- China

- /

- Electrical

- /

- SZSE:300602

Uncovering Three Hidden Gems with Strong Fundamentals

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape marked by rising inflation and interest rate uncertainties, U.S. stock indexes are climbing toward record highs, with growth stocks outpacing value shares. Despite small-cap stocks lagging behind larger indices like the S&P 500, this environment presents an opportune moment to explore lesser-known companies that boast strong fundamentals and potential for growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

engcon (OM:ENGCON B)

Simply Wall St Value Rating: ★★★★★☆

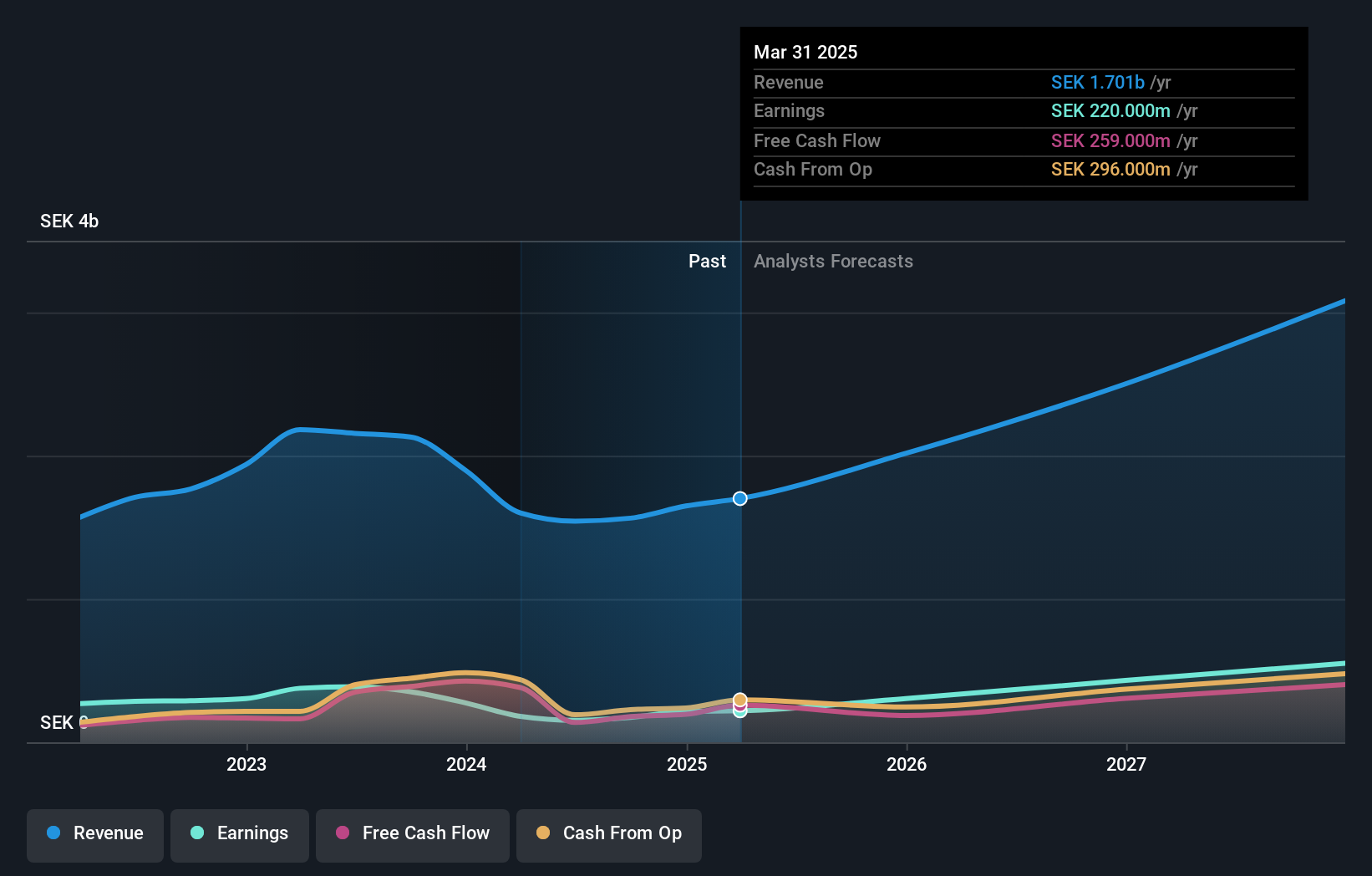

Overview: Engcon AB (publ) specializes in designing, producing, and selling excavator tools across various international markets and has a market cap of approximately SEK16.97 billion.

Operations: The company's primary revenue stream is from its Construction Machinery & Equipment segment, generating SEK1.56 billion. The net profit margin presents a notable aspect of financial performance, reflecting the company's ability to convert sales into profit efficiently.

Engcon, a niche player in the excavator tool industry, is capitalizing on its high-quality earnings and strategic expansions. Despite negative earnings growth of 51% last year, the company maintains a strong position with cash surpassing total debt and interest payments covered 13 times by EBIT. Recent moves include establishing a sales company in Japan to penetrate the large but under-aware market for tiltrotators. Although profit margins dipped from 16.6% to 11.1%, forecasts suggest a promising annual revenue growth of 27.4%. Nonetheless, economic uncertainties in Europe and potential currency fluctuations remain key considerations for investors.

L&K Engineering (Suzhou)Ltd (SHSE:603929)

Simply Wall St Value Rating: ★★★★★★

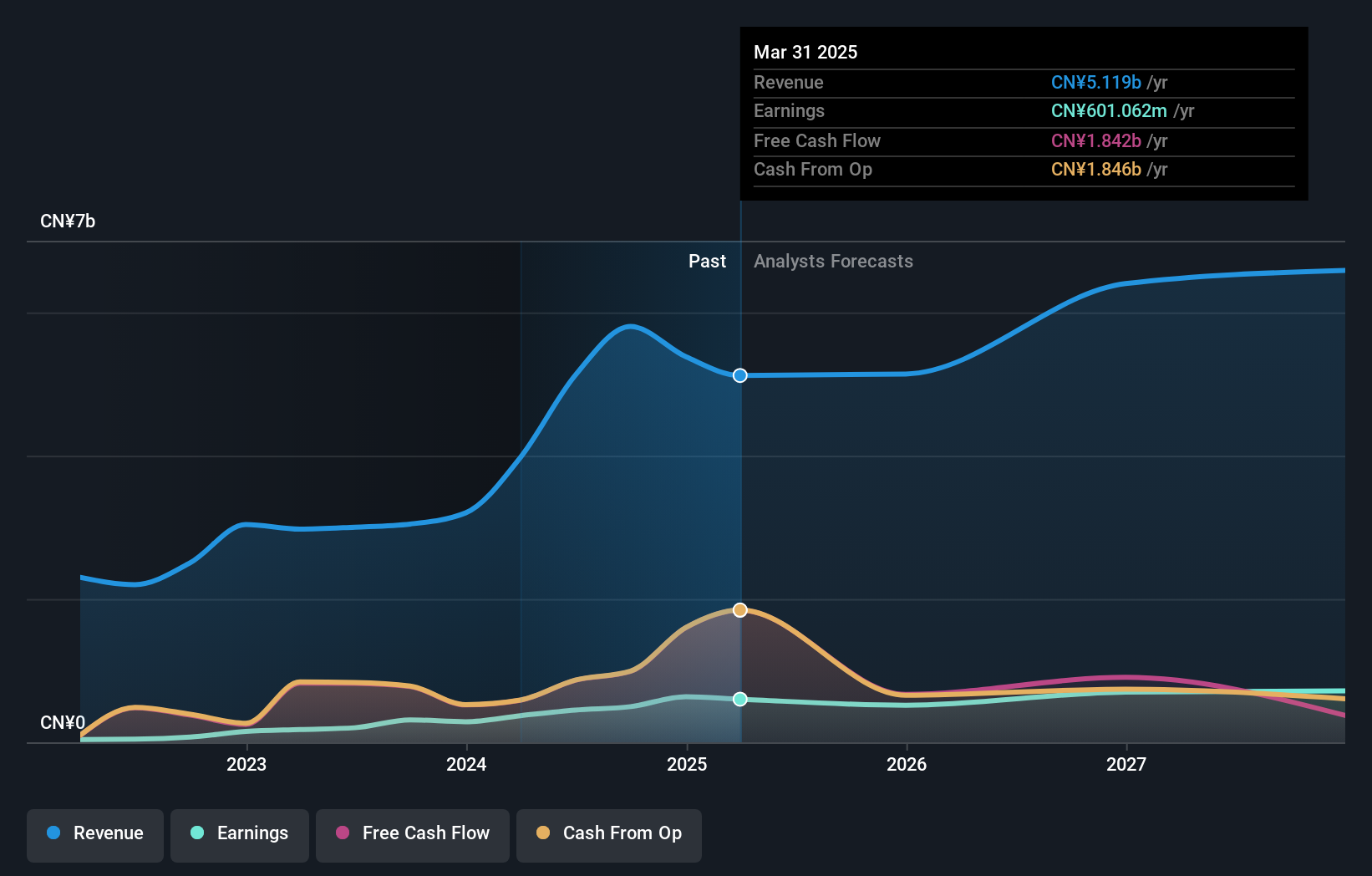

Overview: L&K Engineering (Suzhou) Co., Ltd. offers specialized engineering technical services in China and has a market cap of CN¥6.70 billion.

Operations: L&K Engineering (Suzhou) Co., Ltd. generates revenue primarily through its specialized engineering technical services in China. The company has observed fluctuations in its net profit margin, which was noted at 8% in the most recent financial period.

L&K Engineering (Suzhou) Ltd., a small player in the construction sector, has been making waves with its solid financial footing and promising growth trajectory. Over the past year, earnings surged by 59%, outpacing the industry's -4% performance. The company is debt-free, providing a sturdy platform for future endeavors, and its shares are trading at 33% below estimated fair value. With high-quality earnings and free cash flow turning positive recently, L&K seems well-positioned to capitalize on industry opportunities while maintaining financial stability. Prospects appear favorable as earnings are forecasted to grow annually by 12%.

Shenzhen FRD Science & Technology (SZSE:300602)

Simply Wall St Value Rating: ★★★★★☆

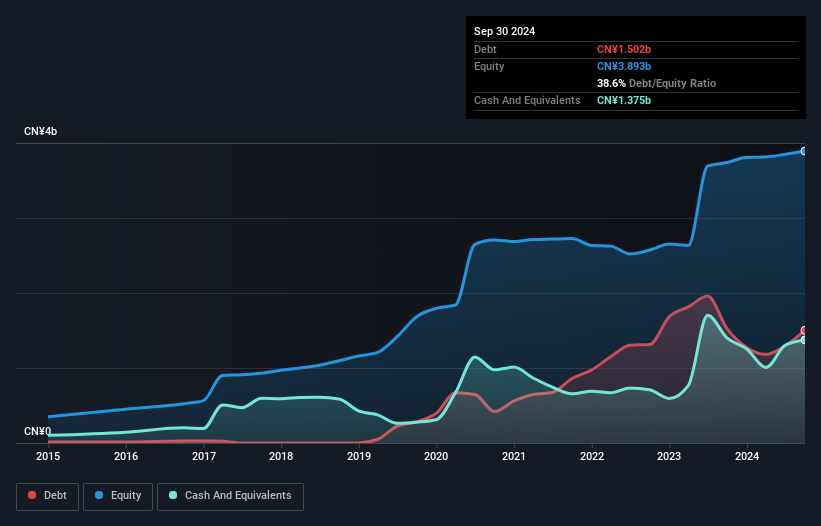

Overview: Shenzhen FRD Science & Technology Co., Ltd. is a company involved in electronic components manufacturing, with a market cap of CN¥12.41 billion.

Operations: The company generates revenue primarily from electronic components manufacturing, totaling CN¥4.86 billion.

Shenzhen FRD Science & Technology, a smaller player in the tech space, has seen its debt to equity ratio rise from 16.9% to 38.6% over five years, indicating increased leverage. Despite this, the net debt to equity ratio remains satisfactory at 3.3%, and interest payments are well covered with EBIT providing an 11.2x coverage. The company's earnings grew by 9.5% last year, outpacing the electrical industry’s growth of 1.1%. Recent developments include a potential sale of subsidiary equities and a significant acquisition by YunnanTrust valuing shares at CNY 15.72 each for CNY 460 million in total.

Turning Ideas Into Actions

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4725 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300602

Shenzhen FRD Science & Technology

Shenzhen FRD Science & Technology Co., Ltd.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives