- China

- /

- Aerospace & Defense

- /

- SZSE:300775

Potential Upside For Xi'an Triangle Defense Co.,Ltd (SZSE:300775) Not Without Risk

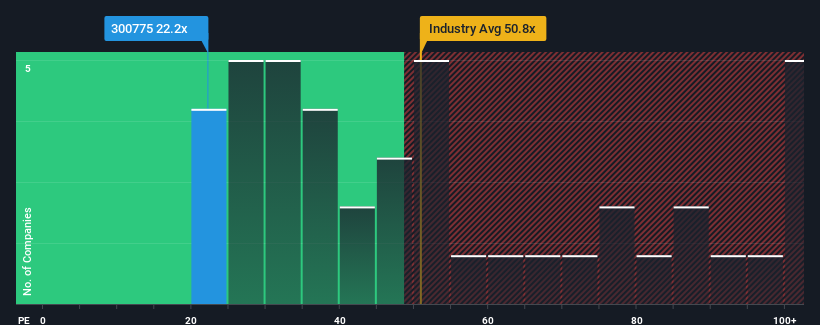

Xi'an Triangle Defense Co.,Ltd's (SZSE:300775) price-to-earnings (or "P/E") ratio of 22.2x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 27x and even P/E's above 50x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Xi'an Triangle DefenseLtd hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Xi'an Triangle DefenseLtd

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Xi'an Triangle DefenseLtd's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 130% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 27% each year during the coming three years according to the three analysts following the company. That's shaping up to be materially higher than the 23% per year growth forecast for the broader market.

With this information, we find it odd that Xi'an Triangle DefenseLtd is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Xi'an Triangle DefenseLtd currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Xi'an Triangle DefenseLtd that you should be aware of.

If these risks are making you reconsider your opinion on Xi'an Triangle DefenseLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300775

Xi'an Triangle DefenseLtd

Produces and sells airplane structure parts, engine discs, and large and medium-sized die forgings in China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives