February 2025's Top Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating corporate earnings and competitive pressures in the AI sector, investors are keenly observing central bank policies with the ECB cutting rates while the Fed maintains its stance. Amidst this volatility, identifying stocks that are trading below their fair value can offer opportunities for investors seeking to capitalize on potential market inefficiencies. In such an environment, a good stock is often characterized by strong fundamentals and resilience against broader economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhongji Innolight (SZSE:300308) | CN¥98.25 | CN¥195.83 | 49.8% |

| North American Construction Group (TSX:NOA) | CA$27.04 | CA$53.73 | 49.7% |

| Decisive Dividend (TSXV:DE) | CA$5.90 | CA$11.79 | 50% |

| Northwest Bancshares (NasdaqGS:NWBI) | US$13.17 | US$26.31 | 49.9% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.72 | €5.43 | 49.9% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK83.22 | SEK165.90 | 49.8% |

| Spin Master (TSX:TOY) | CA$30.23 | CA$60.17 | 49.8% |

| Coastal Financial (NasdaqGS:CCB) | US$86.74 | US$172.68 | 49.8% |

| Equifax (NYSE:EFX) | US$266.77 | US$531.78 | 49.8% |

| Facephi Biometria (BME:FACE) | €2.23 | €4.45 | 49.8% |

Here's a peek at a few of the choices from the screener.

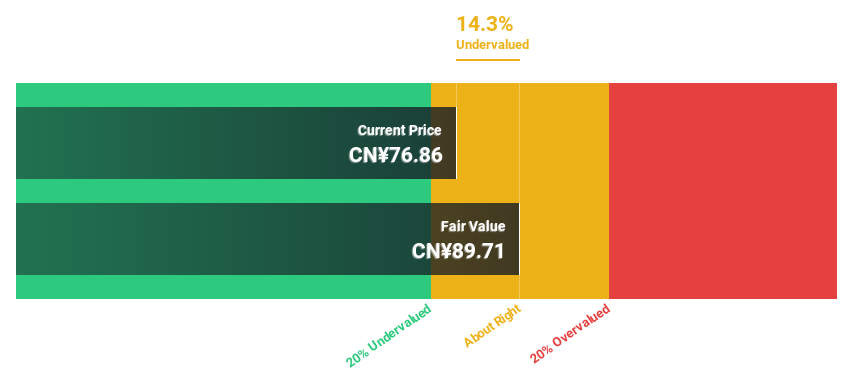

DBAPPSecurity (SHSE:688023)

Overview: DBAPPSecurity Co., Ltd. focuses on the research, development, manufacture, and sale of cybersecurity products in China with a market cap of CN¥4.41 billion.

Operations: DBAPPSecurity Co., Ltd. generates revenue through its research, development, and sale of cybersecurity products in China.

Estimated Discount To Fair Value: 47.3%

DBAPPSecurity is trading at CN¥52.12, significantly undervalued compared to its estimated fair value of CN¥98.84, offering a potential opportunity based on discounted cash flow analysis. Despite being dropped from the S&P Global BMI Index, its revenue is expected to grow 19% annually—outpacing the Chinese market average of 13.3%. Although currently unprofitable, it is forecasted to achieve profitability within three years with above-average market growth expectations.

- Our expertly prepared growth report on DBAPPSecurity implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on DBAPPSecurity's balance sheet by reading our health report here.

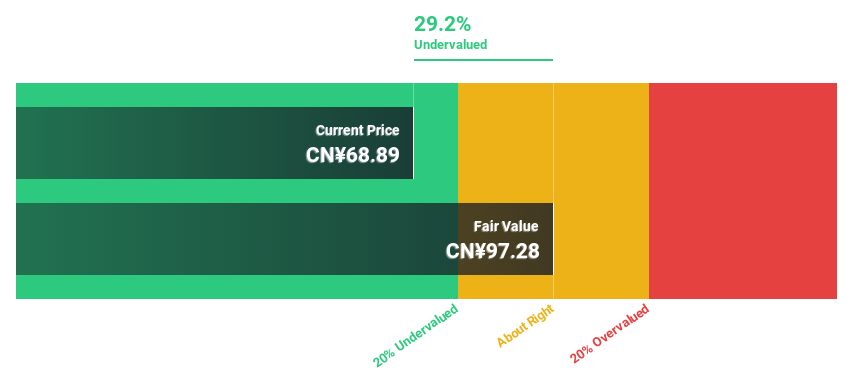

Guangdong Huicheng Vacuum Technology (SZSE:301392)

Overview: Guangdong Huicheng Vacuum Technology Co., Ltd., with a market cap of CN¥6.13 billion, specializes in the development and production of vacuum equipment and related technologies.

Operations: The company's revenue primarily comes from the Machinery & Industrial Equipment segment, which generated CN¥564.79 million.

Estimated Discount To Fair Value: 32.7%

Guangdong Huicheng Vacuum Technology, recently added to the S&P Global BMI Index, is trading at CN¥64.8, significantly below its estimated fair value of CN¥96.3. Despite high share price volatility, it presents a compelling case for undervaluation based on cash flows. Earnings and revenue are forecasted to grow substantially above the market average over the next few years, although its dividend coverage by free cash flows remains weak.

- Our earnings growth report unveils the potential for significant increases in Guangdong Huicheng Vacuum Technology's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Guangdong Huicheng Vacuum Technology.

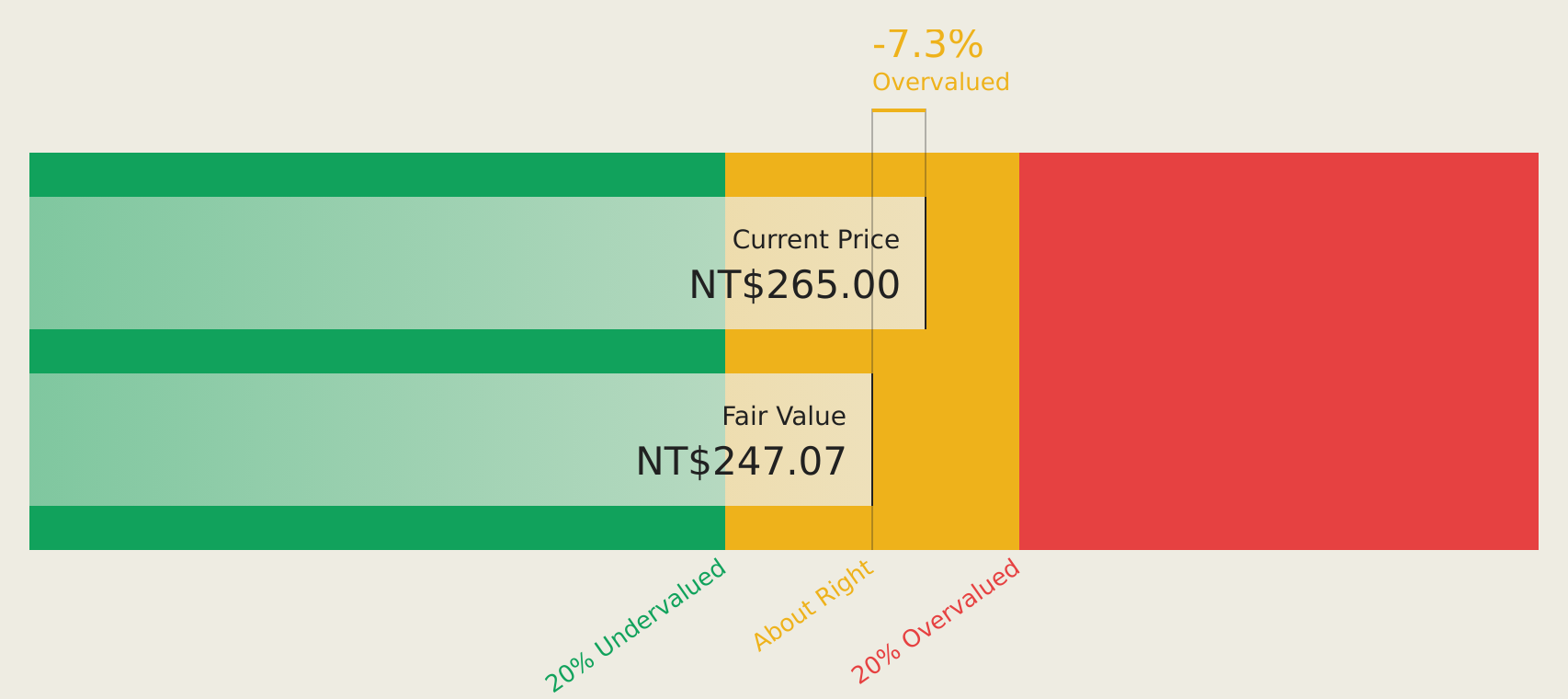

Ennoconn (TWSE:6414)

Overview: Ennoconn Corporation, along with its subsidiaries, manufactures and sells data storage and processing equipment, industrial motherboards, and network communications across Taiwan, China, Europe, and internationally with a market cap of NT$39.02 billion.

Operations: The company's revenue is primarily generated from the Factory System and Electromechanical System Service Business Department with NT$60.85 billion, followed by the Information Systems Department at NT$54.61 billion, and the Industrial Computer Software and Hardware Sales Department contributing NT$26.93 billion, while the Network Communications Production and Sales department adds NT$4.16 billion.

Estimated Discount To Fair Value: 15.8%

Ennoconn is trading at NT$300.5, below its estimated fair value of NT$356.99, suggesting potential undervaluation based on cash flows. The company forecasts revenue and earnings growth above the Taiwan market average, with earnings expected to grow significantly over the next three years. Despite becoming profitable this year, recent results show a decline in net income and EPS compared to last year. Analysts anticipate a 23.4% stock price increase amidst an unstable dividend track record.

- Our comprehensive growth report raises the possibility that Ennoconn is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Ennoconn.

Next Steps

- Delve into our full catalog of 935 Undervalued Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688023

DBAPPSecurity

Engages in the research and development, manufacture, and sale of cybersecurity products in China.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives