- France

- /

- Oil and Gas

- /

- ENXTPA:ES

Exploring Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

In a week marked by mixed performances across major indices, the S&P 500 and Nasdaq Composite continued to reach record highs, while the Russell 2000 saw a decline following its recent outperformance against larger-cap peers. This divergence highlights the nuanced landscape for small-cap stocks amidst broader market shifts and economic indicators such as job growth rebounding in November. In this context, identifying promising stocks involves looking beyond immediate market trends to uncover potential hidden gems that may offer unique opportunities for growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Jiangyin Haida Rubber And Plastic | 15.90% | 6.43% | -13.73% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Kangping Technology (Suzhou) | 28.70% | 2.21% | 3.71% | ★★★★★☆ |

| Thai Energy Storage Technology | 9.49% | -1.42% | 1.73% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

EssoF (ENXTPA:ES)

Simply Wall St Value Rating: ★★★★★★

Overview: Esso S.A.F. is engaged in the refining, distribution, and marketing of refined petroleum products both in France and internationally, with a market capitalization of approximately €1.37 billion.

Operations: EssoF generates revenue primarily from its refining and distribution segment, which reported €18.93 billion. The company's financial performance is influenced by the costs associated with these operations, impacting its profitability metrics such as gross profit margin or net profit margin.

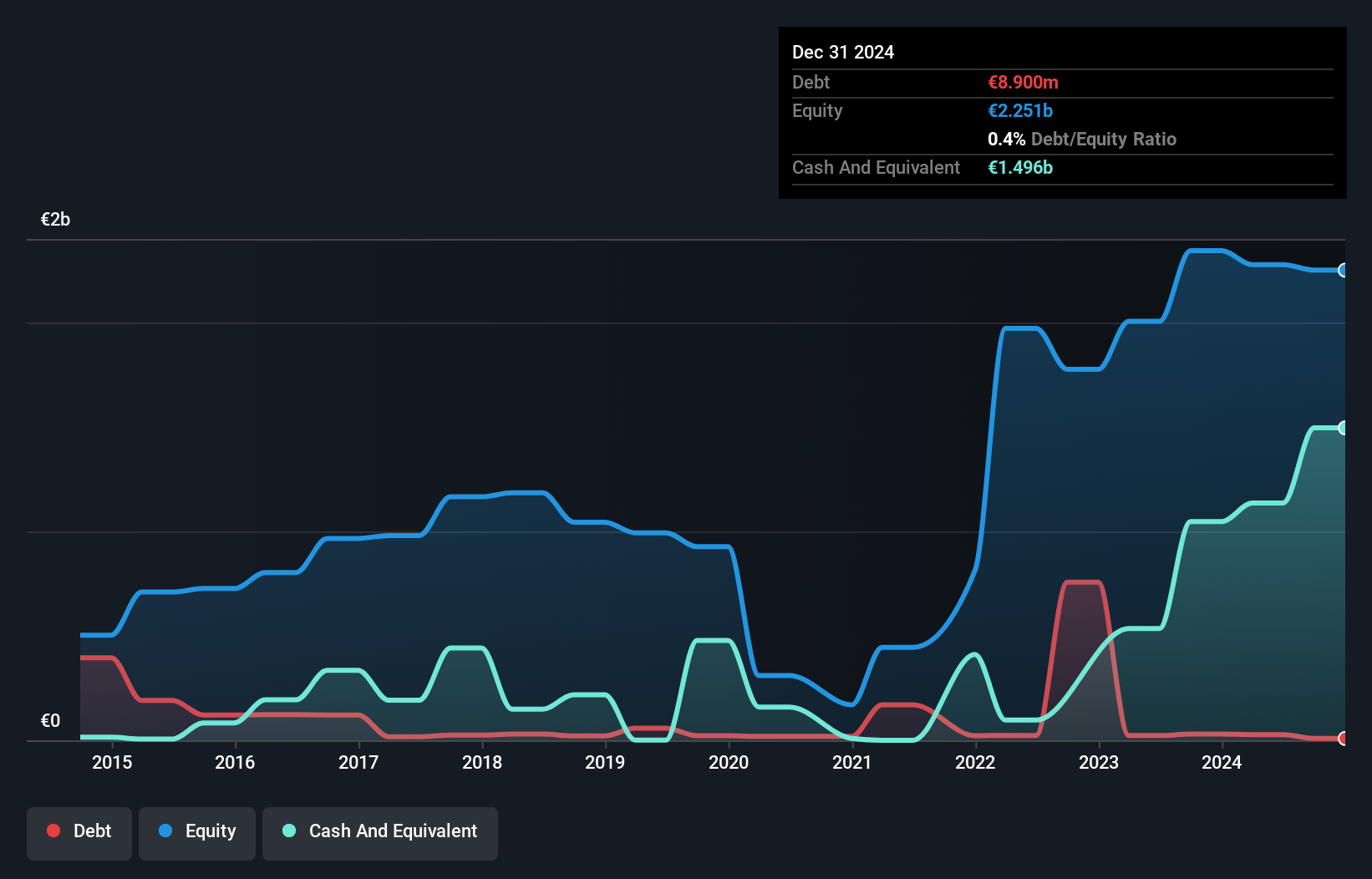

EssoF, a relatively small player in the oil and gas sector, has recently turned profitable, setting it apart from the industry’s -13.9% earnings trend. Over five years, its debt to equity ratio impressively dropped from 5.8% to 1.2%, reflecting stronger financial health. The company seems undervalued, trading at 97% below estimated fair value, suggesting potential upside for investors seeking hidden opportunities. With high-quality earnings and more cash than total debt, EssoF's financial position appears robust. Its ability to cover interest payments comfortably further solidifies its standing as a potentially attractive investment in this space.

- Dive into the specifics of EssoF here with our thorough health report.

Understand EssoF's track record by examining our Past report.

Akfen Yenilenebilir Enerji (IBSE:AKFYE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Akfen Yenilenebilir Enerji focuses on the production of renewable energy in Turkey, with a market capitalization of TRY20.15 billion.

Operations: The company generates revenue primarily from three segments: GES Grubu (TRY678.92 million), HES Grubu (TRY845.57 million), and RES Grubu (TRY2.05 billion).

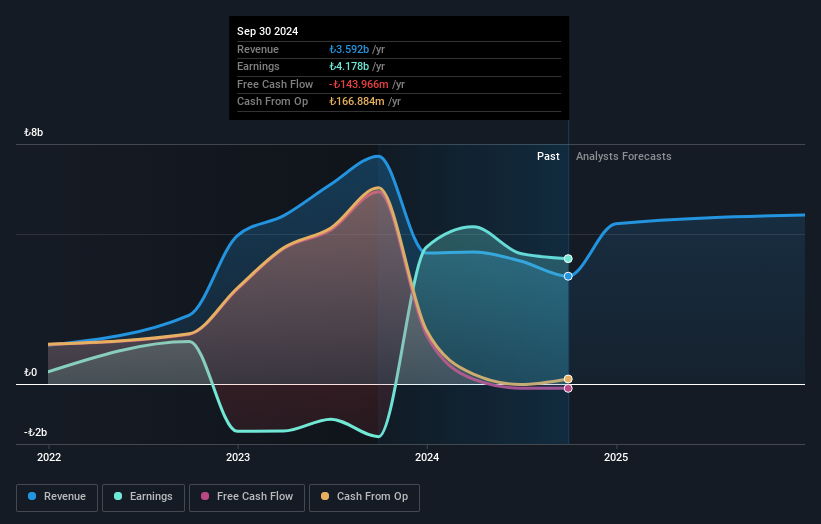

Akfen Yenilenebilir Enerji has shown a significant turnaround, becoming profitable this year despite the renewable energy industry's struggles. The company's debt to equity ratio impressively fell from 762.4% to 32.9% over five years, and its net debt to equity ratio is a satisfactory 24%. However, recent earnings reports reveal challenges; third-quarter sales dropped to TRY 1,083 million from TRY 1,592 million the previous year, resulting in a net loss of TRY 148.91 million compared to a net income of TRY 21.43 million last year. Despite these hurdles, its price-to-earnings ratio of 4.8x suggests potential value against the market's average of 15.9x.

Suzhou Future Electrical (SZSE:301386)

Simply Wall St Value Rating: ★★★★★★

Overview: Suzhou Future Electrical Co., Ltd. focuses on the research, development, production, and sale of low-voltage circuit breaker accessories in China and has a market cap of CN¥3.23 billion.

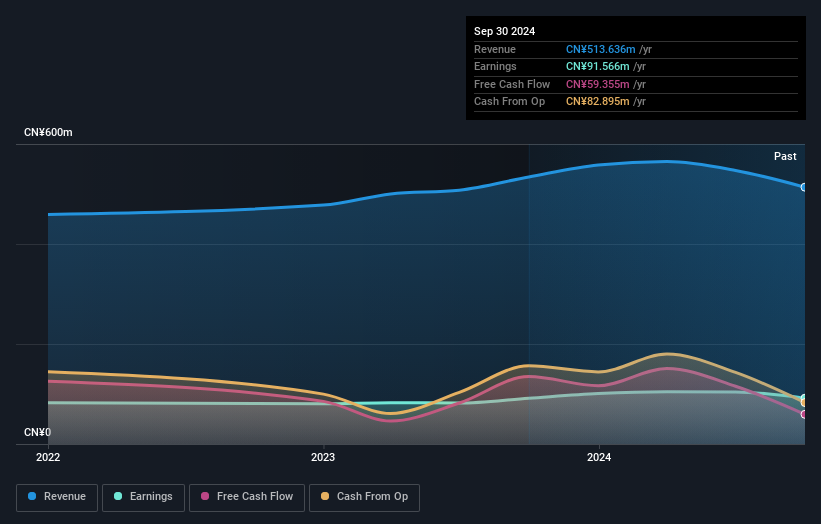

Operations: Suzhou Future Electrical generates revenue primarily through the production and sales of low-voltage apparatus, amounting to CN¥513.64 million.

Future Electrical, a small cap player in the electrical industry, shows mixed signals. Over the last five years, earnings have grown annually by 6.4%, but recent figures reveal some challenges. For the nine months ending September 2024, sales were CNY 382.89 million compared to CNY 427.09 million in the previous year, with net income at CNY 64.48 million down from CNY 73.7 million last year. Despite this dip, Future Electrical's debt-to-equity ratio has impressively dropped from 6.5 to just 0.9 over five years and its price-to-earnings ratio of 36x remains competitive against the market's average of 38x in China.

Make It Happen

- Reveal the 4622 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EssoF might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ES

EssoF

Esso S.A.F. refines, distributes, and markets refined petroleum products in France and internationally.

Flawless balance sheet and good value.