- China

- /

- Commercial Services

- /

- SZSE:300203

There Is A Reason Focused Photonics (Hangzhou), Inc.'s (SZSE:300203) Price Is Undemanding

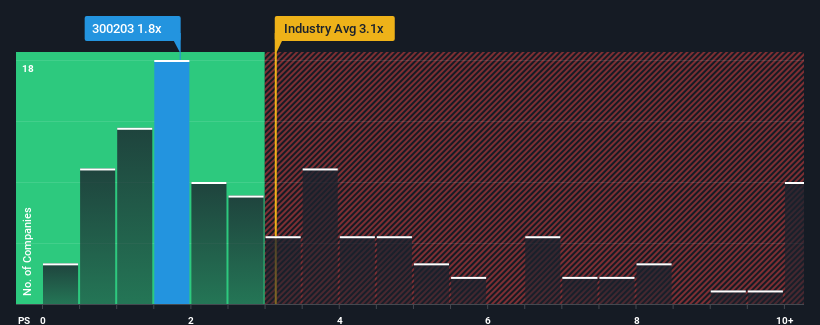

With a price-to-sales (or "P/S") ratio of 1.8x Focused Photonics (Hangzhou), Inc. (SZSE:300203) may be sending bullish signals at the moment, given that almost half of all the Commercial Services companies in China have P/S ratios greater than 3.1x and even P/S higher than 6x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Focused Photonics (Hangzhou)

What Does Focused Photonics (Hangzhou)'s P/S Mean For Shareholders?

There hasn't been much to differentiate Focused Photonics (Hangzhou)'s and the industry's revenue growth lately. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Focused Photonics (Hangzhou).Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Focused Photonics (Hangzhou) would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 3.2%. However, this wasn't enough as the latest three year period has seen an unpleasant 10% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 10% over the next year. Meanwhile, the rest of the industry is forecast to expand by 34%, which is noticeably more attractive.

With this information, we can see why Focused Photonics (Hangzhou) is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Focused Photonics (Hangzhou)'s P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Focused Photonics (Hangzhou) maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Focused Photonics (Hangzhou) (at least 1 which is concerning), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Focused Photonics (Hangzhou), explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Focused Photonics (Hangzhou), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300203

Focused Photonics (Hangzhou)

Engages in the research and development, production, and sale of tunable laser diode absorption spectroscopy in China.

Reasonable growth potential average dividend payer.

Market Insights

Community Narratives