- China

- /

- Construction

- /

- SZSE:301046

January 2025's Leading Growth Companies With Insider Influence

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with U.S. stocks wrapping up a strong two-year performance despite recent economic data concerns, investors are increasingly focusing on companies with robust growth potential and significant insider ownership. Such companies often demonstrate resilience and strategic alignment between management and shareholders, making them compelling considerations in today's market landscape.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| EHang Holdings (NasdaqGM:EH) | 31.4% | 79.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Here we highlight a subset of our preferred stocks from the screener.

Luoyang Jianlong Micro-nano New Material (SHSE:688357)

Simply Wall St Growth Rating: ★★★★★☆

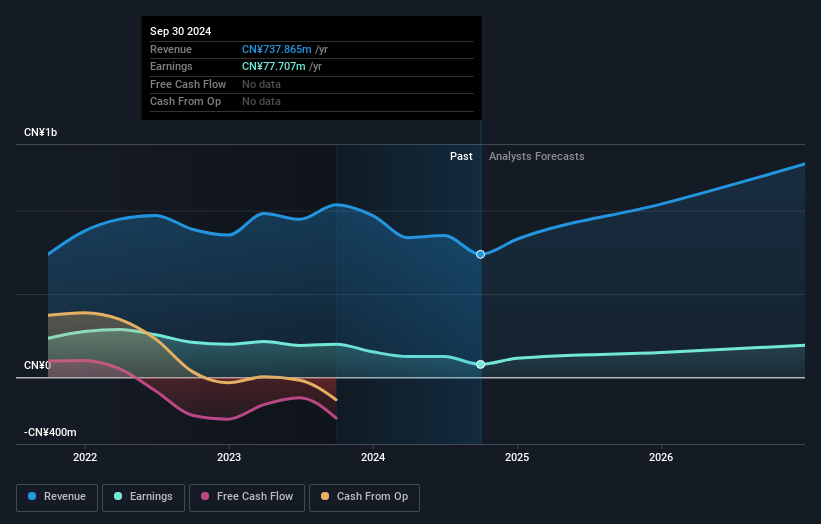

Overview: Luoyang Jianlong Micro-nano New Material Co., Ltd, with a market cap of CN¥2.14 billion, manufactures and sells molecular sieves in China.

Operations: The company generates revenue of CN¥737.86 million from its Chemical Raw Materials and Chemical Products Manufacturing segment.

Insider Ownership: 24.3%

Earnings Growth Forecast: 35% p.a.

Luoyang Jianlong Micro-nano New Material is poised for strong growth, with earnings expected to rise significantly at 35% annually, outpacing the broader CN market. Revenue is also forecasted to grow at 24.1% per year, surpassing market expectations. Despite a decline in net profit margins from 19.2% to 10.5%, the company's price-to-earnings ratio of 27.2x remains attractive compared to the market average of 33.4x, suggesting potential value for investors focused on growth prospects amidst high insider ownership dynamics.

- Click to explore a detailed breakdown of our findings in Luoyang Jianlong Micro-nano New Material's earnings growth report.

- According our valuation report, there's an indication that Luoyang Jianlong Micro-nano New Material's share price might be on the expensive side.

Dalian Insulator Group (SZSE:002606)

Simply Wall St Growth Rating: ★★★★★☆

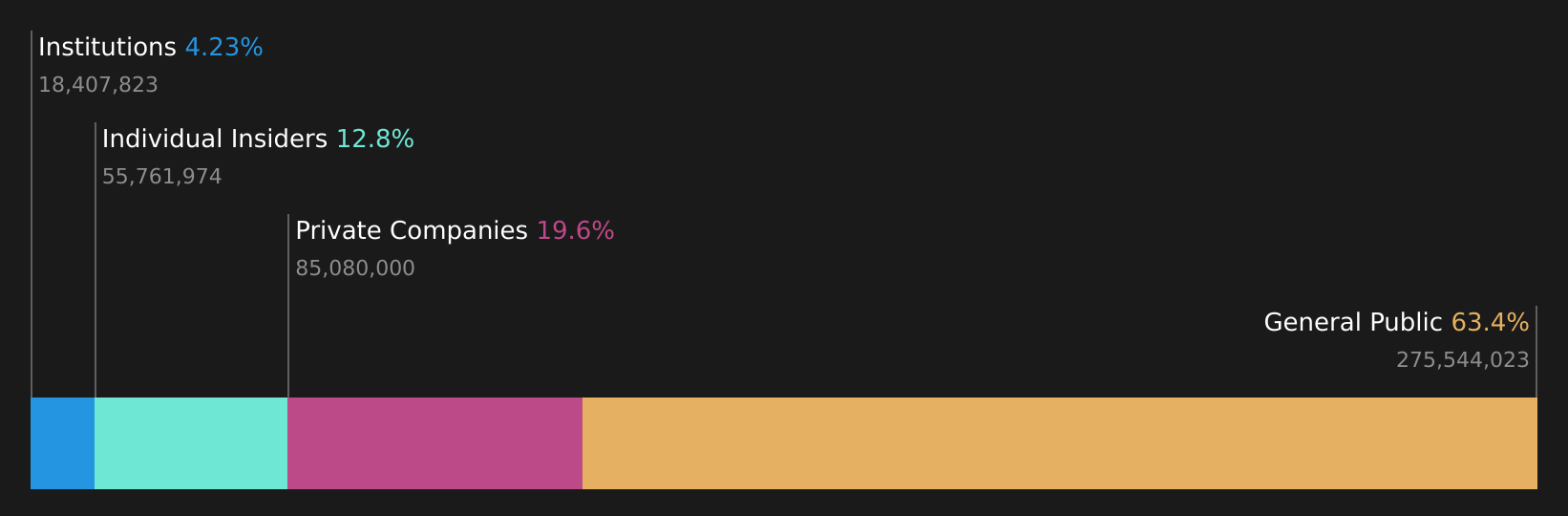

Overview: Dalian Insulator Group Co., Ltd, along with its subsidiaries, focuses on the research, development, manufacture, and sale of porcelain insulators both in China and internationally, with a market cap of CN¥3.93 billion.

Operations: Dalian Insulator Group Co., Ltd generates revenue primarily through its operations in the research, development, manufacture, and sale of porcelain insulators within domestic and international markets.

Insider Ownership: 13%

Earnings Growth Forecast: 33% p.a.

Dalian Insulator Group shows promising growth potential with earnings forecasted to increase by 33% annually, surpassing the broader CN market. Revenue is expected to grow at 27.2% per year, indicating robust expansion prospects. The company's price-to-earnings ratio of 23.3x is favorable compared to the CN market average of 33.4x, highlighting its relative value appeal despite low return on equity forecasts and a dividend not well covered by free cash flows amidst high insider ownership dynamics.

- Unlock comprehensive insights into our analysis of Dalian Insulator Group stock in this growth report.

- Our expertly prepared valuation report Dalian Insulator Group implies its share price may be lower than expected.

Shanghai Nenghui TechnologyLtd (SZSE:301046)

Simply Wall St Growth Rating: ★★★★★☆

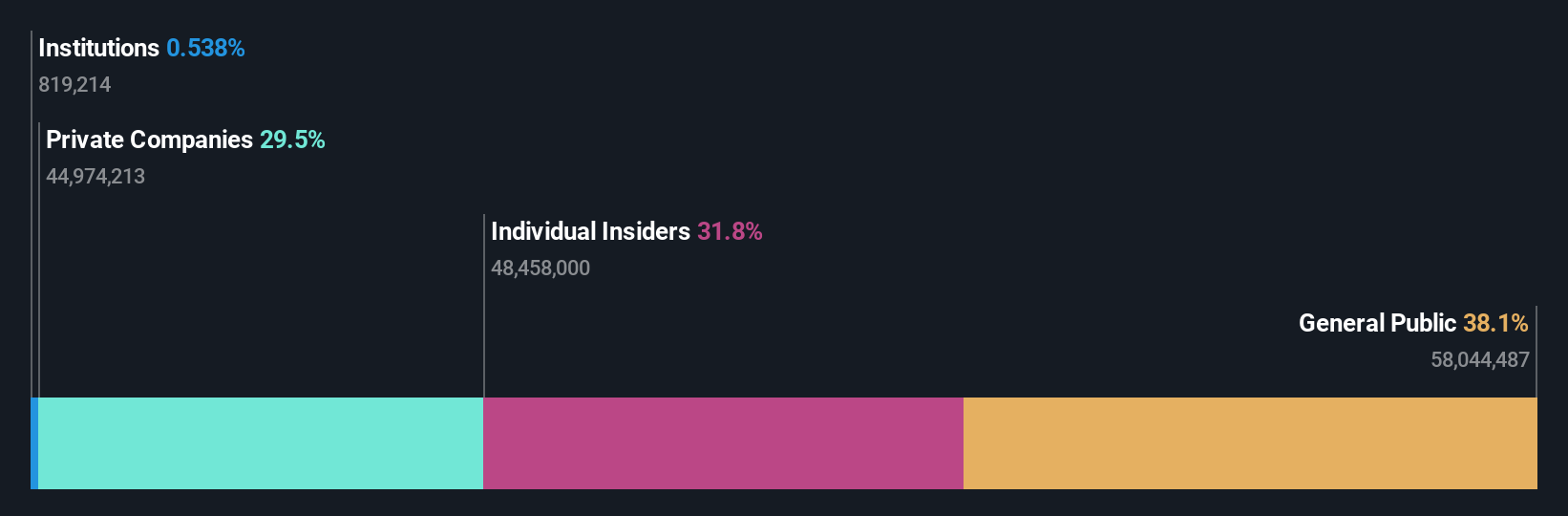

Overview: Shanghai Nenghui Technology Co., Ltd. specializes in the research, development, design, system integration, investment, and operation of photovoltaic power stations with a market cap of CN¥2.97 billion.

Operations: The company generates revenue from its activities in the research, development, design, system integration, investment, and operation of photovoltaic power stations.

Insider Ownership: 32.5%

Earnings Growth Forecast: 29.4% p.a.

Shanghai Nenghui Technology Ltd. demonstrates strong growth potential, with revenue forecasted to increase by 30.5% annually, outpacing the broader CN market's 13.6%. Earnings have grown significantly, with a 75.4% increase over the past year and expected annual profit growth of 29.4%, surpassing the CN market's average of 25.1%. However, its return on equity is projected to be low at 14.6%, and dividends are not well supported by free cash flows despite high insider ownership levels.

- Click here to discover the nuances of Shanghai Nenghui TechnologyLtd with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Shanghai Nenghui TechnologyLtd's current price could be inflated.

Where To Now?

- Delve into our full catalog of 1481 Fast Growing Companies With High Insider Ownership here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301046

Shanghai Nenghui TechnologyLtd

Engages in research, development, design, system integration, investment, and operation of photovoltaic power stations.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives