Earnings Tell The Story For Guangdong Topstar Technology Co., Ltd. (SZSE:300607) As Its Stock Soars 25%

Those holding Guangdong Topstar Technology Co., Ltd. (SZSE:300607) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 14% over that time.

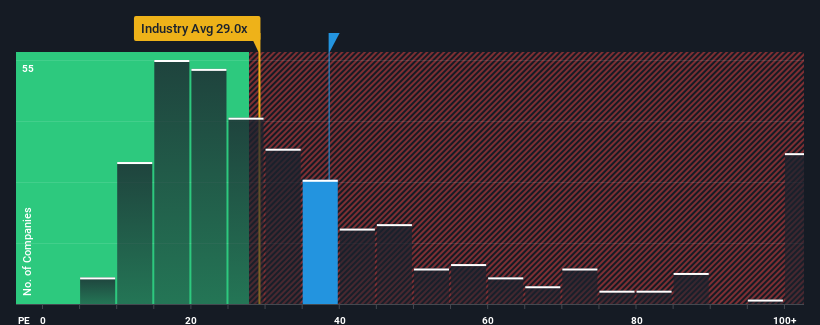

Since its price has surged higher, Guangdong Topstar Technology's price-to-earnings (or "P/E") ratio of 38.5x might make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 30x and even P/E's below 18x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times have been pleasing for Guangdong Topstar Technology as its earnings have risen in spite of the market's earnings going into reverse. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Guangdong Topstar Technology

Does Growth Match The High P/E?

In order to justify its P/E ratio, Guangdong Topstar Technology would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered an exceptional 103% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 79% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 78% over the next year. Meanwhile, the rest of the market is forecast to only expand by 41%, which is noticeably less attractive.

With this information, we can see why Guangdong Topstar Technology is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Guangdong Topstar Technology's P/E

Guangdong Topstar Technology's P/E is getting right up there since its shares have risen strongly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Guangdong Topstar Technology maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for Guangdong Topstar Technology that you need to take into consideration.

If these risks are making you reconsider your opinion on Guangdong Topstar Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300607

Guangdong Topstar Technology

Engages in the research and development, manufacture, and sale of industrial robots in China.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives