- China

- /

- General Merchandise and Department Stores

- /

- SZSE:002187

Unearthing Asia's Hidden Stock Gems In April 2025

Reviewed by Simply Wall St

As global trade tensions escalate due to unexpected tariff announcements, Asian markets are experiencing heightened volatility, with small-cap stocks particularly feeling the pressure. Despite these challenges, the search for promising investment opportunities continues, and in this environment of uncertainty, identifying resilient companies with strong fundamentals becomes crucial.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Togami Electric Mfg | 1.60% | 4.56% | 15.25% | ★★★★★★ |

| Synmosa Biopharma | 30.18% | 16.26% | 21.16% | ★★★★★★ |

| Ve Wong | 11.50% | 0.72% | 3.87% | ★★★★★★ |

| Hubei Three Gorges Tourism Group | 11.32% | -9.98% | 7.95% | ★★★★★★ |

| BBK Test Systems | NA | 8.57% | 12.90% | ★★★★★★ |

| Renxin New MaterialLtd | NA | 0.65% | -39.64% | ★★★★★★ |

| Synergy Innovation | 16.72% | 13.04% | 53.00% | ★★★★★★ |

| Tibet Development | 51.47% | -1.07% | 56.62% | ★★★★★★ |

| Komori | 9.28% | 8.79% | 64.70% | ★★★★★☆ |

| Kwang Dong Pharmaceutical | 44.94% | 6.47% | 3.58% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Guangzhou Grandbuy (SZSE:002187)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangzhou Grandbuy Co., Ltd. operates department store retail services in China and has a market capitalization of CN¥4.95 billion.

Operations: The company generates revenue primarily from its department store retail services in China. It has a market capitalization of CN¥4.95 billion, indicating its significant presence in the retail sector.

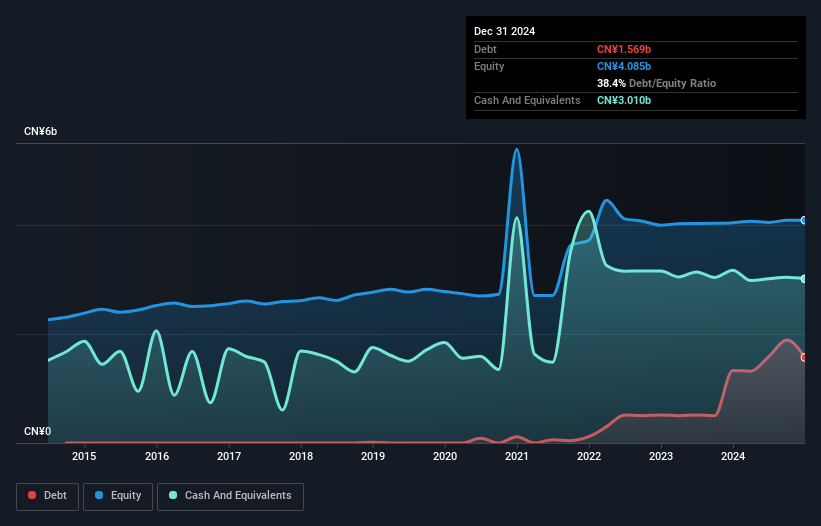

Guangzhou Grandbuy, a nimble player in the retail sector, seems to offer intriguing prospects. Trading at 67.7% below its estimated fair value, it appears undervalued. The company reported sales of CN¥5.53 billion for 2024, up from CN¥5.34 billion the previous year, while net income climbed to CN¥47.61 million from CN¥36.17 million in 2023. With a notable earnings growth of 31.6% over the past year outpacing industry averages and basic earnings per share rising to CNY0.07 from CNY0.05, Grandbuy's financial health is underlined by more cash than debt and positive free cash flow despite recent volatility in its share price and an increased debt-to-equity ratio of 38%.

- Click to explore a detailed breakdown of our findings in Guangzhou Grandbuy's health report.

Explore historical data to track Guangzhou Grandbuy's performance over time in our Past section.

Qinhuangdao Tianqin Equipment ManufacturingLtd (SZSE:300922)

Simply Wall St Value Rating: ★★★★★★

Overview: Qinhuangdao Tianqin Equipment Manufacturing Co., Ltd. operates in the equipment manufacturing industry and has a market cap of CN¥2.99 billion.

Operations: Tianqin Equipment Manufacturing generates revenue primarily from its equipment manufacturing operations. The company has a market capitalization of CN¥2.99 billion, indicating its scale within the industry.

Qinhuangdao Tianqin Equipment Manufacturing, a small player in the Aerospace & Defense sector, has shown impressive earnings growth of 90% over the past year, outpacing industry averages. Despite a volatile share price recently, this debt-free company boasts high-quality earnings and no concerns regarding interest payments. However, its free cash flow remains negative, which could be attributed to significant capital expenditures of approximately US$124 million in recent periods. A special shareholders meeting is scheduled for March 25, 2025, to address board composition changes. These factors suggest potential but also highlight areas needing attention for sustained growth.

DaikokutenbussanLtd (TSE:2791)

Simply Wall St Value Rating: ★★★★★☆

Overview: Daikokutenbussan Co., Ltd. operates discount stores and has a market capitalization of approximately ¥93.51 billion.

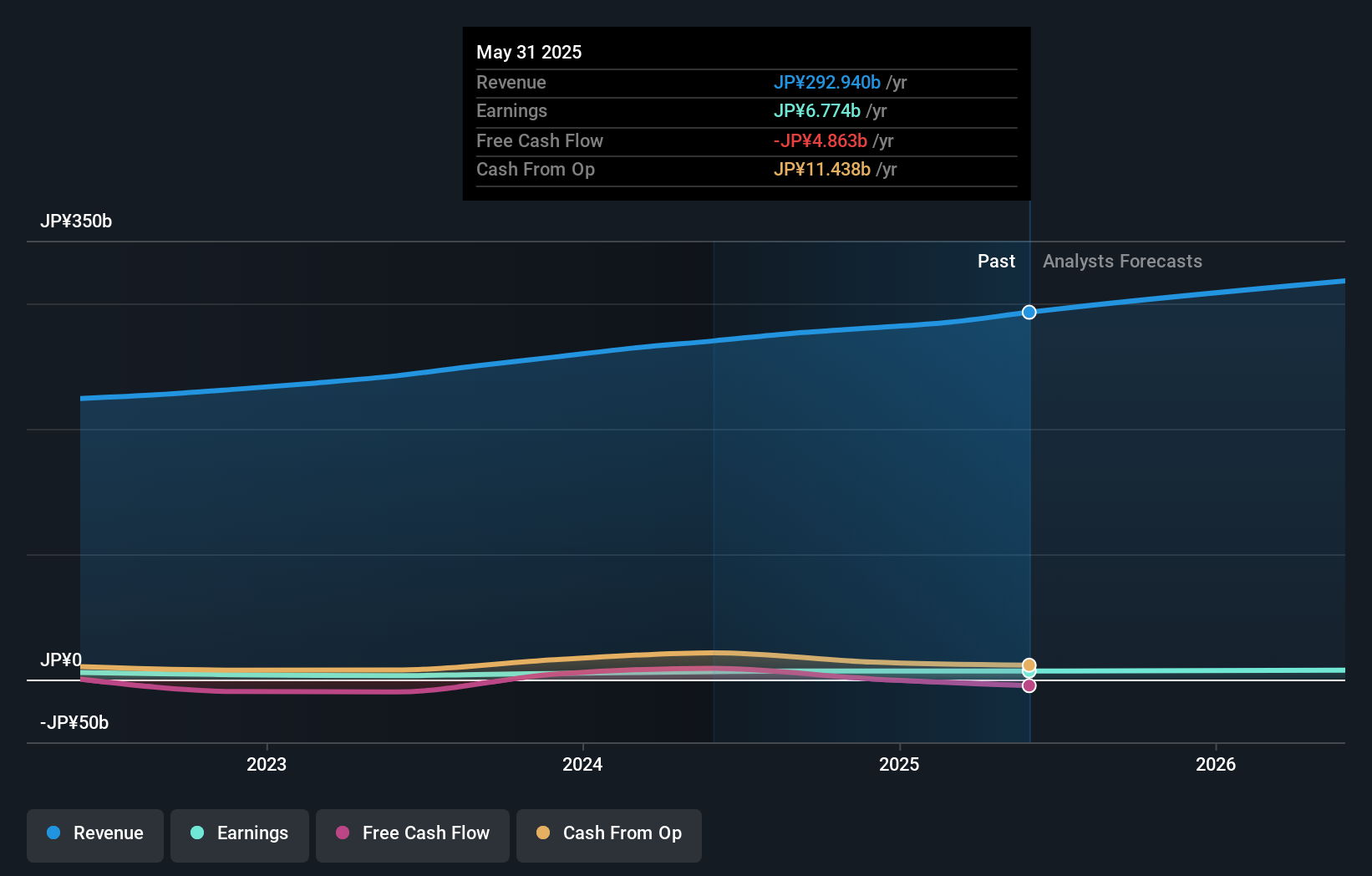

Operations: Daikokutenbussan generates its revenue primarily from its retail segment, amounting to ¥27.91 billion. The company's financial performance is influenced by its gross profit margin trends over time.

Daikokutenbussan, a relatively small player in the retail sector, has been making waves with its impressive financial performance. Over the past year, earnings surged by 41.7%, outpacing the Consumer Retailing industry's 9.7% growth. The company's net debt to equity ratio stands at a satisfactory 8.4%, reflecting prudent financial management as it decreased from 39.9% over five years. Interest payments are comfortably covered by EBIT with an impressive 3353x coverage, showcasing robust operational efficiency. Recent earnings announcements revealed sales of ¥142 billion and net income of ¥3 billion for the half-year ending November 2024, indicating solid profitability and potential for continued growth in this dynamic market segment.

Turning Ideas Into Actions

- Click here to access our complete index of 2556 Asian Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002187

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives