- China

- /

- Electrical

- /

- SZSE:300660

Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

In the wake of recent Fed rate cuts and cautious economic forecasts, global markets have experienced a mix of setbacks and recoveries, with smaller-cap indexes facing particular challenges. Amidst this backdrop of uncertainty, investors are increasingly on the lookout for stocks that demonstrate resilience and potential for growth despite broader market volatility. Identifying such "undiscovered gems" involves looking for companies with strong fundamentals, innovative strategies, or niche market positions that can thrive even when larger indices waver.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| PBA Holdings Bhd | 1.86% | 7.41% | 40.17% | ★★★★★☆ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Napier Port Holdings (NZSE:NPH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Napier Port Holdings Limited offers a range of port services in New Zealand, with a market capitalization of NZ$526.55 million.

Operations: Napier Port Holdings generates revenue primarily from its port services, amounting to NZ$141.35 million.

Napier Port Holdings, a smaller player in the infrastructure sector, has shown significant earnings growth of 49.7% over the past year, outpacing its industry peers. The company's net debt to equity ratio stands at a satisfactory 25.6%, indicating prudent financial management. Recent financial results include a net income increase to NZ$24.83 million from NZ$16.59 million the previous year, partly influenced by a one-off gain of NZ$8 million. With interest payments well covered by EBIT at 4.7 times and trading at an attractive valuation below estimated fair value, Napier Port presents intriguing potential for investors seeking undervalued opportunities.

Lontium Semiconductor (SHSE:688486)

Simply Wall St Value Rating: ★★★★★★

Overview: Lontium Semiconductor Corporation develops and markets semiconductor products globally, with a market capitalization of CN¥8.18 billion.

Operations: The company's primary revenue streams are derived from the development and marketing of semiconductor products globally. It has a market capitalization of CN¥8.18 billion.

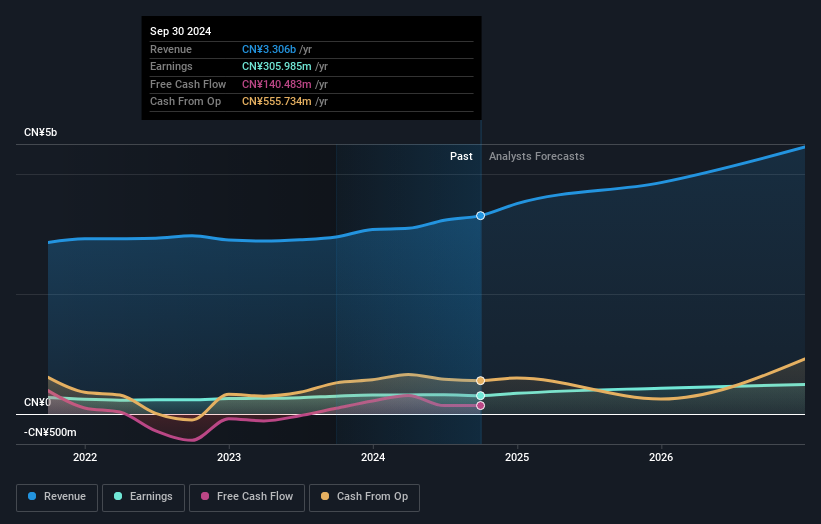

Lontium Semiconductor, a smaller player in the semiconductor industry, has shown impressive growth with earnings rising 40.6% over the past year, outpacing the industry's 12.9%. The company remains debt-free for five years, easing concerns about interest obligations. Its price-to-earnings ratio stands at 64.8x, slightly below the industry average of 66.3x, suggesting reasonable valuation within its sector context. Recent financials highlight a net income increase to CNY 93.99 million from CNY 70.42 million last year and an active share repurchase program totaling CNY 59.2 million for nearly 0.85% of shares as of September's end in response to market conditions.

- Get an in-depth perspective on Lontium Semiconductor's performance by reading our health report here.

Assess Lontium Semiconductor's past performance with our detailed historical performance reports.

Jiangsu Leili Motor (SZSE:300660)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangsu Leili Motor Co., Ltd specializes in the R&D, production, and sale of household appliances, micro motors, and intelligent components both in China and globally with a market capitalization of CN¥13.03 billion.

Operations: Jiangsu Leili Motor generates revenue primarily from the sale of household appliances, micro motors, and intelligent components. The company's net profit margin has shown notable fluctuations over recent periods.

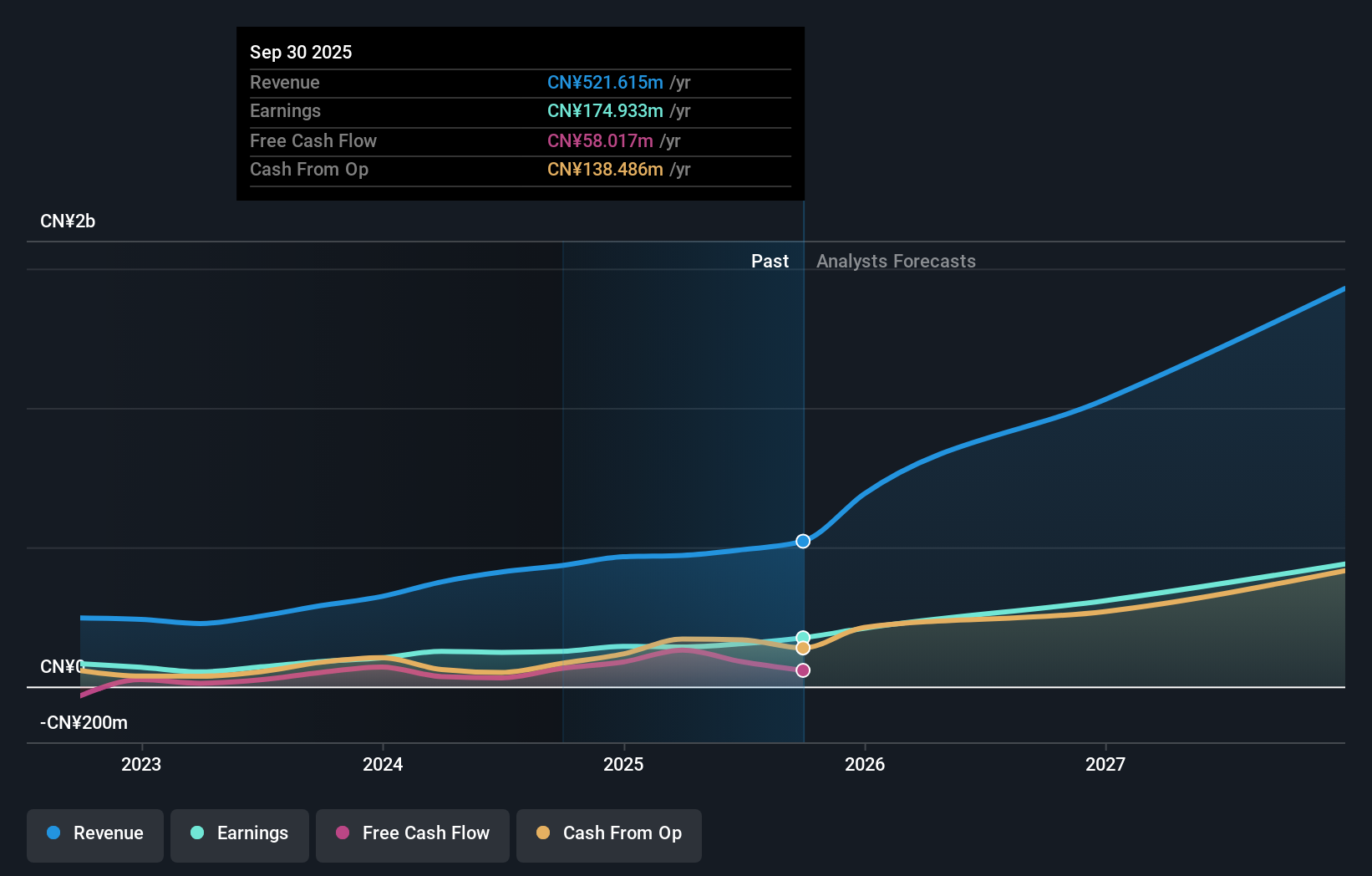

Jiangsu Leili Motor, a dynamic player in the electrical industry, has seen its debt to equity ratio climb from 0.3% to 21.1% over five years, indicating increased leverage but manageable due to more cash than total debt. Despite a volatile share price recently, earnings growth of 2.8% last year outpaced the industry's 1.1%, showcasing resilience and potential for future expansion with forecasts suggesting a robust annual growth of 21.2%. The company reported CNY 2,475 million in sales for nine months ending September 2024, slightly up from CNY 2,246 million year-on-year despite net income dipping to CNY 240 million from CNY 252 million previously.

Key Takeaways

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4630 more companies for you to explore.Click here to unveil our expertly curated list of 4633 Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300660

Jiangsu Leili Motor

Engages in the research and development, production, and sale of household appliances, micro motors, and intelligent components in China and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives