- China

- /

- Commercial Services

- /

- SZSE:002825

Global Undiscovered Gems Featuring Three Promising Small Caps

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed performances and economic uncertainties, small-cap indexes have notably outperformed, posting gains for the fifth consecutive week amid hopes for tariff de-escalation. This environment presents an intriguing backdrop to explore potential opportunities in lesser-known stocks that may offer unique growth prospects. Identifying promising small-cap stocks often involves looking beyond immediate market fluctuations to assess a company's fundamentals, industry position, and adaptability in the face of evolving trade dynamics and economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Natural Food International Holding | NA | 5.61% | 32.98% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 15.01% | 0.09% | ★★★★★★ |

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | 0.57% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Taiyo KagakuLtd | 0.69% | 5.32% | -0.36% | ★★★★★☆ |

| Hong Leong Finance | 0.07% | 6.89% | 6.61% | ★★★★★☆ |

| Uju Holding | 33.18% | 8.01% | -15.93% | ★★★★★☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Shanghai NAR Industrial (SZSE:002825)

Simply Wall St Value Rating: ★★★★★☆

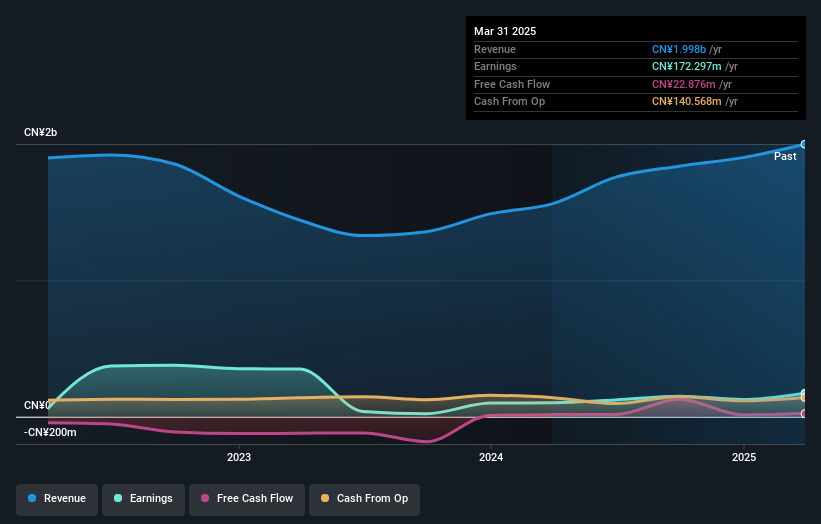

Overview: Shanghai NAR Industrial Co., Ltd. develops, produces, and sells digital printing materials in China with a market capitalization of CN¥4.09 billion.

Operations: Shanghai NAR Industrial generates revenue primarily from the sale of digital printing materials. The company's cost structure involves production and operational expenses associated with manufacturing these materials. The financial performance is highlighted by its net profit margin, which provides insight into profitability relative to total revenue.

Shanghai NAR Industrial, a nimble player in the commercial services sector, has shown impressive growth with earnings surging 67.8% over the past year, outpacing the industry average of 4.5%. The company reported a net income of CNY 68.78 million for Q1 2025, up from CNY 22.82 million last year, reflecting its robust performance. With a price-to-earnings ratio of 24.5x below the CN market's average of 38.3x and high-quality earnings, it seems attractively valued for investors seeking opportunities in smaller firms with potential upside. Additionally, its debt-to-equity ratio rose to just 16%, indicating manageable leverage levels amidst this growth phase.

Taiwan Speciality Chemicals (TPEX:4772)

Simply Wall St Value Rating: ★★★★★★

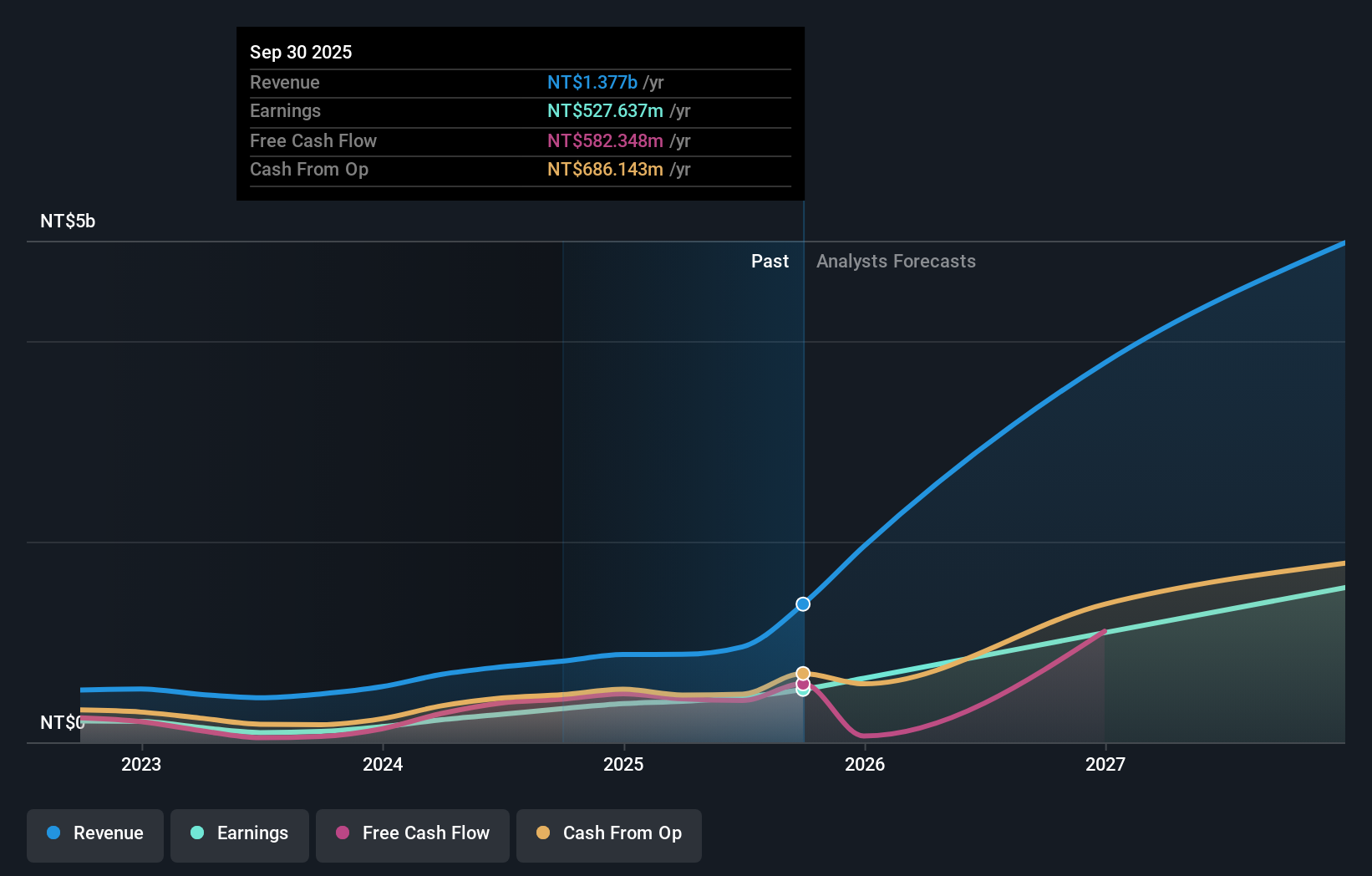

Overview: Taiwan Speciality Chemicals Corporation focuses on the production and sale of specialty electronic-graded gases and chemicals in Taiwan, with a market capitalization of NT$28.35 billion.

Operations: The primary revenue stream for Taiwan Speciality Chemicals comes from the research, development, and sales of precision chemical materials, generating NT$876.65 million.

Taiwan Speciality Chemicals showcases a compelling narrative with its debt-free status and impressive earnings growth of 81.3% over the past year, outpacing the industry average of 16%. The company reported first-quarter sales for 2025 at TWD 219.62 million, slightly up from TWD 216.93 million the previous year, while net income increased to TWD 102.73 million from TWD 81.03 million. Its free cash flow turned positive over recent years, reaching US$483.19 by December 2024, indicating robust financial health despite share price volatility in recent months. This paints a picture of resilience and potential amidst market fluctuations.

NIPPON ROAD (TSE:1884)

Simply Wall St Value Rating: ★★★★★☆

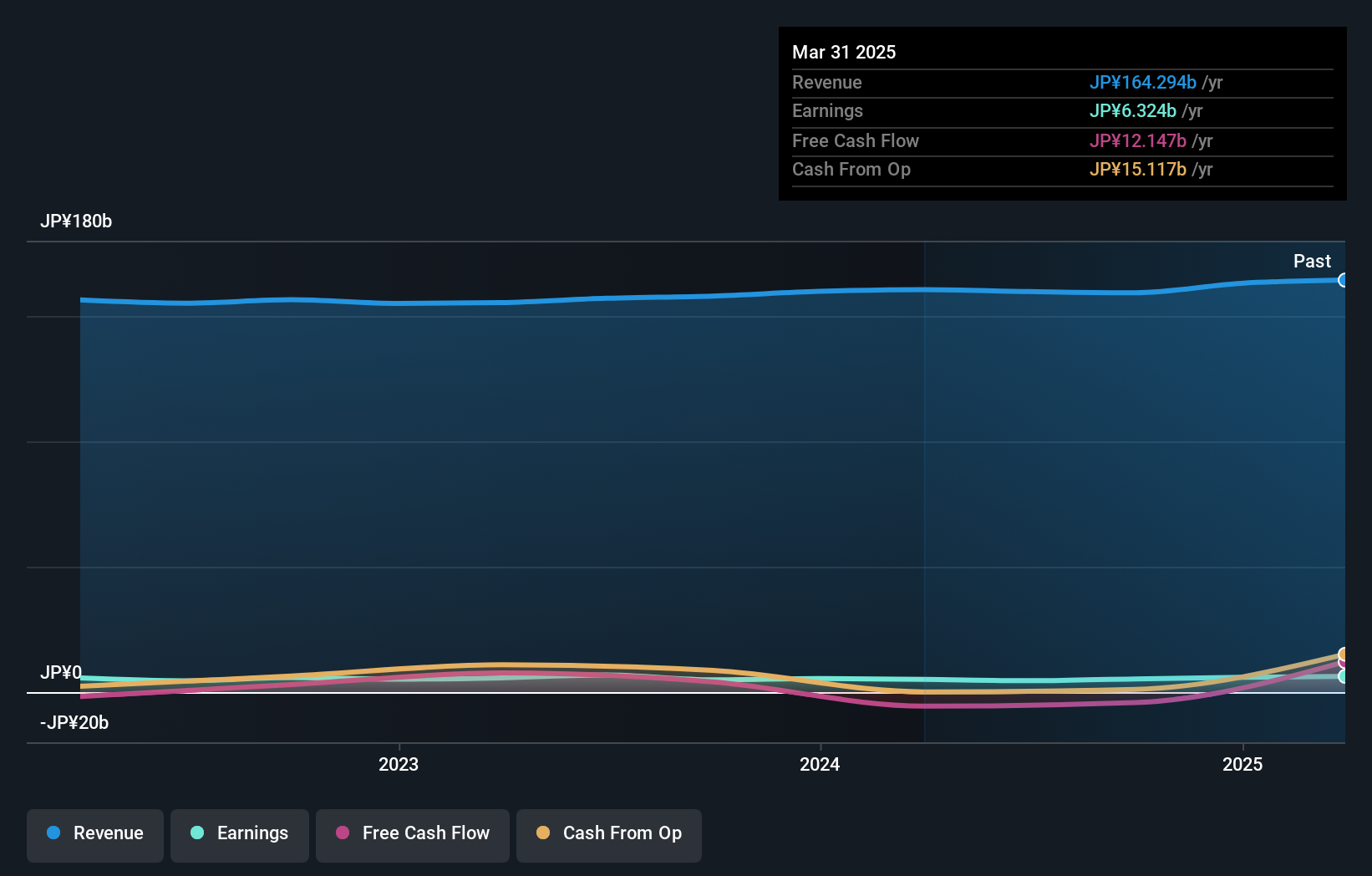

Overview: THE NIPPON ROAD Co., Ltd. provides general construction, construction design, supervision, and management services both in Japan and internationally with a market cap of ¥95.31 billion.

Operations: Nippon Road generates revenue primarily from its construction business, contributing ¥132.67 billion, and its manufacturing and sales business, which adds ¥33.52 billion.

Nippon Road, a smaller player in the construction sector, shows a mixed financial landscape. Despite earnings growing by 8.5% last year, they lag behind the industry's 25.3% growth rate. Over five years, earnings have decreased by 6.5% annually, yet the company maintains a healthy debt profile with cash exceeding total debt and a reduced debt-to-equity ratio from 11.7 to 9.7 over this period. While free cash flow remains negative, Nippon Road's ability to cover interest payments is solid and its high-quality earnings reflect operational resilience amidst industry challenges as it prepares for its fiscal year results announcement today.

- Unlock comprehensive insights into our analysis of NIPPON ROAD stock in this health report.

Evaluate NIPPON ROAD's historical performance by accessing our past performance report.

Summing It All Up

- Take a closer look at our Global Undiscovered Gems With Strong Fundamentals list of 3238 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Shanghai NAR Industrial, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002825

Shanghai NAR Industrial

Develops, produces, and sells digital printing materials in China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives