Subdued Growth No Barrier To Guangdong Topstar Technology Co., Ltd. (SZSE:300607) With Shares Advancing 29%

Guangdong Topstar Technology Co., Ltd. (SZSE:300607) shares have had a really impressive month, gaining 29% after a shaky period beforehand. The last month tops off a massive increase of 168% in the last year.

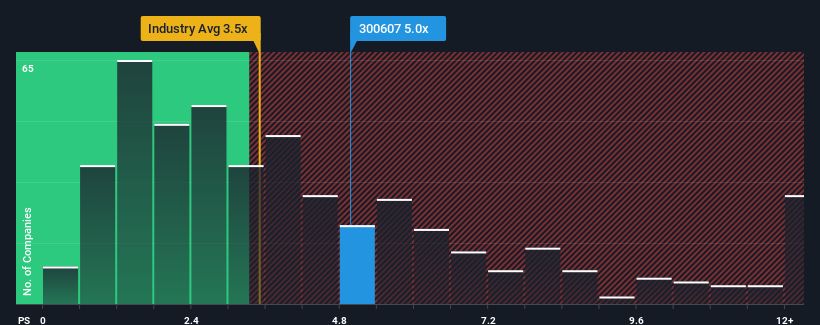

After such a large jump in price, you could be forgiven for thinking Guangdong Topstar Technology is a stock not worth researching with a price-to-sales ratios (or "P/S") of 5x, considering almost half the companies in China's Machinery industry have P/S ratios below 3.5x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Guangdong Topstar Technology

How Guangdong Topstar Technology Has Been Performing

Guangdong Topstar Technology could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Guangdong Topstar Technology's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Guangdong Topstar Technology's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 28%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 18% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 11% during the coming year according to the three analysts following the company. With the industry predicted to deliver 23% growth, that's a disappointing outcome.

With this in mind, we find it intriguing that Guangdong Topstar Technology's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On Guangdong Topstar Technology's P/S

Guangdong Topstar Technology shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

For a company with revenues that are set to decline in the context of a growing industry, Guangdong Topstar Technology's P/S is much higher than we would've anticipated. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. At these price levels, investors should remain cautious, particularly if things don't improve.

You should always think about risks. Case in point, we've spotted 1 warning sign for Guangdong Topstar Technology you should be aware of.

If these risks are making you reconsider your opinion on Guangdong Topstar Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Guangdong Topstar Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300607

Guangdong Topstar Technology

Engages in the research and development, manufacture, and sale of industrial robots in China.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives