- China

- /

- Commercial Services

- /

- SZSE:300334

Optimistic Investors Push Tianjin MOTIMO Membrane Technology Co.,Ltd (SZSE:300334) Shares Up 30% But Growth Is Lacking

Tianjin MOTIMO Membrane Technology Co.,Ltd (SZSE:300334) shareholders have had their patience rewarded with a 30% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 14% over that time.

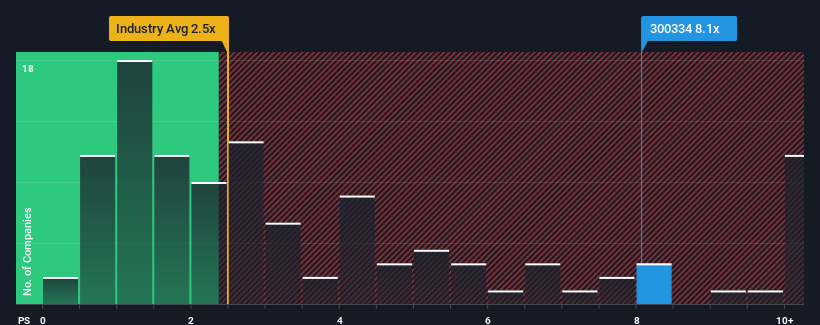

Following the firm bounce in price, you could be forgiven for thinking Tianjin MOTIMO Membrane TechnologyLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 8.1x, considering almost half the companies in China's Commercial Services industry have P/S ratios below 2.5x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Tianjin MOTIMO Membrane TechnologyLtd

What Does Tianjin MOTIMO Membrane TechnologyLtd's P/S Mean For Shareholders?

Revenue has risen firmly for Tianjin MOTIMO Membrane TechnologyLtd recently, which is pleasing to see. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Tianjin MOTIMO Membrane TechnologyLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Tianjin MOTIMO Membrane TechnologyLtd's Revenue Growth Trending?

Tianjin MOTIMO Membrane TechnologyLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 10%. However, this wasn't enough as the latest three year period has seen an unpleasant 56% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 28% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's alarming that Tianjin MOTIMO Membrane TechnologyLtd's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From Tianjin MOTIMO Membrane TechnologyLtd's P/S?

Shares in Tianjin MOTIMO Membrane TechnologyLtd have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Tianjin MOTIMO Membrane TechnologyLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Before you take the next step, you should know about the 2 warning signs for Tianjin MOTIMO Membrane TechnologyLtd (1 doesn't sit too well with us!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Tianjin MOTIMO Membrane TechnologyLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tianjin MOTIMO Membrane TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300334

Tianjin MOTIMO Membrane TechnologyLtd

Engages in the research and development, manufacture, and sale of ultra- and micro filtration membranes, membrane modules, and membrane equipment.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives