Changsha DIALINE New Material Sci.&Tech. Co., Ltd.'s (SZSE:300700) Shares Not Telling The Full Story

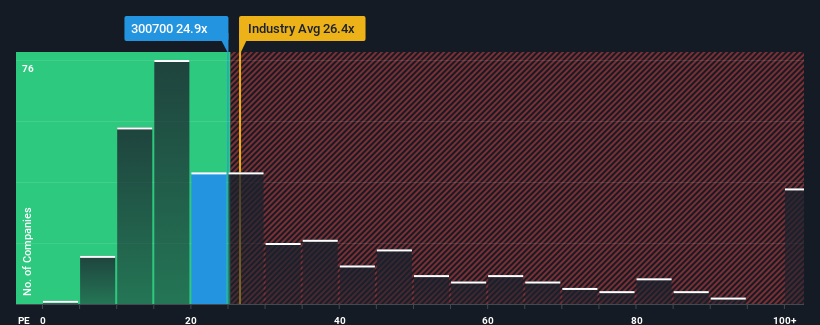

There wouldn't be many who think Changsha DIALINE New Material Sci.&Tech. Co., Ltd.'s (SZSE:300700) price-to-earnings (or "P/E") ratio of 24.9x is worth a mention when the median P/E in China is similar at about 27x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

While the market has experienced earnings growth lately, Changsha DIALINE New Material Sci.&Tech's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for Changsha DIALINE New Material Sci.&Tech

Is There Some Growth For Changsha DIALINE New Material Sci.&Tech?

The only time you'd be comfortable seeing a P/E like Changsha DIALINE New Material Sci.&Tech's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's bottom line. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 49% each year during the coming three years according to the sole analyst following the company. Meanwhile, the rest of the market is forecast to only expand by 23% each year, which is noticeably less attractive.

In light of this, it's curious that Changsha DIALINE New Material Sci.&Tech's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Changsha DIALINE New Material Sci.&Tech's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Changsha DIALINE New Material Sci.&Tech currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It is also worth noting that we have found 1 warning sign for Changsha DIALINE New Material Sci.&Tech that you need to take into consideration.

If you're unsure about the strength of Changsha DIALINE New Material Sci.&Tech's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Changsha DIALINE New Material Sci.&Tech, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300700

Changsha DIALINE New Material Sci.&Tech

Changsha DIALINE New Material Sci.&Tech. Co., Ltd.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives