- China

- /

- Electrical

- /

- SZSE:301222

Zhejiang Hengwei Battery Co., Ltd.'s (SZSE:301222) Share Price Boosted 31% But Its Business Prospects Need A Lift Too

Zhejiang Hengwei Battery Co., Ltd. (SZSE:301222) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 8.4% in the last twelve months.

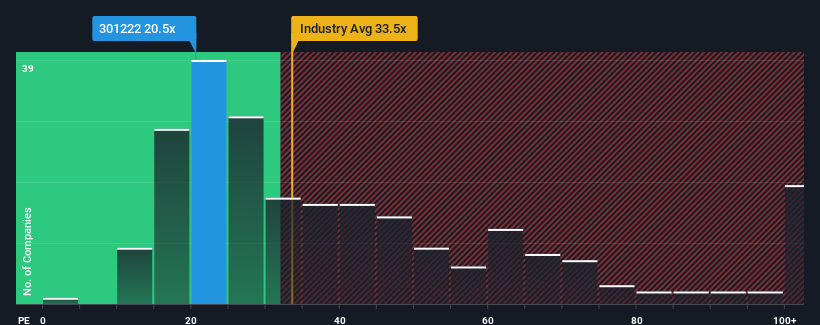

Even after such a large jump in price, Zhejiang Hengwei Battery may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 20.5x, since almost half of all companies in China have P/E ratios greater than 34x and even P/E's higher than 67x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

For example, consider that Zhejiang Hengwei Battery's financial performance has been pretty ordinary lately as earnings growth is non-existent. One possibility is that the P/E is low because investors think this benign earnings growth rate will likely underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Zhejiang Hengwei Battery

How Is Zhejiang Hengwei Battery's Growth Trending?

In order to justify its P/E ratio, Zhejiang Hengwei Battery would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with earnings down 4.8% overall from three years ago. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 37% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's understandable that Zhejiang Hengwei Battery's P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

The latest share price surge wasn't enough to lift Zhejiang Hengwei Battery's P/E close to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Zhejiang Hengwei Battery maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 2 warning signs for Zhejiang Hengwei Battery (1 shouldn't be ignored!) that you should be aware of.

Of course, you might also be able to find a better stock than Zhejiang Hengwei Battery. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Hengwei Battery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301222

Zhejiang Hengwei Battery

Engages in the research, development, production, and sale of battery products in China and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives