- China

- /

- Professional Services

- /

- SHSE:603030

Global Penny Stocks: Shanghai Trendzone Holdings GroupLtd And 2 Other Noteworthy Picks

Reviewed by Simply Wall St

Global markets have shown signs of optimism recently, with U.S. equities rising on the back of easing trade tensions and better-than-expected corporate earnings. Amid this backdrop, investors continue to seek opportunities that balance affordability and potential growth, often turning to penny stocks as a viable option. Though the term may feel outdated, penny stocks still represent an intriguing investment area where smaller or newer companies can offer both value and growth potential when supported by strong financials.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.425 | SGD172.25M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.22 | SGD8.74B | ✅ 5 ⚠️ 0 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.78 | SEK283.44M | ✅ 4 ⚠️ 3 View Analysis > |

| SKP Resources Bhd (KLSE:SKPRES) | MYR0.89 | MYR1.39B | ✅ 5 ⚠️ 2 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.34 | MYR945.94M | ✅ 4 ⚠️ 3 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ✅ 5 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.06 | HK$681.43M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.90 | £315.07M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.735 | £422.08M | ✅ 4 ⚠️ 1 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.93 | £2.16B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 5,637 stocks from our Global Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Shanghai Trendzone Holdings GroupLtd (SHSE:603030)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shanghai Trendzone Holdings Group Co., Ltd, with a market cap of CN¥3.16 billion, offers integrated solutions in design, construction, production, and services both within China and internationally.

Operations: Shanghai Trendzone Holdings Group Co., Ltd has not reported specific revenue segments.

Market Cap: CN¥3.16B

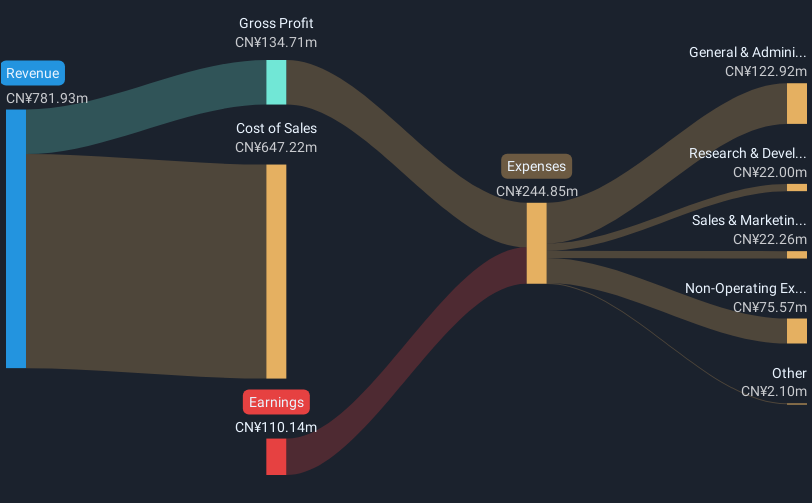

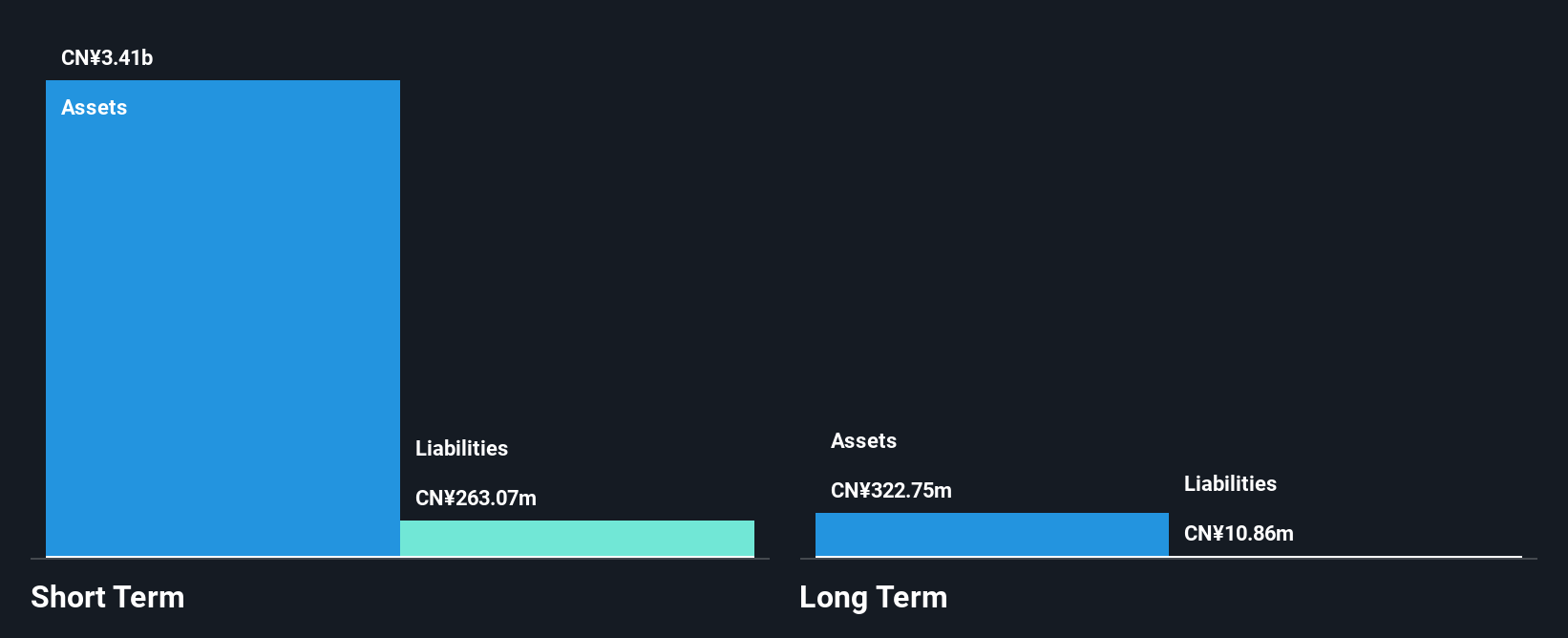

Shanghai Trendzone Holdings Group Co., Ltd, despite its CN¥3.16 billion market cap, faces challenges with declining sales and a net loss of CN¥110.14 million for 2024. The company has a satisfactory net debt to equity ratio of 29.7% and its short-term assets of CN¥1.4 billion exceed both short- and long-term liabilities, indicating some financial stability. However, it struggles with less than one year of cash runway and increasing losses over the past five years at 13.6% annually, raising concerns about its ability to sustain operations without additional capital or improved cash flow management strategies.

- Click to explore a detailed breakdown of our findings in Shanghai Trendzone Holdings GroupLtd's financial health report.

- Examine Shanghai Trendzone Holdings GroupLtd's past performance report to understand how it has performed in prior years.

Tongding Interconnection Information (SZSE:002491)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tongding Interconnection Information Co., Ltd. operates in the telecommunications industry, focusing on the production and distribution of communication cables and related products, with a market cap of CN¥5.15 billion.

Operations: No specific revenue segments are reported for Tongding Interconnection Information Co., Ltd.

Market Cap: CN¥5.15B

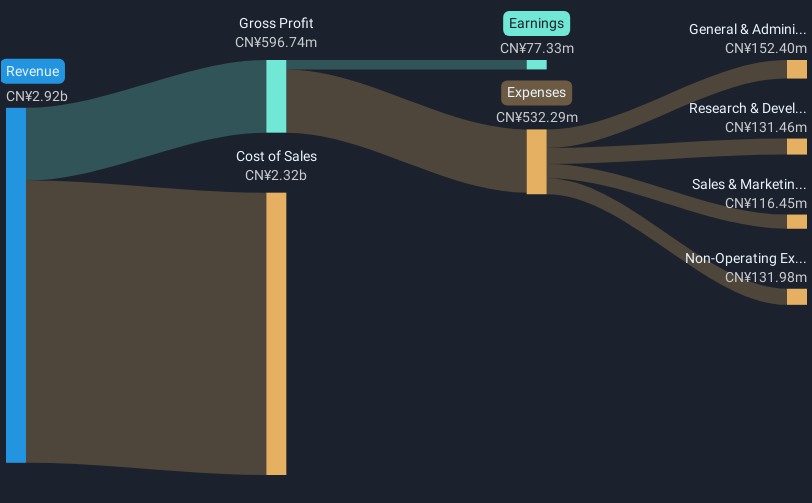

Tongding Interconnection Information Co., Ltd. has a market cap of CN¥5.15 billion and reported declining sales of CN¥2.92 billion for 2024, down from CN¥3.35 billion the previous year, with net income falling to CN¥77.33 million from CN¥236.76 million. Despite this, the company maintains financial stability with short-term assets covering both short- and long-term liabilities and a satisfactory net debt to equity ratio of 16.7%. However, its profit margins have decreased significantly due to large one-off losses impacting recent financial results, highlighting challenges in maintaining consistent profitability amidst industry pressures.

- Click here and access our complete financial health analysis report to understand the dynamics of Tongding Interconnection Information.

- Gain insights into Tongding Interconnection Information's historical outcomes by reviewing our past performance report.

Nanjing Xinlian Electronics (SZSE:002546)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nanjing Xinlian Electronics Co., Ltd specializes in manufacturing power consumption information collection systems for power grid enterprises and enterprise users in China, with a market cap of CN¥3.76 billion.

Operations: No specific revenue segments are reported for Nanjing Xinlian Electronics Co., Ltd.

Market Cap: CN¥3.76B

Nanjing Xinlian Electronics Co., Ltd, with a market cap of CN¥3.76 billion, has demonstrated significant earnings growth over the past year, increasing by 330.8%, driven by improved net profit margins and stable weekly volatility. The company's short-term assets comfortably cover both its short- and long-term liabilities, reflecting strong liquidity. Despite a low return on equity at 7.9%, the company benefits from having more cash than total debt and robust operating cash flow coverage of debt at over 1000%. However, recent results were influenced by large one-off gains impacting earnings quality for the period ending December 2024.

- Unlock comprehensive insights into our analysis of Nanjing Xinlian Electronics stock in this financial health report.

- Explore historical data to track Nanjing Xinlian Electronics' performance over time in our past results report.

Seize The Opportunity

- Click through to start exploring the rest of the 5,634 Global Penny Stocks now.

- Curious About Other Options? Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603030

Shanghai Trendzone Holdings GroupLtd

Provides integrated solutions across design, construction, production, and services in China and internationally.

Adequate balance sheet very low.

Market Insights

Community Narratives