A Piece Of The Puzzle Missing From Changchun Zhiyuan New Energy Equipment Co., Ltd's (SZSE:300985) 48% Share Price Climb

Changchun Zhiyuan New Energy Equipment Co., Ltd (SZSE:300985) shareholders have had their patience rewarded with a 48% share price jump in the last month. Looking further back, the 20% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

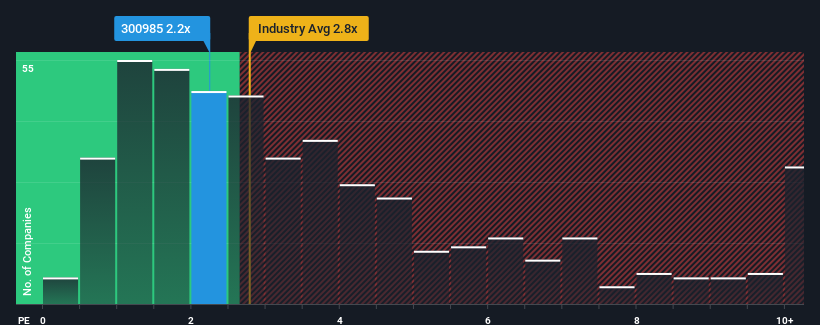

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Changchun Zhiyuan New Energy Equipment's P/S ratio of 2.2x, since the median price-to-sales (or "P/S") ratio for the Machinery industry in China is also close to 2.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Changchun Zhiyuan New Energy Equipment

What Does Changchun Zhiyuan New Energy Equipment's Recent Performance Look Like?

Changchun Zhiyuan New Energy Equipment certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Changchun Zhiyuan New Energy Equipment's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Changchun Zhiyuan New Energy Equipment's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 218%. The strong recent performance means it was also able to grow revenue by 118% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 23% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's curious that Changchun Zhiyuan New Energy Equipment's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Changchun Zhiyuan New Energy Equipment's P/S?

Changchun Zhiyuan New Energy Equipment's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Changchun Zhiyuan New Energy Equipment currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It is also worth noting that we have found 5 warning signs for Changchun Zhiyuan New Energy Equipment (4 are potentially serious!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Changchun Zhiyuan New Energy Equipment, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300985

Changchun Zhiyuan New Energy Equipment

Research and development, production, and sale of vehicle-mounted liquefied natural gas (LNG) gas supply systems and marine LNG fuel gas supply systems in China and internationally.

Adequate balance sheet slight.

Market Insights

Community Narratives