Changchun Zhiyuan New Energy Equipment Co., Ltd (SZSE:300985) Investors Are Less Pessimistic Than Expected

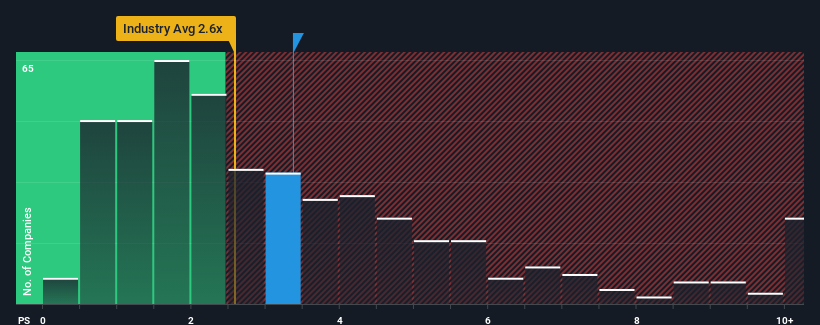

Changchun Zhiyuan New Energy Equipment Co., Ltd's (SZSE:300985) price-to-sales (or "P/S") ratio of 3.4x may not look like an appealing investment opportunity when you consider close to half the companies in the Machinery industry in China have P/S ratios below 2.6x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Changchun Zhiyuan New Energy Equipment

What Does Changchun Zhiyuan New Energy Equipment's Recent Performance Look Like?

Changchun Zhiyuan New Energy Equipment certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Changchun Zhiyuan New Energy Equipment, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Changchun Zhiyuan New Energy Equipment's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Changchun Zhiyuan New Energy Equipment's to be considered reasonable.

Retrospectively, the last year delivered an explosive gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 11% drop in revenue in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to deliver 28% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we find it worrying that Changchun Zhiyuan New Energy Equipment's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On Changchun Zhiyuan New Energy Equipment's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Changchun Zhiyuan New Energy Equipment currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 1 warning sign for Changchun Zhiyuan New Energy Equipment that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Changchun Zhiyuan New Energy Equipment, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300985

Changchun Zhiyuan New Energy Equipment

Research and development, production, and sale of vehicle-mounted liquefied natural gas (LNG) gas supply systems and marine LNG fuel gas supply systems in China and internationally.

Adequate balance sheet slight.

Market Insights

Community Narratives