- Taiwan

- /

- Entertainment

- /

- TPEX:8446

Asian Dividend Stocks To Consider In May 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of trade negotiations and economic uncertainties, Asian stock markets have shown resilience, with Chinese indices advancing amid positive trade talks and policy measures. In this environment, dividend stocks in Asia can offer a measure of stability and income potential for investors seeking to balance growth with regular returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.77% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.20% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.55% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.00% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.91% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.36% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.22% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.40% | ★★★★★★ |

Click here to see the full list of 1196 stocks from our Top Asian Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

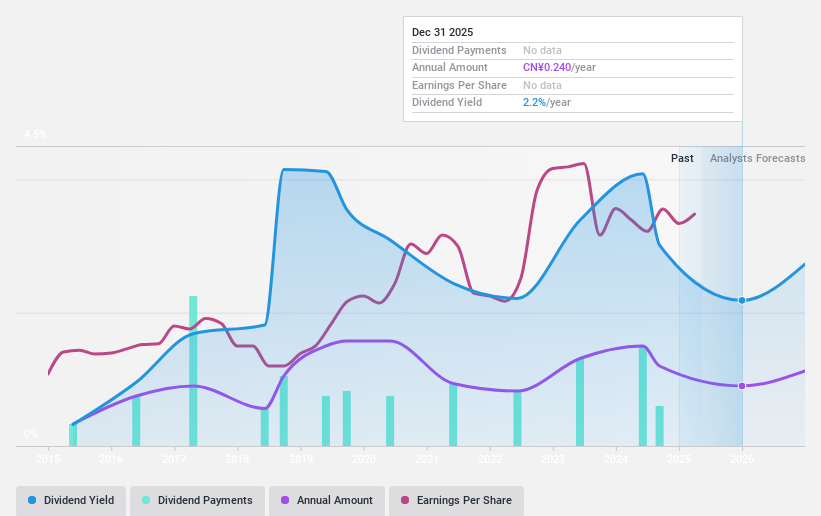

UE Furniture (SHSE:603600)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: UE Furniture Co., Ltd. specializes in the research, development, production, and sale of healthy seating solutions both in China and internationally, with a market cap of CN¥3.67 billion.

Operations: UE Furniture Co., Ltd. generates revenue through its operations in the research, development, production, and sale of healthy seating solutions across domestic and international markets.

Dividend Yield: 4.1%

UE Furniture's dividend yield of 4.14% ranks in the top 25% of CN market payers, yet its dividends have been volatile over the past decade and are not well-covered by free cash flows. Despite a low payout ratio of 49.6%, earnings do not fully sustain dividend payments. Recent Q1 2025 results show revenue growth to CNY 1 billion and net income rising to CNY 57.55 million, reflecting positive earnings momentum that may support future dividends if sustained.

- Delve into the full analysis dividend report here for a deeper understanding of UE Furniture.

- The valuation report we've compiled suggests that UE Furniture's current price could be quite moderate.

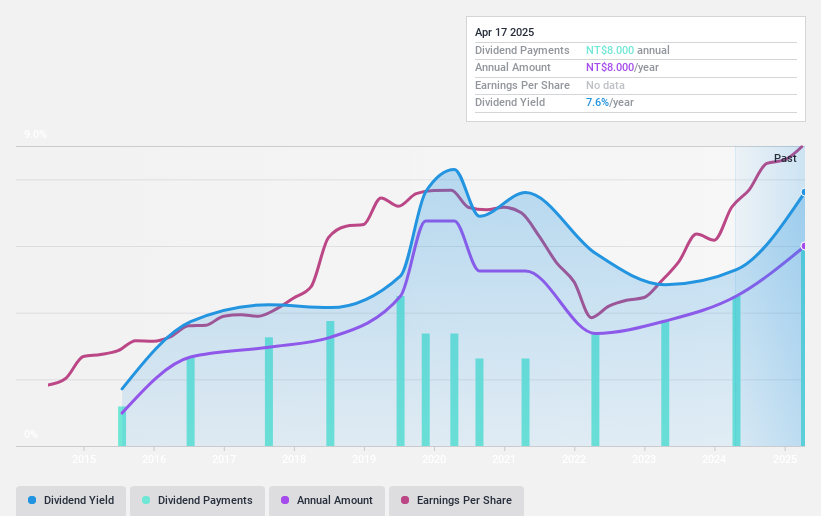

HIM International Music (TPEX:8446)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HIM International Music Inc. is involved in the recording and distribution of music, with a market cap of NT$5.45 billion.

Operations: HIM International Music Inc.'s revenue primarily stems from its music recording and distribution activities.

Dividend Yield: 7.8%

HIM International Music's dividend yield of 7.77% is among the top in Taiwan, supported by a payout ratio of 66.8% and cash flow coverage at 82.3%. Despite past volatility in dividends, recent earnings growth—25.3% over the last year—strengthens its financial position. Q1 2025 results show net income rising to TWD 176.01 million from TWD 148.07 million a year ago, indicating robust earnings that could support future dividend stability if maintained.

- Click to explore a detailed breakdown of our findings in HIM International Music's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of HIM International Music shares in the market.

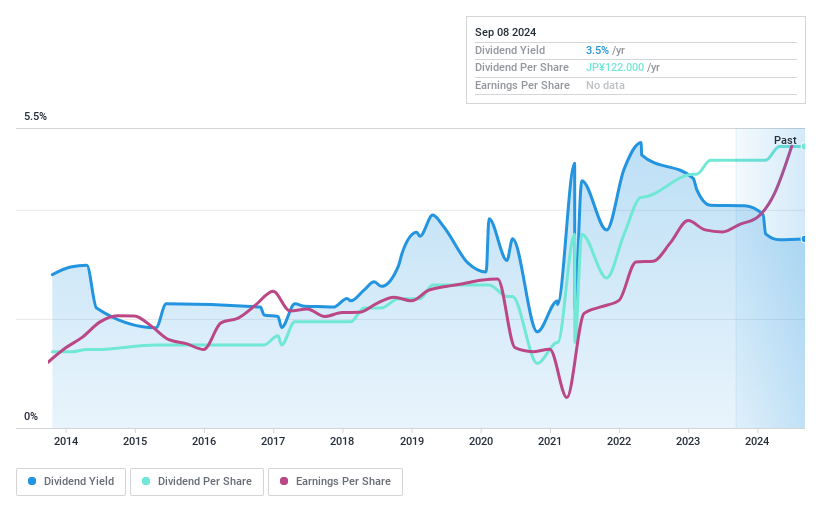

Chori (TSE:8014)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chori Co., Ltd. operates in the textiles, chemicals, and machinery sectors both in China and internationally, with a market cap of ¥94.64 billion.

Operations: Chori Co., Ltd.'s revenue is primarily derived from its Chemicals Business, which generated ¥157.86 billion, and its Fibers, Textiles, and Garments segment, contributing ¥152.74 billion.

Dividend Yield: 3.7%

Chori Co., Ltd. recently announced a dividend increase to JPY 81.00 per share for the fiscal year ended March 31, 2025, up from JPY 60.00 previously, with future guidance indicating a slight reduction to JPY 72.00 per share for the fiscal year ending March 31, 2026. While its payout ratio of 30% suggests dividends are well-covered by earnings and cash flows (83%), past volatility raises concerns about consistency despite recent profit growth of over ¥11 billion projected for FY2026.

- Click here to discover the nuances of Chori with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Chori is trading beyond its estimated value.

Where To Now?

- Navigate through the entire inventory of 1196 Top Asian Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HIM International Music might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:8446

HIM International Music

Engages in the recording and distribution of music.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives