- China

- /

- Commercial Services

- /

- SHSE:603600

UE Furniture Co., Ltd. (SHSE:603600) Surges 26% Yet Its Low P/E Is No Reason For Excitement

UE Furniture Co., Ltd. (SHSE:603600) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 31%.

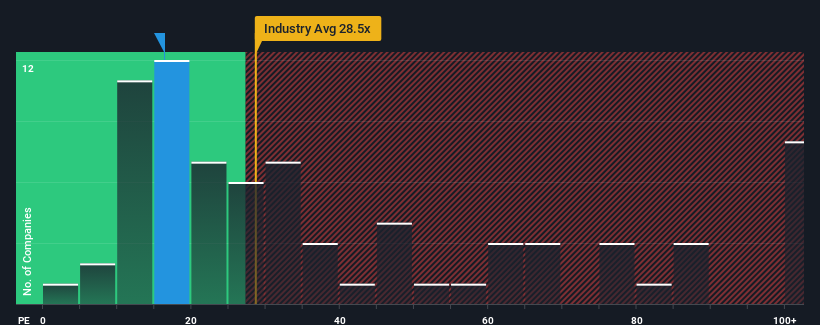

In spite of the firm bounce in price, UE Furniture's price-to-earnings (or "P/E") ratio of 16.3x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 31x and even P/E's above 57x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

UE Furniture could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for UE Furniture

Is There Any Growth For UE Furniture?

In order to justify its P/E ratio, UE Furniture would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 17%. This means it has also seen a slide in earnings over the longer-term as EPS is down 1.5% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 17% over the next year. That's shaping up to be materially lower than the 36% growth forecast for the broader market.

With this information, we can see why UE Furniture is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Despite UE Furniture's shares building up a head of steam, its P/E still lags most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that UE Furniture maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for UE Furniture that you should be aware of.

If you're unsure about the strength of UE Furniture's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603600

UE Furniture

Engages in the research, development, production, and sale of healthy seats in China and Internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives