- China

- /

- Electrical

- /

- SZSE:300648

Market Participants Recognise Fujian Nebula Electronics Co., Ltd.'s (SZSE:300648) Revenues Pushing Shares 30% Higher

Those holding Fujian Nebula Electronics Co., Ltd. (SZSE:300648) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 51% share price drop in the last twelve months.

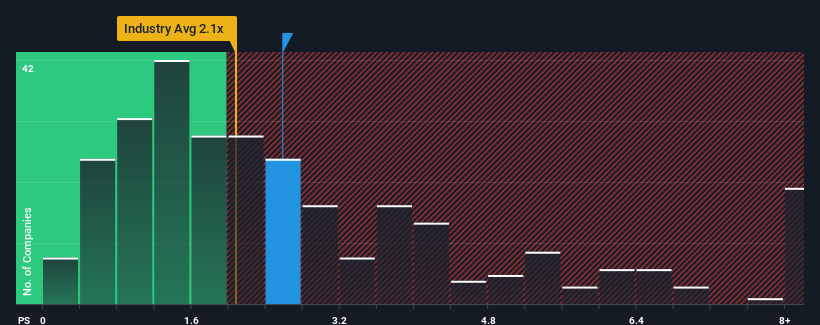

Following the firm bounce in price, you could be forgiven for thinking Fujian Nebula Electronics is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.6x, considering almost half the companies in China's Electrical industry have P/S ratios below 2.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Fujian Nebula Electronics

How Fujian Nebula Electronics Has Been Performing

While the industry has experienced revenue growth lately, Fujian Nebula Electronics' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Fujian Nebula Electronics.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Fujian Nebula Electronics' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.1%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 116% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 171% over the next year. That's shaping up to be materially higher than the 26% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Fujian Nebula Electronics' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Fujian Nebula Electronics' P/S?

Fujian Nebula Electronics' P/S is on the rise since its shares have risen strongly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Fujian Nebula Electronics maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electrical industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 1 warning sign for Fujian Nebula Electronics that we have uncovered.

If these risks are making you reconsider your opinion on Fujian Nebula Electronics, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300648

Fujian Nebula Electronics

Develops, produces, and sells lithium battery pack testing equipment, energy storage intelligent converters, and charging piles in China.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success