- China

- /

- Commercial Services

- /

- SZSE:300203

Not Many Are Piling Into Focused Photonics (Hangzhou), Inc. (SZSE:300203) Stock Yet As It Plummets 32%

The Focused Photonics (Hangzhou), Inc. (SZSE:300203) share price has fared very poorly over the last month, falling by a substantial 32%. For any long-term shareholders, the last month ends a year to forget by locking in a 58% share price decline.

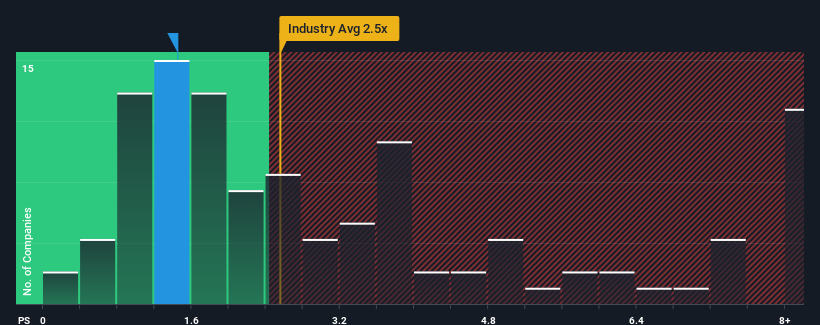

Since its price has dipped substantially, Focused Photonics (Hangzhou)'s price-to-sales (or "P/S") ratio of 1.4x might make it look like a buy right now compared to the Commercial Services industry in China, where around half of the companies have P/S ratios above 2.5x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Focused Photonics (Hangzhou)

What Does Focused Photonics (Hangzhou)'s P/S Mean For Shareholders?

Focused Photonics (Hangzhou) could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Focused Photonics (Hangzhou)'s future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Focused Photonics (Hangzhou) would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. The last three years don't look nice either as the company has shrunk revenue by 9.1% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 29% during the coming year according to the one analyst following the company. That's shaping up to be similar to the 27% growth forecast for the broader industry.

With this information, we find it odd that Focused Photonics (Hangzhou) is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What Does Focused Photonics (Hangzhou)'s P/S Mean For Investors?

The southerly movements of Focused Photonics (Hangzhou)'s shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Focused Photonics (Hangzhou)'s revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Focused Photonics (Hangzhou) (1 shouldn't be ignored!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Focused Photonics (Hangzhou), explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300203

Focused Photonics (Hangzhou)

Engages in the research and development, production, and sale of tunable laser diode absorption spectroscopy in China.

Reasonable growth potential average dividend payer.

Market Insights

Community Narratives