- China

- /

- Commercial Services

- /

- SZSE:300692

Anhui Zhonghuan Environmental Protection Technology Co.,Ltd's (SZSE:300692) 26% Price Boost Is Out Of Tune With Earnings

Anhui Zhonghuan Environmental Protection Technology Co.,Ltd (SZSE:300692) shares have continued their recent momentum with a 26% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 2.5% isn't as impressive.

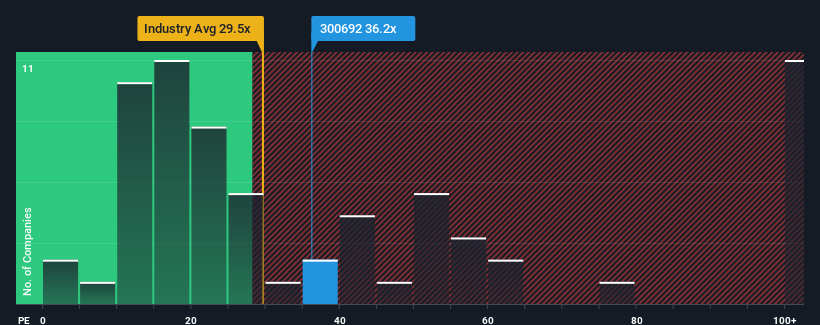

Even after such a large jump in price, it's still not a stretch to say that Anhui Zhonghuan Environmental Protection TechnologyLtd's price-to-earnings (or "P/E") ratio of 36.2x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 35x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

For instance, Anhui Zhonghuan Environmental Protection TechnologyLtd's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Anhui Zhonghuan Environmental Protection TechnologyLtd

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Anhui Zhonghuan Environmental Protection TechnologyLtd's is when the company's growth is tracking the market closely.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 35%. The last three years don't look nice either as the company has shrunk EPS by 65% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 41% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's somewhat alarming that Anhui Zhonghuan Environmental Protection TechnologyLtd's P/E sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Final Word

Its shares have lifted substantially and now Anhui Zhonghuan Environmental Protection TechnologyLtd's P/E is also back up to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Anhui Zhonghuan Environmental Protection TechnologyLtd currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Anhui Zhonghuan Environmental Protection TechnologyLtd (2 are concerning!) that you need to be mindful of.

Of course, you might also be able to find a better stock than Anhui Zhonghuan Environmental Protection TechnologyLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300692

Anhui Zhonghuan Environmental Protection TechnologyLtd

Engages in the municipal sewage, industrial wastewater treatment, black and odorous water, wetland treatment, other water environment treatment, and waste incineration power generation businesses in China.

Low unattractive dividend payer.

Market Insights

Community Narratives