- China

- /

- Construction

- /

- SZSE:300982

Shenzhen Anche Technologies And 2 Other Stocks That Could Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global markets edge toward record highs, driven by robust performances in major indices like the Nasdaq Composite and S&P 500, investors are keenly observing inflation trends and potential interest rate adjustments. Amidst these developments, identifying stocks that may be undervalued can present opportunities for those looking to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vimi Fasteners (BIT:VIM) | €0.97 | €1.91 | 49.2% |

| Hibino (TSE:2469) | ¥2796.00 | ¥5515.05 | 49.3% |

| 3onedata (SHSE:688618) | CN¥24.76 | CN¥48.83 | 49.3% |

| Shanghai Haohai Biological Technology (SEHK:6826) | HK$26.30 | HK$52.47 | 49.9% |

| Neosem (KOSDAQ:A253590) | ₩12020.00 | ₩23912.59 | 49.7% |

| Power Wind Health Industry (TWSE:8462) | NT$112.50 | NT$222.53 | 49.4% |

| América Móvil. de (BMV:AMX B) | MX$15.05 | MX$29.71 | 49.3% |

| Accent Group (ASX:AX1) | A$2.14 | A$4.23 | 49.5% |

| Superloop (ASX:SLC) | A$2.19 | A$4.35 | 49.6% |

| Integral Diagnostics (ASX:IDX) | A$2.89 | A$5.73 | 49.6% |

Here's a peek at a few of the choices from the screener.

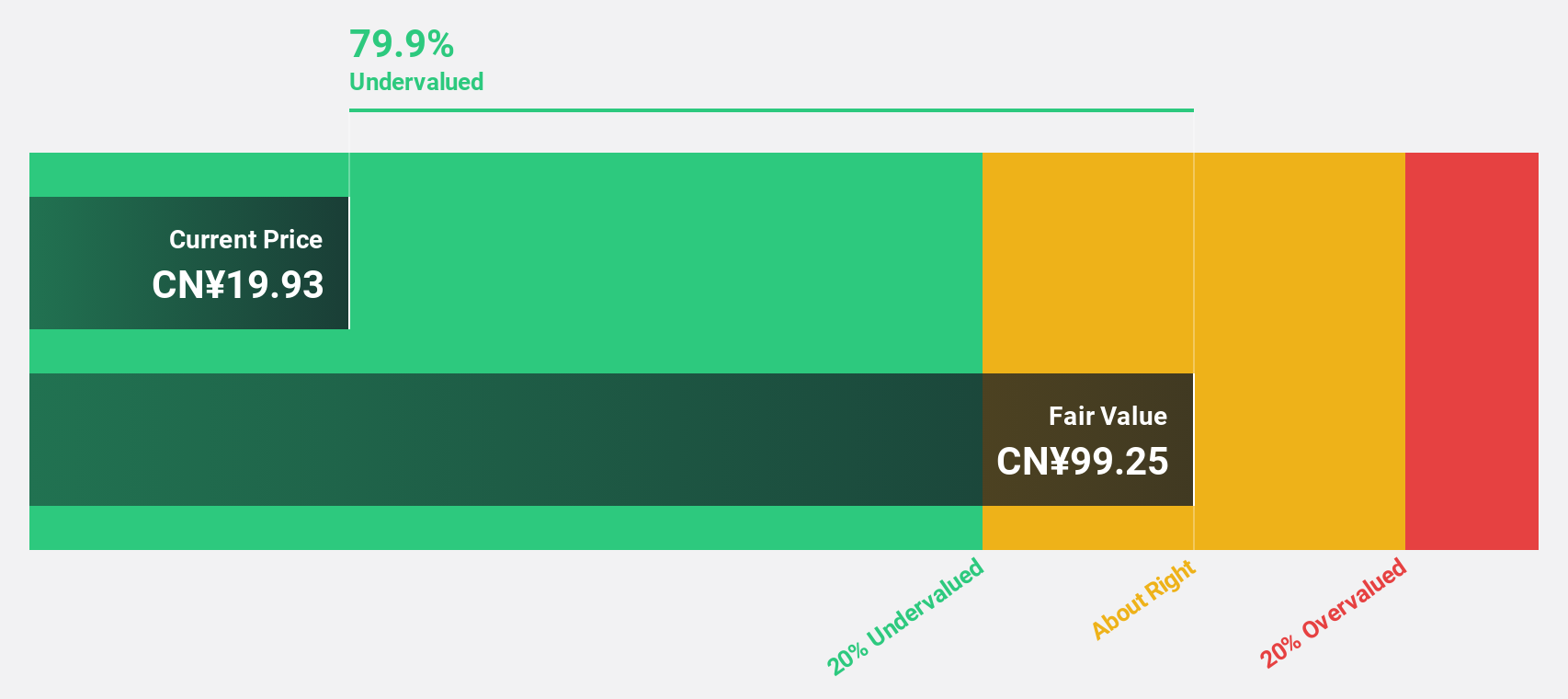

Shenzhen Anche Technologies (SZSE:300572)

Overview: Shenzhen Anche Technologies Co., Ltd. offers motor vehicle inspection solutions in China and has a market cap of CN¥4.23 billion.

Operations: Unfortunately, the provided text does not contain specific revenue segment data for Shenzhen Anche Technologies Co., Ltd., so a summary of revenue segments cannot be generated.

Estimated Discount To Fair Value: 48.4%

Shenzhen Anche Technologies is trading at CN¥19.06, significantly below its estimated fair value of CN¥36.96, suggesting it may be undervalued based on cash flows. Revenue is projected to grow 43.3% annually, outpacing the Chinese market's growth rate of 13.4%. Despite a low forecasted return on equity of 3.7%, earnings are expected to increase by over 100% per year, supported by recent strategic M&A activities involving a CNY 210 million investment.

- Upon reviewing our latest growth report, Shenzhen Anche Technologies' projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Shenzhen Anche Technologies.

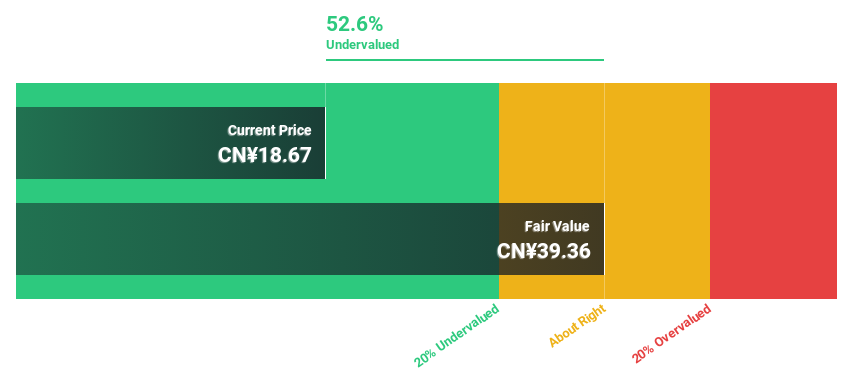

Suwen Electric Energy TechnologyLtd (SZSE:300982)

Overview: Suwen Electric Energy Technology Co., Ltd. (SZSE:300982) operates in the electric energy sector and has a market capitalization of approximately CN¥3.66 billion.

Operations: Suwen Electric Energy Technology Co., Ltd. primarily generates its revenue from operations within the electric energy sector.

Estimated Discount To Fair Value: 31.9%

Suwen Electric Energy Technology is trading at CN¥18.45, over 31% below its estimated fair value of CN¥27.09, highlighting potential undervaluation based on cash flows. Revenue is forecast to grow 34.8% annually, surpassing the Chinese market's growth rate of 13.4%. However, the anticipated return on equity remains low at 7.7%, and dividends are not well covered by earnings or free cash flows despite recent share buybacks totaling CNY 100 million.

- The analysis detailed in our Suwen Electric Energy TechnologyLtd growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Suwen Electric Energy TechnologyLtd.

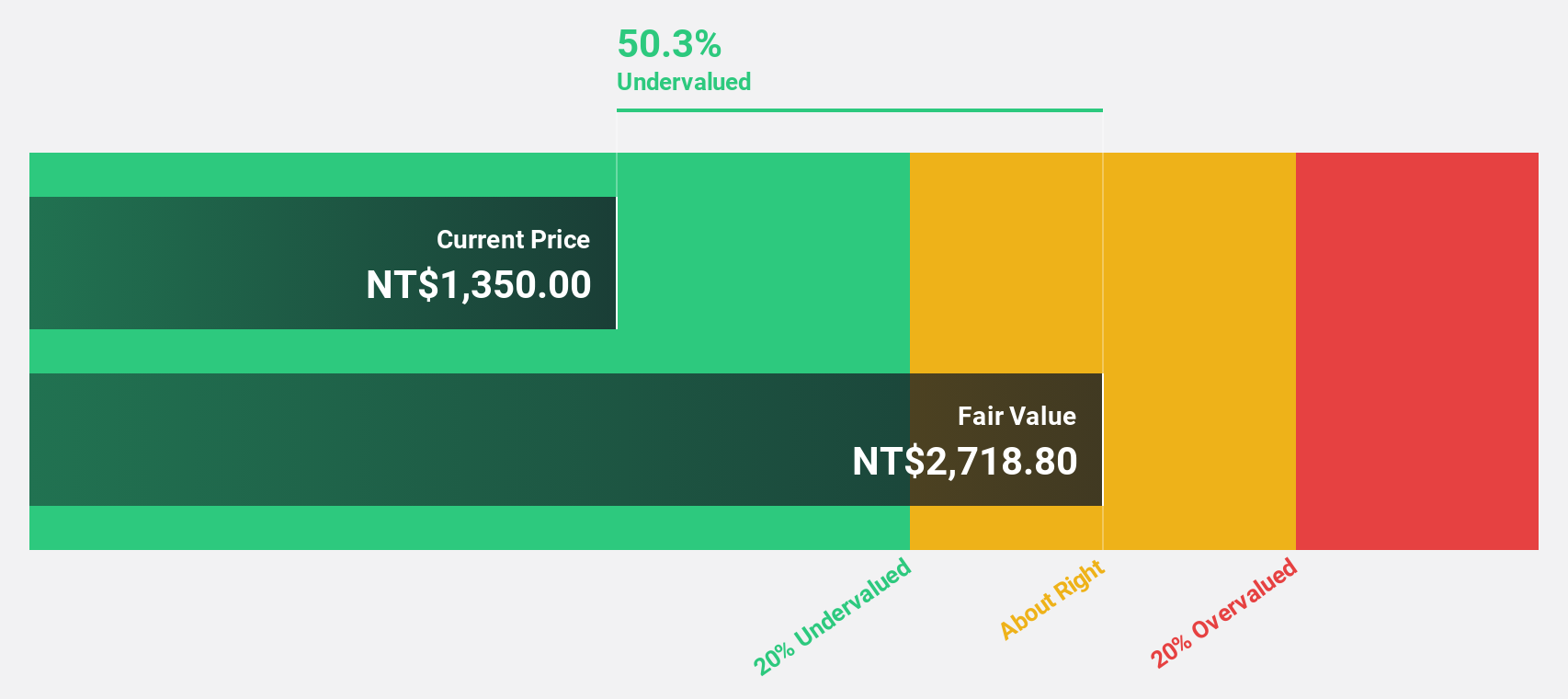

Lotes (TWSE:3533)

Overview: Lotes Co., Ltd designs, manufactures, and sells electronic interconnect and hardware components in Taiwan, Mainland China, and internationally with a market cap of NT$203.13 billion.

Operations: The company generates revenue primarily from its Electronic Components & Parts segment, which amounts to NT$28.36 billion.

Estimated Discount To Fair Value: 29.2%

Lotes is trading at NT$1825, 29.2% below its estimated fair value of NT$2577.02, suggesting potential undervaluation based on cash flows. Earnings are expected to grow significantly at 20.27% annually over the next three years, outpacing the TW market's growth rate of 17.9%. However, the stock has experienced high volatility recently, which could present risks despite its promising earnings and revenue forecasts exceeding market averages.

- In light of our recent growth report, it seems possible that Lotes' financial performance will exceed current levels.

- Click here to discover the nuances of Lotes with our detailed financial health report.

Seize The Opportunity

- Discover the full array of 905 Undervalued Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300982

Suwen Electric Energy TechnologyLtd

Suwen Electric Energy Technology Co.,Ltd.

High growth potential and good value.

Market Insights

Community Narratives