- China

- /

- Commercial Services

- /

- SHSE:601718

Investors in Jihua Group (SHSE:601718) from five years ago are still down 24%, even after 3.8% gain this past week

For many, the main point of investing is to generate higher returns than the overall market. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Jihua Group Corporation Limited (SHSE:601718) shareholders for doubting their decision to hold, with the stock down 26% over a half decade. More recently, the share price has dropped a further 12% in a month. But this could be related to poor market conditions -- stocks are down 4.9% in the same time.

While the last five years has been tough for Jihua Group shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Check out our latest analysis for Jihua Group

We don't think that Jihua Group's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last five years Jihua Group saw its revenue shrink by 12% per year. That puts it in an unattractive cohort, to put it mildly. It seems pretty reasonable to us that the share price dipped 5% per year in that time. We doubt many shareholders are delighted with this share price performance. Risk averse investors probably wouldn't like this one much.

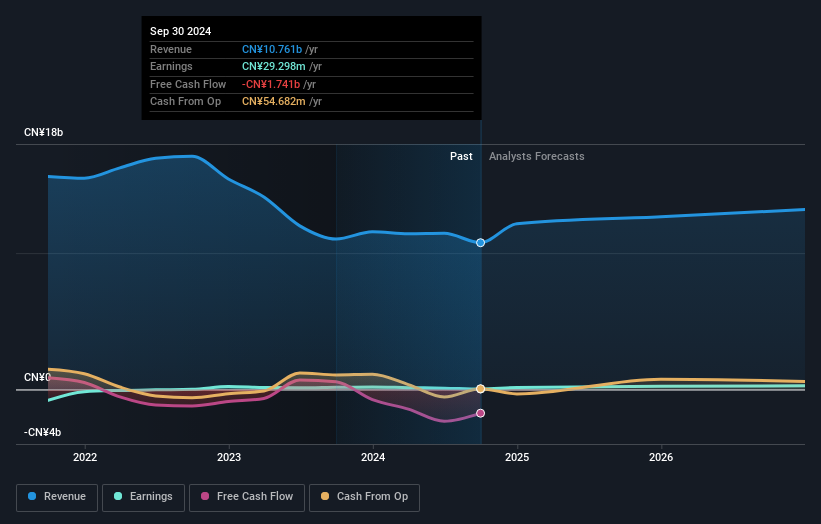

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that Jihua Group has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Jihua Group's financial health with this free report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Jihua Group, it has a TSR of -24% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Jihua Group shareholders gained a total return of 1.9% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 4% endured over half a decade. It could well be that the business is stabilizing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Jihua Group (1 shouldn't be ignored) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601718

Jihua Group

Manufactures and distributes military products in China and internationally.

Adequate balance sheet with moderate growth potential.