We Think Guangdong Topstar Technology (SZSE:300607) Can Stay On Top Of Its Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Guangdong Topstar Technology Co., Ltd. (SZSE:300607) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Guangdong Topstar Technology

How Much Debt Does Guangdong Topstar Technology Carry?

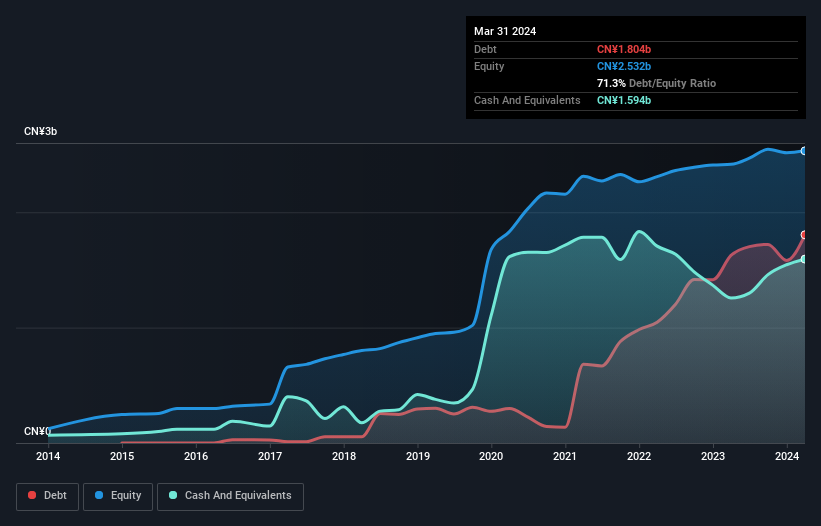

As you can see below, at the end of March 2024, Guangdong Topstar Technology had CN¥1.80b of debt, up from CN¥1.63b a year ago. Click the image for more detail. However, because it has a cash reserve of CN¥1.59b, its net debt is less, at about CN¥210.6m.

How Healthy Is Guangdong Topstar Technology's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Guangdong Topstar Technology had liabilities of CN¥3.53b due within 12 months and liabilities of CN¥1.01b due beyond that. Offsetting these obligations, it had cash of CN¥1.59b as well as receivables valued at CN¥2.80b due within 12 months. So its liabilities total CN¥145.1m more than the combination of its cash and short-term receivables.

Given Guangdong Topstar Technology has a market capitalization of CN¥5.35b, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Guangdong Topstar Technology's low debt to EBITDA ratio of 0.84 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 5.4 times last year does give us pause. So we'd recommend keeping a close eye on the impact financing costs are having on the business. It is well worth noting that Guangdong Topstar Technology's EBIT shot up like bamboo after rain, gaining 61% in the last twelve months. That'll make it easier to manage its debt. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Guangdong Topstar Technology's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Guangdong Topstar Technology burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Based on what we've seen Guangdong Topstar Technology is not finding it easy, given its conversion of EBIT to free cash flow, but the other factors we considered give us cause to be optimistic. In particular, we are dazzled with its EBIT growth rate. When we consider all the elements mentioned above, it seems to us that Guangdong Topstar Technology is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. Over time, share prices tend to follow earnings per share, so if you're interested in Guangdong Topstar Technology, you may well want to click here to check an interactive graph of its earnings per share history.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you're looking to trade Guangdong Topstar Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300607

Guangdong Topstar Technology

Engages in the research and development, manufacture, and sale of industrial robots in China.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives