There's Reason For Concern Over Kunshan TopA Intelligent Equipment Co.,Ltd's (SZSE:300836) Massive 31% Price Jump

Despite an already strong run, Kunshan TopA Intelligent Equipment Co.,Ltd (SZSE:300836) shares have been powering on, with a gain of 31% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 26% in the last year.

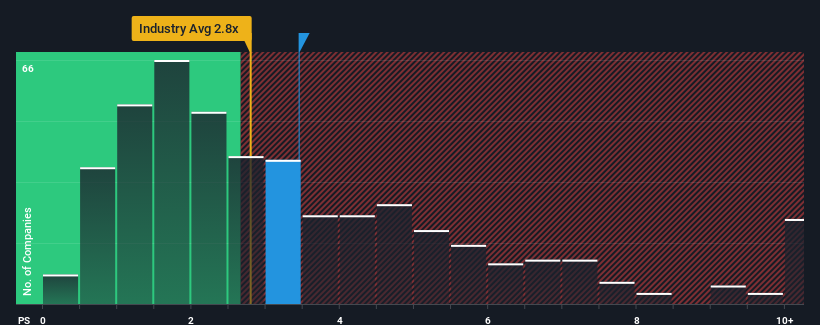

After such a large jump in price, when almost half of the companies in China's Machinery industry have price-to-sales ratios (or "P/S") below 2.8x, you may consider Kunshan TopA Intelligent EquipmentLtd as a stock probably not worth researching with its 3.4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Kunshan TopA Intelligent EquipmentLtd

What Does Kunshan TopA Intelligent EquipmentLtd's P/S Mean For Shareholders?

Kunshan TopA Intelligent EquipmentLtd has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Kunshan TopA Intelligent EquipmentLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Kunshan TopA Intelligent EquipmentLtd's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a decent 10% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 60% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 26% shows it's noticeably less attractive.

With this information, we find it concerning that Kunshan TopA Intelligent EquipmentLtd is trading at a P/S higher than the industry. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Kunshan TopA Intelligent EquipmentLtd's P/S

Kunshan TopA Intelligent EquipmentLtd's P/S is on the rise since its shares have risen strongly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Kunshan TopA Intelligent EquipmentLtd revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

You should always think about risks. Case in point, we've spotted 2 warning signs for Kunshan TopA Intelligent EquipmentLtd you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Kunshan TopA Intelligent EquipmentLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300836

Kunshan TopA Intelligent EquipmentLtd

Engages in the research, development, production, and sale of intelligent equipment and digital factory system in China and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives