- China

- /

- Electrical

- /

- SZSE:301107

Is The Market Rewarding Chongqing YuXin Pingrui Electronic Co., Ltd. (SZSE:301107) With A Negative Sentiment As A Result Of Its Mixed Fundamentals?

Chongqing YuXin Pingrui Electronic (SZSE:301107) has had a rough month with its share price down 18%. It seems that the market might have completely ignored the positive aspects of the company's fundamentals and decided to weigh-in more on the negative aspects. Long-term fundamentals are usually what drive market outcomes, so it's worth paying close attention. In this article, we decided to focus on Chongqing YuXin Pingrui Electronic's ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for Chongqing YuXin Pingrui Electronic

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Chongqing YuXin Pingrui Electronic is:

5.6% = CN¥52m ÷ CN¥923m (Based on the trailing twelve months to September 2024).

The 'return' is the amount earned after tax over the last twelve months. One way to conceptualize this is that for each CN¥1 of shareholders' capital it has, the company made CN¥0.06 in profit.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Chongqing YuXin Pingrui Electronic's Earnings Growth And 5.6% ROE

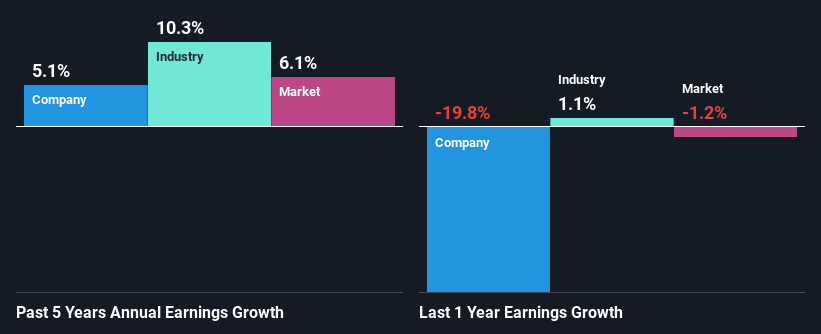

At first glance, Chongqing YuXin Pingrui Electronic's ROE doesn't look very promising. Yet, a closer study shows that the company's ROE is similar to the industry average of 6.4%. On the other hand, Chongqing YuXin Pingrui Electronic reported a moderate 5.1% net income growth over the past five years. Taking into consideration that the ROE is not particularly high, we reckon that there could also be other factors at play which could be influencing the company's growth. For instance, the company has a low payout ratio or is being managed efficiently.

As a next step, we compared Chongqing YuXin Pingrui Electronic's net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 10% in the same period.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Chongqing YuXin Pingrui Electronic fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Chongqing YuXin Pingrui Electronic Efficiently Re-investing Its Profits?

Chongqing YuXin Pingrui Electronic has a significant three-year median payout ratio of 58%, meaning that it is left with only 42% to reinvest into its business. This implies that the company has been able to achieve decent earnings growth despite returning most of its profits to shareholders.

While Chongqing YuXin Pingrui Electronic has been growing its earnings, it only recently started to pay dividends which likely means that the company decided to impress new and existing shareholders with a dividend.

Conclusion

Overall, we have mixed feelings about Chongqing YuXin Pingrui Electronic. Although the company has shown a fair bit of growth in earnings, the reinvestment rate is low. Meaning, the earnings growth number could have been significantly higher had the company been retaining more of its profits and reinvesting that at a higher rate of return. Up till now, we've only made a short study of the company's growth data. So it may be worth checking this free detailed graph of Chongqing YuXin Pingrui Electronic's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301107

Chongqing YuXin Pingrui Electronic

Chongqing YuXin Pingrui Electronic Co., Ltd.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives