- China

- /

- Interactive Media and Services

- /

- SZSE:300494

3 Growth Companies Insiders Are Betting On

Reviewed by Simply Wall St

As global markets navigate mixed signals with U.S. stocks closing out a strong year despite recent slumps and European indices showing varied performance, investors are keenly focused on economic indicators like the Chicago PMI and GDP forecasts. Amidst these fluctuations, insider ownership can be a compelling factor for identifying growth companies that insiders are betting on, as it often signals confidence in the company's future prospects despite broader market uncertainties.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Medley (TSE:4480) | 34% | 27.2% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.2% | 66.3% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's uncover some gems from our specialized screener.

QuantumCTek (SHSE:688027)

Simply Wall St Growth Rating: ★★★★★☆

Overview: QuantumCTek Co., Ltd. is a Chinese company specializing in quantum information technology for ICT security products and services, with a market cap of CN¥21.01 billion.

Operations: QuantumCTek Co., Ltd.'s revenue segments include the manufacturing of quantum information technology-enabled security products and services within the information and communication technology sector in China.

Insider Ownership: 15%

Earnings Growth Forecast: 106.5% p.a.

QuantumCTek has experienced a highly volatile share price over the past three months. Despite this, it is expected to achieve significant revenue growth of 24.3% per year, outpacing the Chinese market average. The company reported sales of CNY 99.71 million for the first nine months of 2024, up from CNY 73.26 million year-on-year, while reducing its net loss to CNY 55.12 million from CNY 79.12 million previously.

- Dive into the specifics of QuantumCTek here with our thorough growth forecast report.

- Our valuation report unveils the possibility QuantumCTek's shares may be trading at a premium.

Hubei Century Network Technology (SZSE:300494)

Simply Wall St Growth Rating: ★★★★★☆

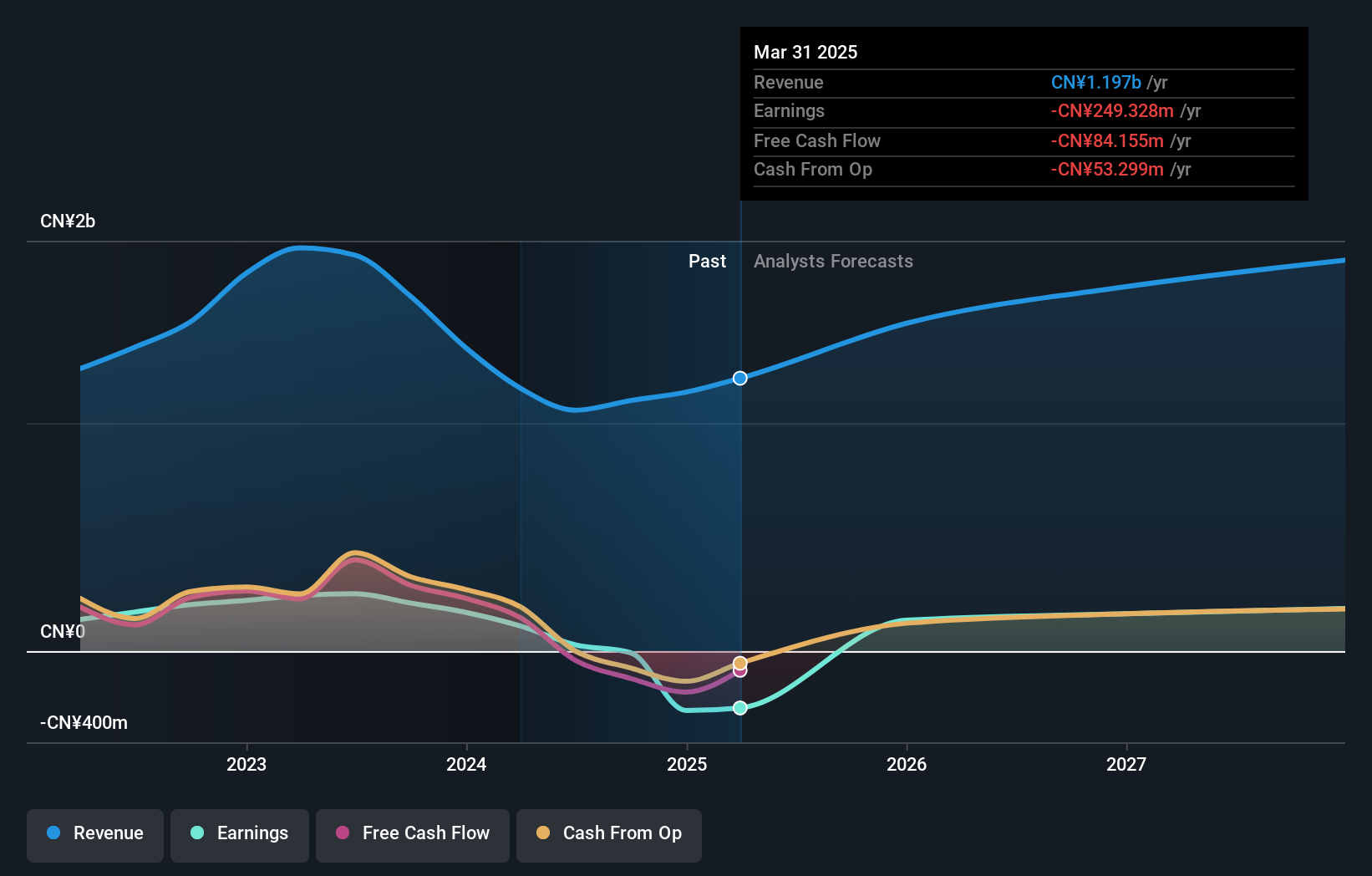

Overview: Hubei Century Network Technology Inc. operates an online entertainment platform in China and internationally, with a market cap of CN¥5.30 billion.

Operations: Hubei Century Network Technology Inc.'s revenue segments are not specified in the provided text.

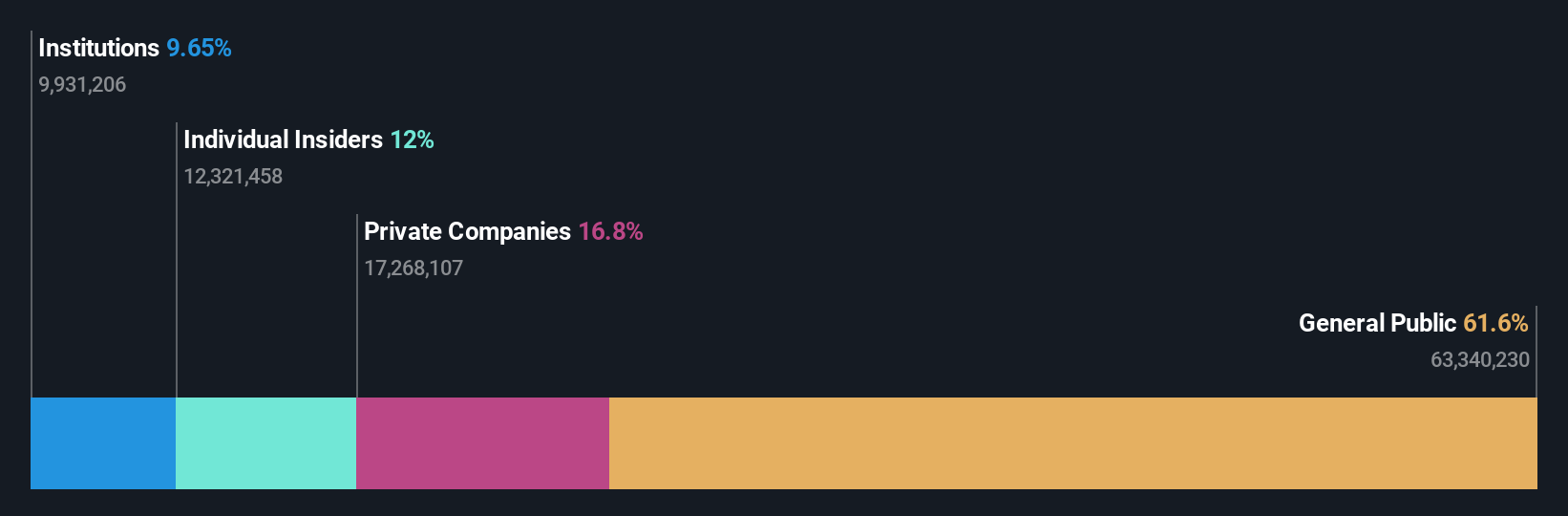

Insider Ownership: 25.5%

Earnings Growth Forecast: 56.7% p.a.

Hubei Century Network Technology is forecast to achieve substantial revenue growth of 22.7% annually, surpassing the Chinese market average. Despite this positive outlook, recent financial results revealed a decline in sales to CNY 852.41 million from CNY 1.08 billion year-on-year and a significant drop in net income to CNY 2.45 million from CNY 178.96 million previously, indicating challenges that accompany its growth trajectory and insider ownership structure.

- Click here to discover the nuances of Hubei Century Network Technology with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Hubei Century Network Technology's share price might be too optimistic.

Jiangsu Gian Technology (SZSE:300709)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Gian Technology Co., Ltd. manufactures and sells metal injection molding products both in China and internationally, with a market cap of CN¥6.72 billion.

Operations: The company generates revenue from the production and sale of metal injection molding products across domestic and international markets.

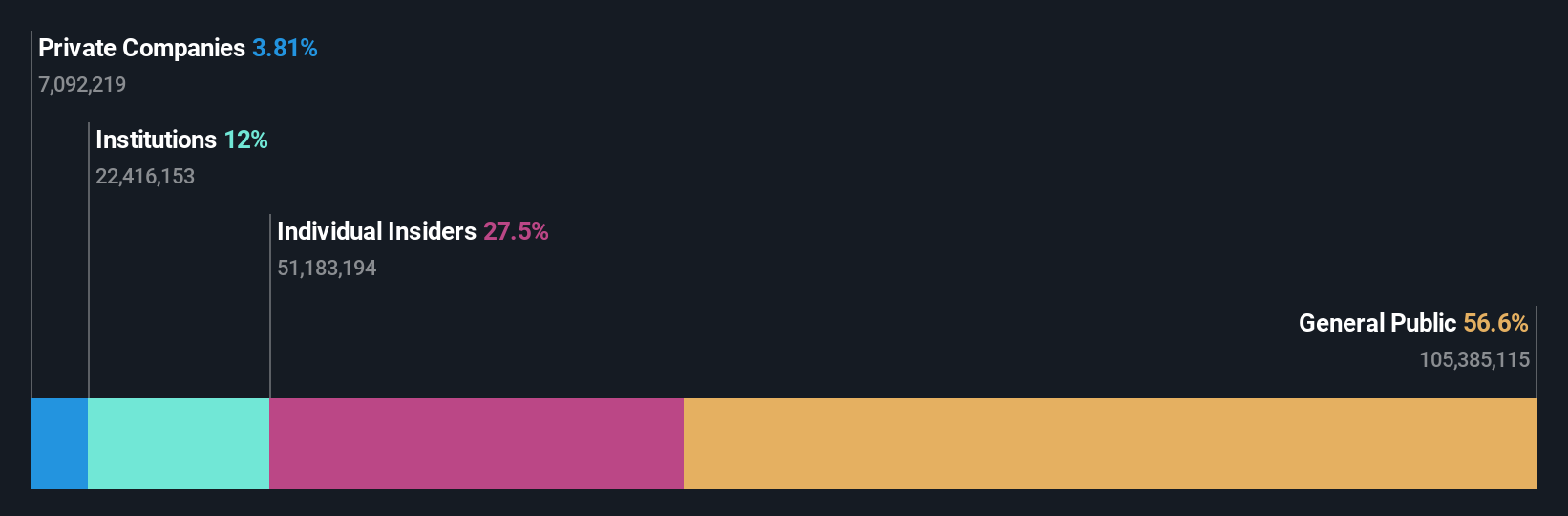

Insider Ownership: 27.5%

Earnings Growth Forecast: 41.1% p.a.

Jiangsu Gian Technology is expected to experience significant earnings growth of 41.1% annually, outpacing the Chinese market average. Despite this, recent results show a decline in sales to CNY 1.58 billion and net income to CNY 99.61 million year-on-year, reflecting potential hurdles in its growth path. The company has been active with shareholder meetings focusing on procedural amendments and strategic initiatives like foreign exchange hedging, indicating proactive governance amidst its high insider ownership structure.

- Get an in-depth perspective on Jiangsu Gian Technology's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Jiangsu Gian Technology's current price could be inflated.

Taking Advantage

- Gain an insight into the universe of 1483 Fast Growing Companies With High Insider Ownership by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hubei Century Network Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300494

Hubei Century Network Technology

Operates an online entertainment platform in China and internationally.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives