensive insights into our analysis of Kerry TJ Logistics stock in this dividend report.

- Our expertly prepared valuation report Kerry TJ Logistics implies its share price may be too high.

O-Bank (TWSE:2897)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: O-Bank Co., Ltd. offers a range of banking services to corporate clients in Taiwan and has a market cap of NT$27.86 billion.

Operations: O-Bank Co., Ltd.'s revenue primarily comes from its Bank Department at NT$7.44 billion, followed by the Bills Segment at NT$2.09 billion and the Overseas Department at NT$1.09 billion.

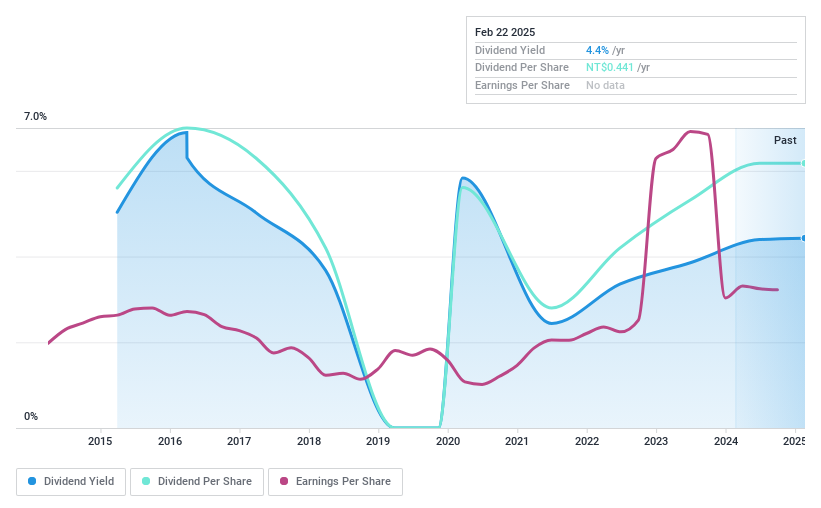

Dividend Yield: 4.4%

O-Bank's dividend yield of 4.43% places it among the top 25% in Taiwan, supported by a modest payout ratio of 47.9%, indicating coverage by earnings. However, dividends have been volatile over the past decade, lacking reliability and stability. Despite trading at a discount to its estimated fair value, profit margins have decreased from last year’s figures. Insufficient data prevents assessing future dividend sustainability or growth potential effectively.

- Click here to discover the nuances of O-Bank with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that O-Bank is priced higher than what may be justified by its financials.

Seize The Opportunity

- Discover the full array of 1994 Top Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300864

Academy of Environmental Planning and DesignLtd. Nanjing University

Academy of Environmental Planning and Design, Co.,Ltd.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives