- China

- /

- Aerospace & Defense

- /

- SZSE:300775

Positive earnings growth hasn't been enough to get Xi'an Triangle DefenseLtd (SZSE:300775) shareholders a favorable return over the last three years

Xi'an Triangle Defense Co.,Ltd (SZSE:300775) shareholders should be happy to see the share price up 27% in the last quarter. But that cannot eclipse the less-than-impressive returns over the last three years. In fact, the share price is down 45% in the last three years, falling well short of the market return.

While the last three years has been tough for Xi'an Triangle DefenseLtd shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Check out our latest analysis for Xi'an Triangle DefenseLtd

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate three years of share price decline, Xi'an Triangle DefenseLtd actually saw its earnings per share (EPS) improve by 2.0% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

It's pretty reasonable to suspect the market was previously to bullish on the stock, and has since moderated expectations. However, taking a look at other business metrics might shed a bit more light on the share price action.

The modest 0.7% dividend yield is unlikely to be guiding the market view of the stock. We note that, in three years, revenue has actually grown at a 21% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating Xi'an Triangle DefenseLtd further; while we may be missing something on this analysis, there might also be an opportunity.

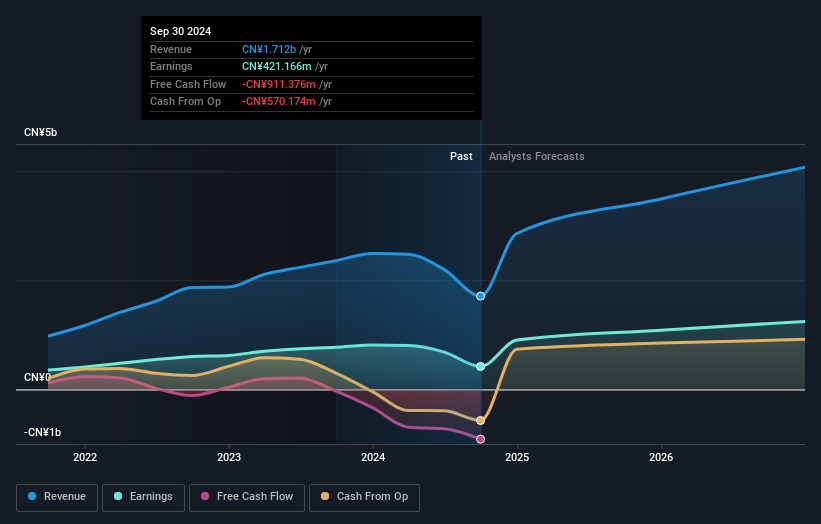

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While the broader market gained around 14% in the last year, Xi'an Triangle DefenseLtd shareholders lost 5.9% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Xi'an Triangle DefenseLtd has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Of course Xi'an Triangle DefenseLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300775

Xi'an Triangle DefenseLtd

Produces and sells airplane structure parts, engine discs, and large and medium-sized die forgings in China and internationally.

High growth potential with adequate balance sheet.