Asian Growth Companies With High Insider Ownership June 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating trade tensions and economic indicators, Asia remains a focal point with its potential for growth amid these uncertainties. In such an environment, companies that exhibit strong insider ownership can be particularly appealing to investors, as this often signals confidence in the company's future prospects and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.9% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.4% | 23.5% |

| Schooinc (TSE:264A) | 30.6% | 68.9% |

| Samyang Foods (KOSE:A003230) | 11.7% | 24.3% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 94.4% |

| NEXTIN (KOSDAQ:A348210) | 12.4% | 33.9% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11% | 63.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 40.2% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

We'll examine a selection from our screener results.

COL GroupLtd (SZSE:300364)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: COL Group Co., Ltd. operates in the digital publishing sector both within China and internationally, with a market capitalization of CN¥16.09 billion.

Operations: The company generates revenue primarily through its digital publishing operations both domestically and abroad.

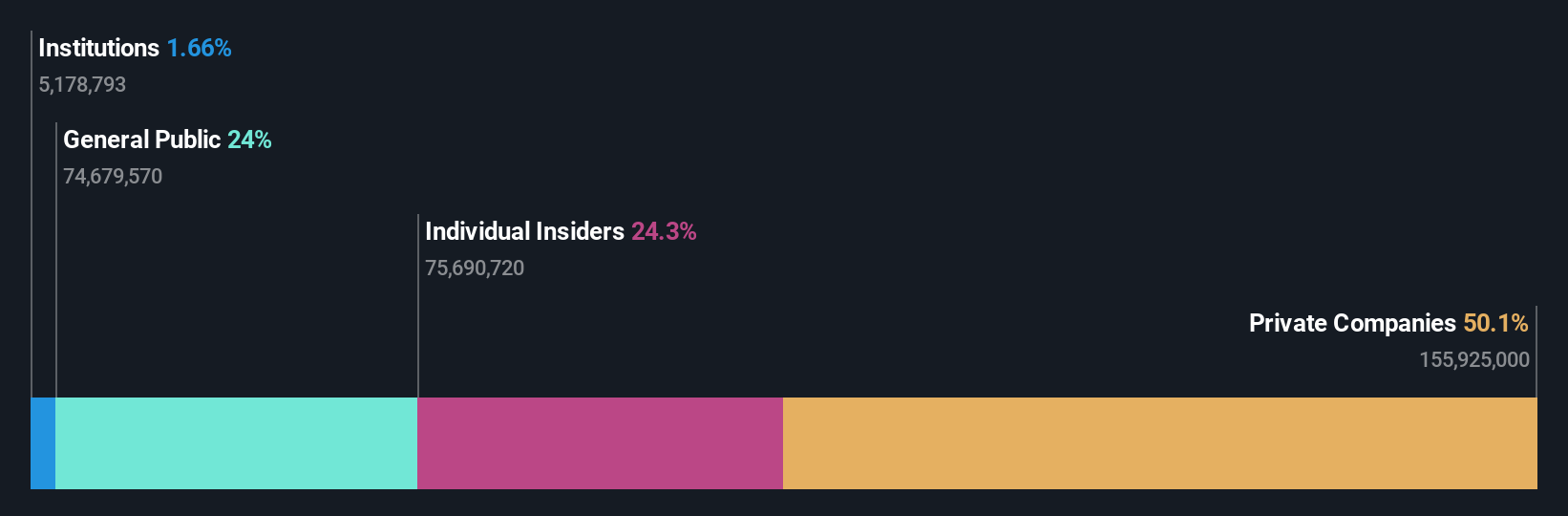

Insider Ownership: 12.5%

Earnings Growth Forecast: 122.6% p.a.

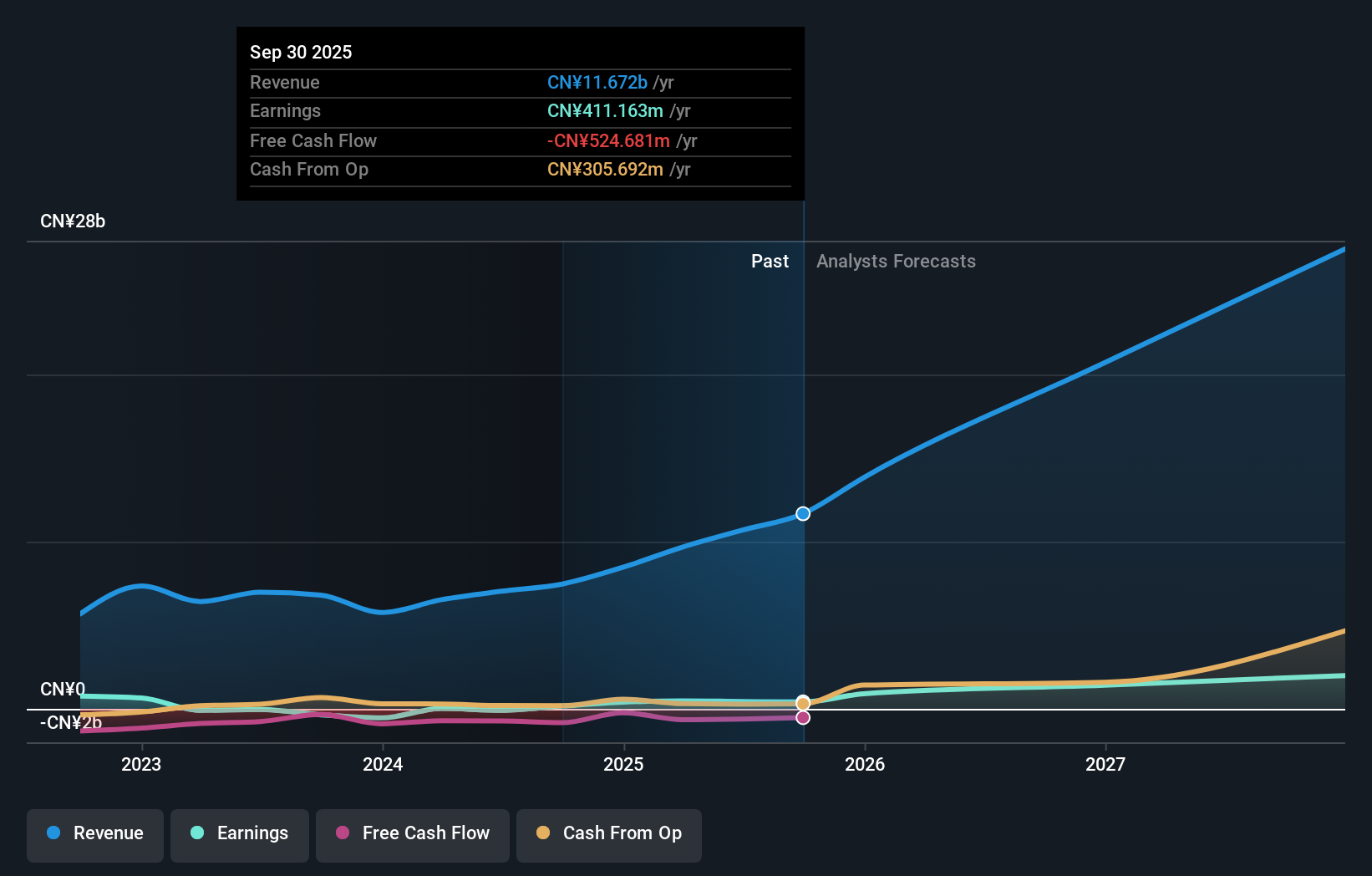

COL Group Ltd. is experiencing revenue growth forecasted at 13.2% annually, outpacing the broader Chinese market's 12.4%. Despite a current net loss of CNY 87.94 million, projections indicate profitability within three years with earnings expected to grow significantly by 122.58% per year. Recent changes in company bylaws and capital structure were approved at the latest AGM, reflecting strategic adjustments amid these growth expectations, though insider trading activity remains unreported for the past three months.

- Click here and access our complete growth analysis report to understand the dynamics of COL GroupLtd.

- Upon reviewing our latest valuation report, COL GroupLtd's share price might be too optimistic.

Fulin Precision (SZSE:300432)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fulin Precision Co., Ltd. focuses on the research, development, manufacture, and sale of automotive engine parts in China, with a market cap of CN¥22.47 billion.

Operations: Fulin Precision's revenue primarily comes from its operations in the research, development, and manufacturing of automotive engine components within China.

Insider Ownership: 13.6%

Earnings Growth Forecast: 44.2% p.a.

Fulin Precision's earnings are forecast to grow significantly at 44.2% annually, surpassing the broader Chinese market growth rate of 23.3%. Revenue is also expected to expand rapidly at 34.2% per year, outpacing the market average of 12.4%. Despite high volatility in its share price recently, no substantial insider trading has been reported in the past three months. The company announced a CNY 1 dividend per ten A shares, reflecting ongoing shareholder returns amid robust growth projections.

- Delve into the full analysis future growth report here for a deeper understanding of Fulin Precision.

- Our valuation report unveils the possibility Fulin Precision's shares may be trading at a premium.

Zhejiang Zhaolong Interconnect TechnologyLtd (SZSE:300913)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Zhaolong Interconnect Technology Co., Ltd. (SZSE:300913) operates in the technology sector, focusing on interconnect solutions, with a market cap of CN¥13.28 billion.

Operations: The company generates revenue primarily from the Digital Communication Cable Industry, amounting to CN¥1.91 billion.

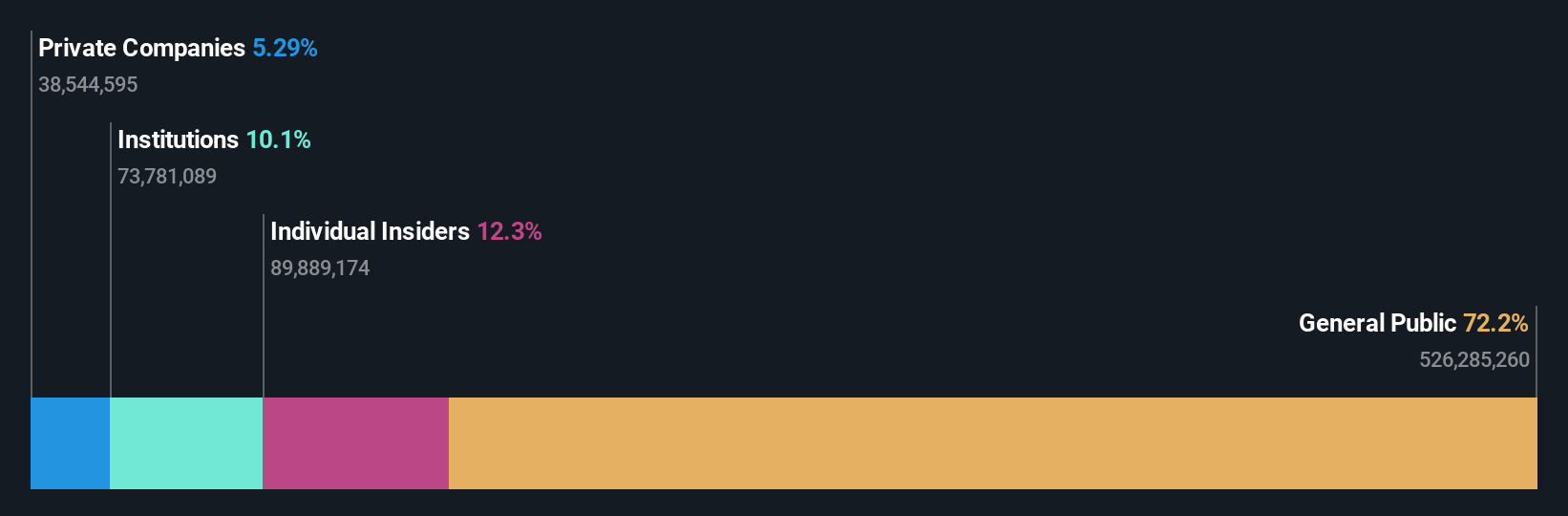

Insider Ownership: 24.3%

Earnings Growth Forecast: 28.8% p.a.

Zhejiang Zhaolong Interconnect Technology's earnings are projected to grow at 28.8% annually, exceeding the Chinese market average of 23.3%, with revenue expected to rise by 23% per year. Despite recent share price volatility, insider ownership remains significant, with no major insider trading reported recently. The company approved a final cash dividend of CNY 1.20 per ten shares for 2024 and appointed three independent directors, indicating strong governance amid its growth trajectory.

- Unlock comprehensive insights into our analysis of Zhejiang Zhaolong Interconnect TechnologyLtd stock in this growth report.

- According our valuation report, there's an indication that Zhejiang Zhaolong Interconnect TechnologyLtd's share price might be on the expensive side.

Key Takeaways

- Click this link to deep-dive into the 614 companies within our Fast Growing Asian Companies With High Insider Ownership screener.

- Curious About Other Options? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300364

COL GroupLtd

Engages in the provision of digital reading products, digital publishing operation, and digital content value-added services in China and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives