As global markets navigate a landscape marked by muted reactions to new U.S. tariffs and mixed economic signals, the Asian market presents unique opportunities for discerning investors. With the recent tariff announcements impacting key trading partners like South Korea and Japan, small-cap stocks in Asia could offer intriguing potential amid broader market uncertainties. Identifying promising stocks often involves looking beyond immediate headlines to uncover companies with strong fundamentals that can weather such external pressures effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Hangzhou Xili Intelligent TechnologyLtd | NA | 11.73% | 9.57% | ★★★★★★ |

| Saha-Union | 0.84% | 0.90% | 15.45% | ★★★★★★ |

| Minmetals Development | 35.99% | 0.88% | -12.63% | ★★★★★★ |

| Savior Lifetec | NA | -10.66% | 5.06% | ★★★★★★ |

| HeXun Biosciences | NA | 74.95% | 119.41% | ★★★★★★ |

| CHT Security | NA | 11.39% | 23.71% | ★★★★★★ |

| Jinsanjiang (Zhaoqing) Silicon Material | 3.59% | 18.23% | -7.68% | ★★★★★☆ |

| Pizu Group Holdings | 41.45% | -2.37% | -15.01% | ★★★★☆☆ |

| ASRock Rack Incorporation | 26.93% | 225.32% | 6287.64% | ★★★★☆☆ |

| Shandong Longquan Pipe IndustryLtd | 50.06% | 3.18% | -3.82% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Shanghai Foreign Service Holding Group (SHSE:600662)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Foreign Service Holding Group Co., Ltd. operates as a comprehensive human resources service provider in China, with a market cap of CN¥12.76 billion.

Operations: Shanghai Foreign Service Holding Group generates revenue primarily through its human resources services in China. The company's net profit margin is 2.15%.

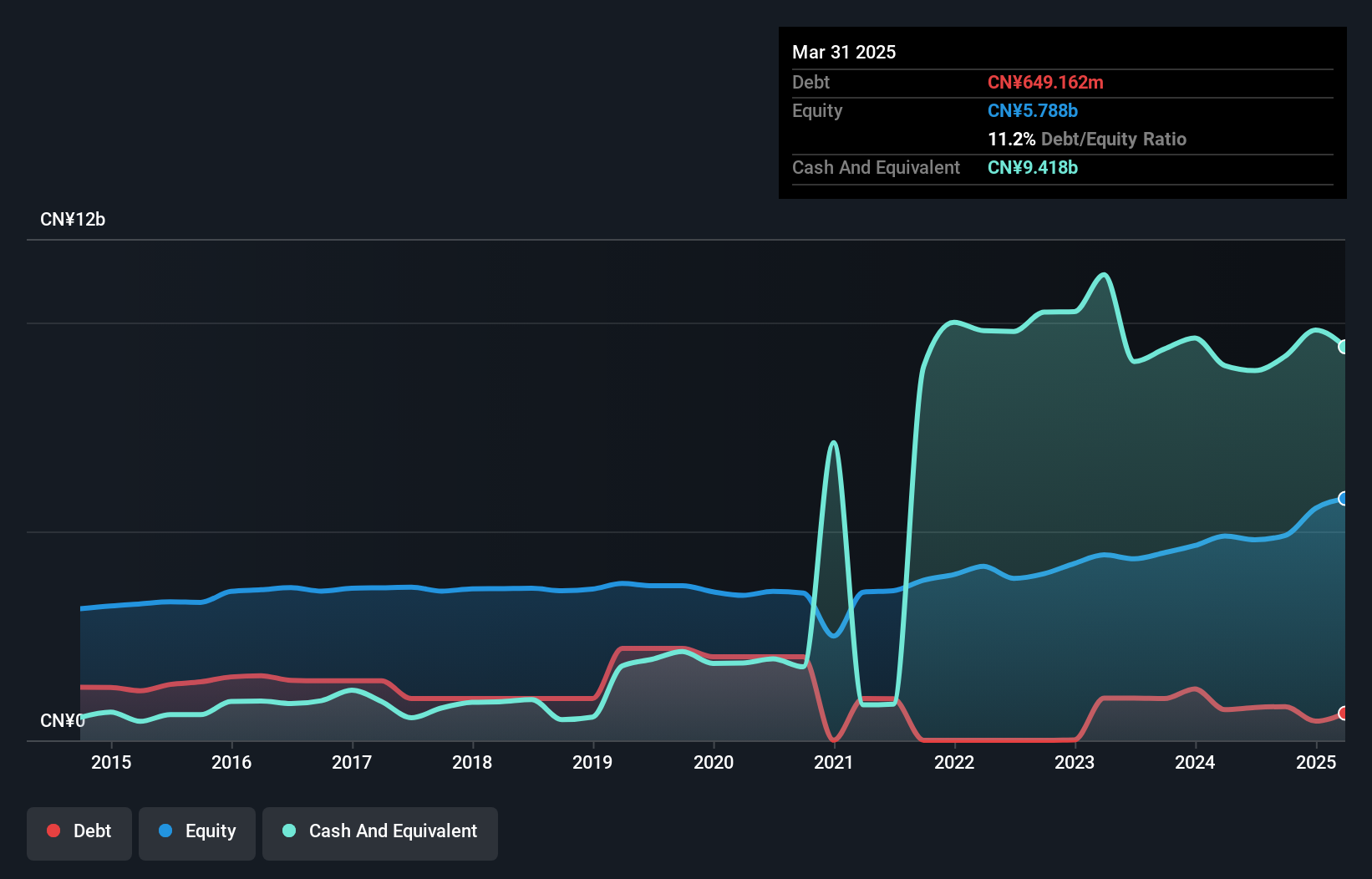

Shanghai Foreign Service Holding Group, a relatively small player in the professional services sector, has shown impressive financial performance recently. Over the past year, earnings surged by 84.9%, significantly outpacing the industry average of -0.5%. The company's debt-to-equity ratio improved from 57.7% to 11.2% over five years, indicating prudent financial management with more cash than total debt on hand. Despite a price-to-earnings ratio of 11.6x being below the CN market average of 40.1x, future earnings are expected to decline by an average of 13.6% annually over the next three years, suggesting potential challenges ahead for growth sustainability.

Co-Tech Development (TPEX:8358)

Simply Wall St Value Rating: ★★★★★★

Overview: Co-Tech Development Corporation, with a market cap of NT$18.33 billion, operates in Taiwan and China focusing on the production and sale of copper foil for the printed circuit board industry.

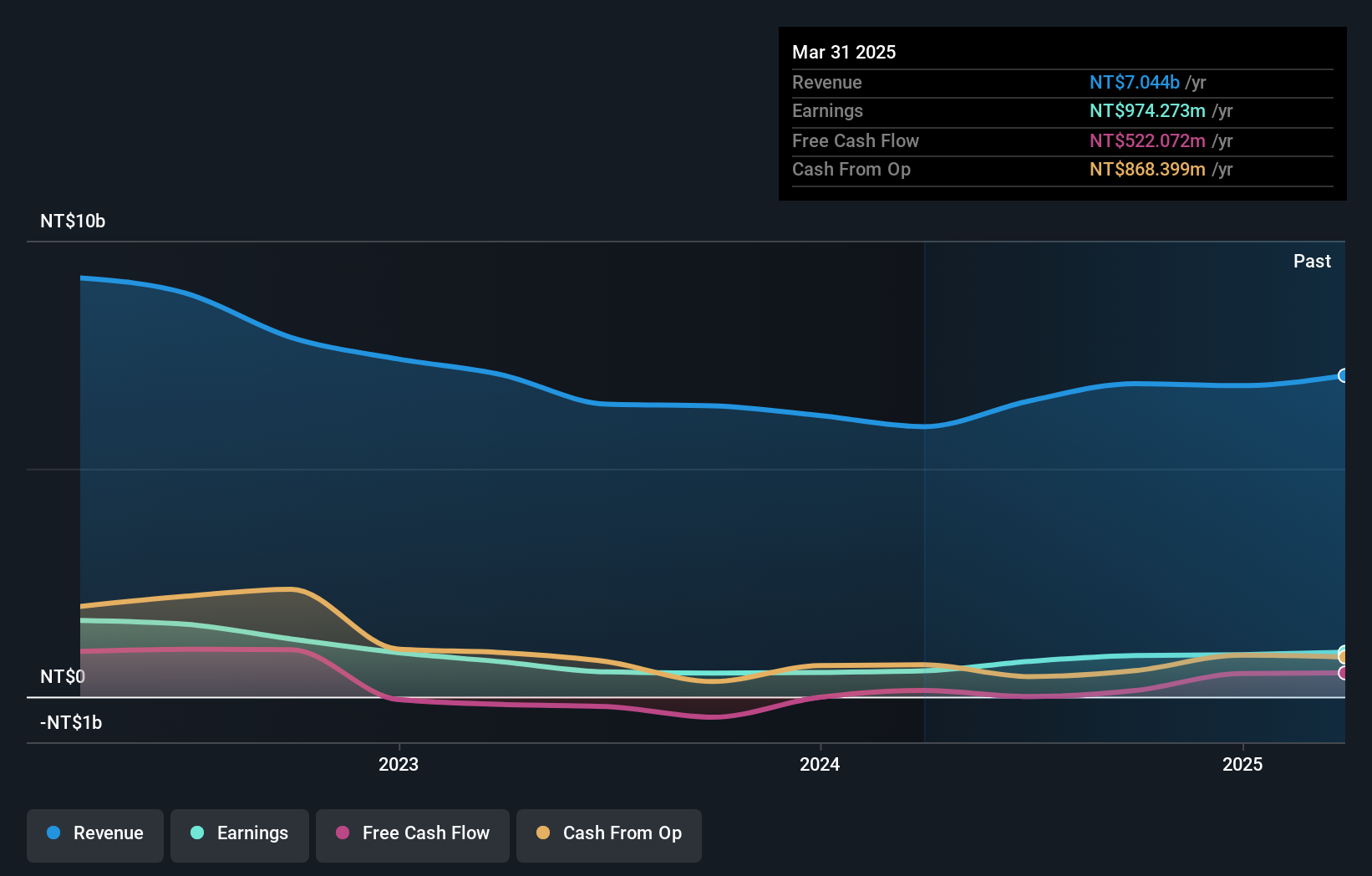

Operations: Co-Tech Development generates revenue primarily from its copper foil segment, amounting to NT$7.04 billion. The company's market capitalization stands at NT$18.33 billion.

Co-Tech Development, a player in the electronics sector, has showcased impressive financial health with earnings growth of 72.1% over the past year, surpassing the industry average of 14.2%. The company's price-to-earnings ratio stands at 18.8x, slightly below the industry average of 19.3x, indicating potential value for investors. With a reduced debt-to-equity ratio from 12.4% to 3.5% over five years and interest payments well covered by EBIT at a multiple of 171.2x, Co-Tech appears financially robust despite recent share price volatility and leadership changes following board restructuring in June 2025.

- Navigate through the intricacies of Co-Tech Development with our comprehensive health report here.

Gain insights into Co-Tech Development's past trends and performance with our Past report.

Ai Robotics (TSE:247A)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ai Robotics Inc. specializes in the planning, development, and sale of skincare products and beauty appliances utilizing AI technology, with a market cap of ¥78.13 billion.

Operations: Ai Robotics generates revenue primarily from its D2C Brand Business, which reported ¥14.21 billion. The company's net profit margin is 12%.

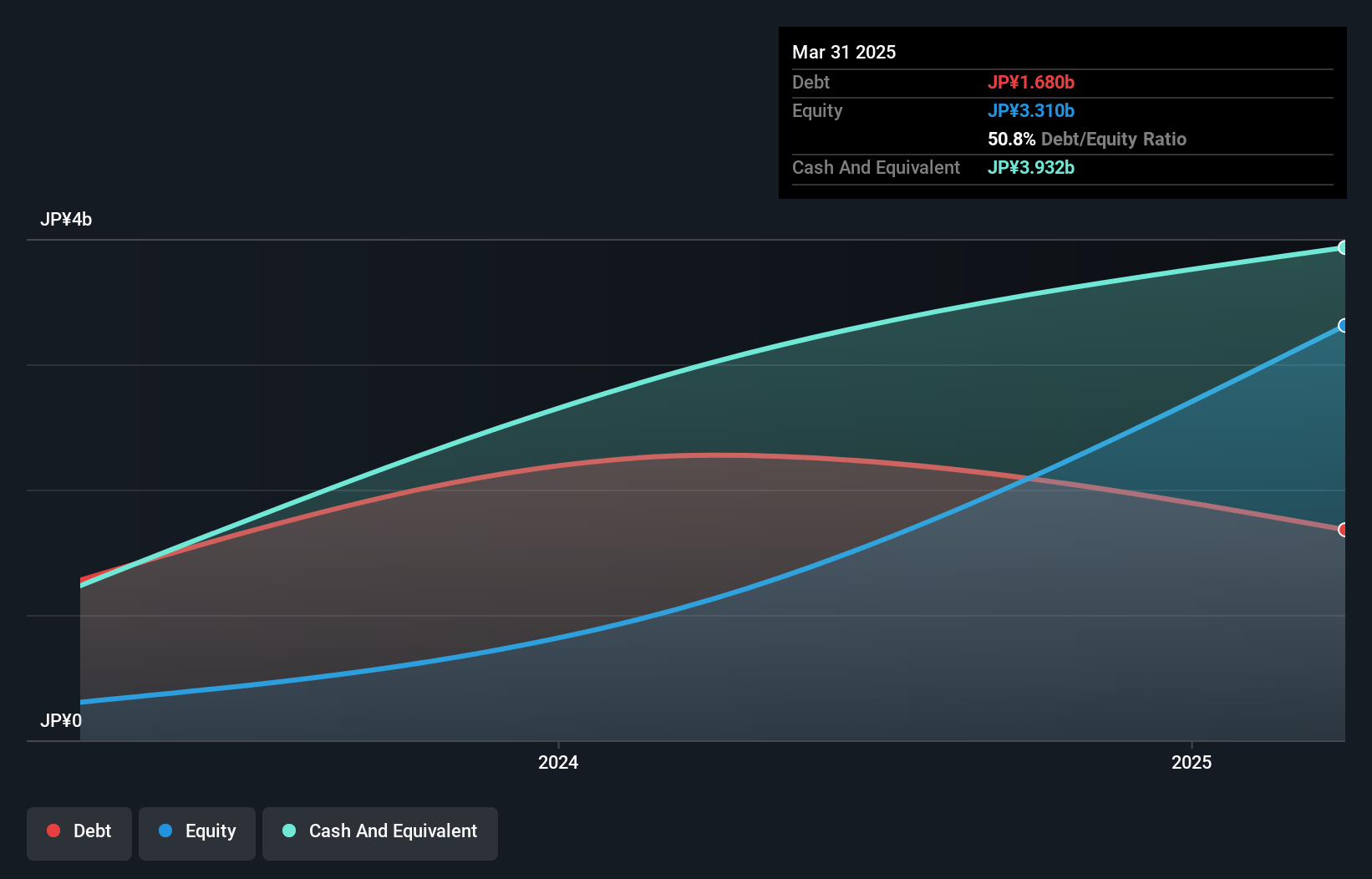

Ai Robotics, a small player in the tech space, has shown impressive earnings growth of 106% over the past year, outpacing the broader Media industry. The company is free cash flow positive with a significant increase from US$861.49 million to US$1.06 billion recently. Its debt situation appears manageable as it holds more cash than total debt, and interest payments are well covered by EBIT at 102 times coverage. Recent guidance suggests net sales of JPY 28 billion and an operating profit of JPY 4.8 billion for fiscal year ending March 2026, indicating potential for continued robust performance.

- Delve into the full analysis health report here for a deeper understanding of Ai Robotics.

Gain insights into Ai Robotics' historical performance by reviewing our past performance report.

Taking Advantage

- Delve into our full catalog of 2602 Asian Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:247A

High growth potential with excellent balance sheet.

Market Insights

Community Narratives