Optimistic Investors Push United Faith Auto-Engineering Co.,Ltd. (SZSE:301112) Shares Up 26% But Growth Is Lacking

The United Faith Auto-Engineering Co.,Ltd. (SZSE:301112) share price has done very well over the last month, posting an excellent gain of 26%. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 9.6% in the last twelve months.

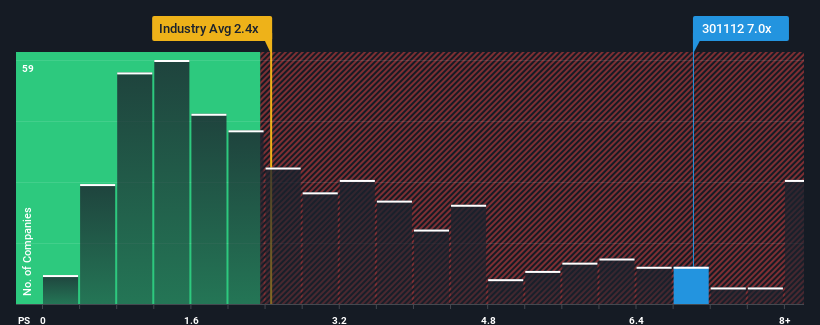

After such a large jump in price, you could be forgiven for thinking United Faith Auto-EngineeringLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 7x, considering almost half the companies in China's Machinery industry have P/S ratios below 2.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for United Faith Auto-EngineeringLtd

What Does United Faith Auto-EngineeringLtd's Recent Performance Look Like?

As an illustration, revenue has deteriorated at United Faith Auto-EngineeringLtd over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on United Faith Auto-EngineeringLtd's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like United Faith Auto-EngineeringLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 12%. As a result, revenue from three years ago have also fallen 28% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 22% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that United Faith Auto-EngineeringLtd is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does United Faith Auto-EngineeringLtd's P/S Mean For Investors?

The strong share price surge has lead to United Faith Auto-EngineeringLtd's P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of United Faith Auto-EngineeringLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

We don't want to rain on the parade too much, but we did also find 4 warning signs for United Faith Auto-EngineeringLtd (2 are a bit concerning!) that you need to be mindful of.

If these risks are making you reconsider your opinion on United Faith Auto-EngineeringLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301112

United Faith Auto-EngineeringLtd

Engages in the design, development, production, assembly, and sale of industrial automation integration products, industrial intelligent production equipment, industrial automation intelligent assembly units, and accessories in China, Japan, Southeast Asian countries, North and South America, and internationally.

Excellent balance sheet slight.

Market Insights

Community Narratives