- China

- /

- Metals and Mining

- /

- SZSE:002290

Asian Growth Companies With High Insider Ownership And Up To 105% Earnings Growth

Reviewed by Simply Wall St

As Asian markets navigate a complex landscape marked by technological advancements and economic shifts, investor focus is increasingly drawn to growth companies with strong insider ownership, which often signals confidence in the company's future prospects. In this environment, identifying stocks with potential for significant earnings growth can be particularly appealing, especially when insiders have substantial stakes that align their interests closely with those of shareholders.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| WinWay Technology (TWSE:6515) | 21.7% | 30.3% |

| UTI (KOSDAQ:A179900) | 25.2% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

We're going to check out a few of the best picks from our screener tool.

Soulbrain (KOSDAQ:A357780)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Soulbrain Co., Ltd. develops, manufactures, and supplies various core materials for high-tech industries with a market cap of ₩2.21 trillion.

Operations: Revenue Segments (in millions of ₩):

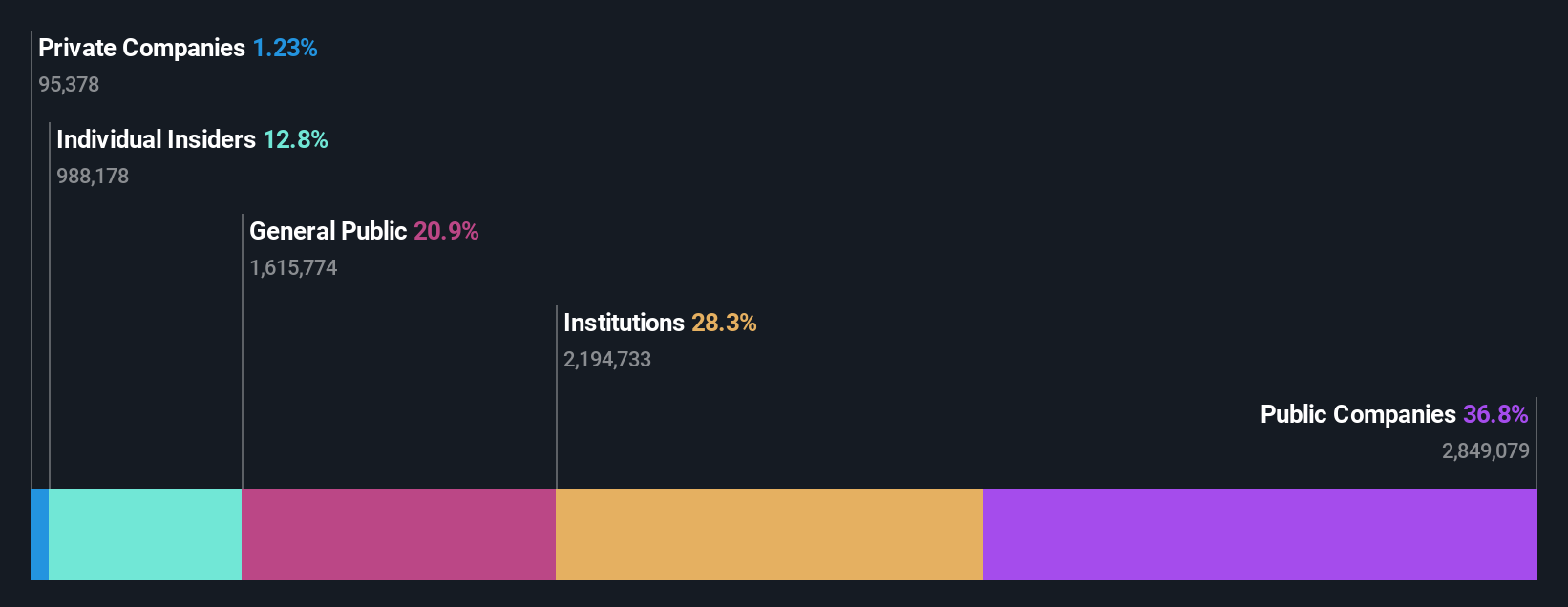

Insider Ownership: 12.8%

Earnings Growth Forecast: 39.5% p.a.

Soulbrain's earnings are forecast to grow significantly at 39.5% annually, outpacing the Korean market's 28.5%. Despite trading at a substantial discount to its estimated fair value, its return on equity is expected to be modest in three years. Revenue growth is projected at 12.1% per year, slightly above the market average but below high-growth benchmarks. Recent buyback activities completed with no insider buying or selling reported in the past three months highlight stable insider ownership dynamics.

- Click here to discover the nuances of Soulbrain with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Soulbrain is trading beyond its estimated value.

Suzhou Hesheng Special Material (SZSE:002290)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Suzhou Hesheng Special Material Co., Ltd. operates in the special materials industry and has a market cap of CN¥10.79 billion.

Operations: Suzhou Hesheng Special Material Co., Ltd. generates revenue through various segments in the special materials industry, contributing to its market cap of CN¥10.79 billion.

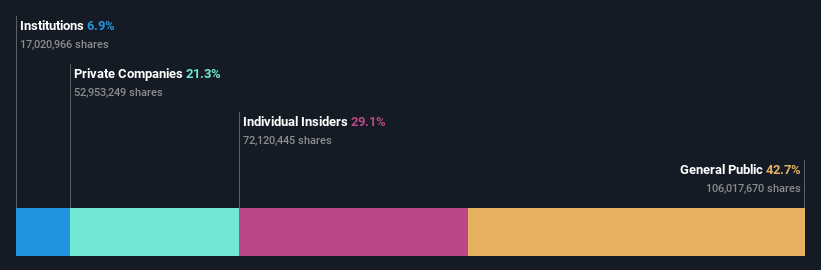

Insider Ownership: 29.1%

Earnings Growth Forecast: 35.7% p.a.

Suzhou Hesheng Special Material is poised for significant earnings growth, with forecasts of 35.7% annually, surpassing the Chinese market's 27.6%. Despite a volatile share price recently, insider ownership remains stable with no recent trading activity reported. Revenue is expected to grow at 16.4% per year, outpacing the market average but below high-growth thresholds. Recent amendments to company bylaws and inclusion in the S&P Global BMI Index reflect active corporate governance and potential for increased visibility.

- Take a closer look at Suzhou Hesheng Special Material's potential here in our earnings growth report.

- The analysis detailed in our Suzhou Hesheng Special Material valuation report hints at an inflated share price compared to its estimated value.

Beijing Relpow Technology (SZSE:300593)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Relpow Technology Co., Ltd specializes in the manufacturing and sale of power supply products both within China and internationally, with a market cap of CN¥14.79 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 28.5%

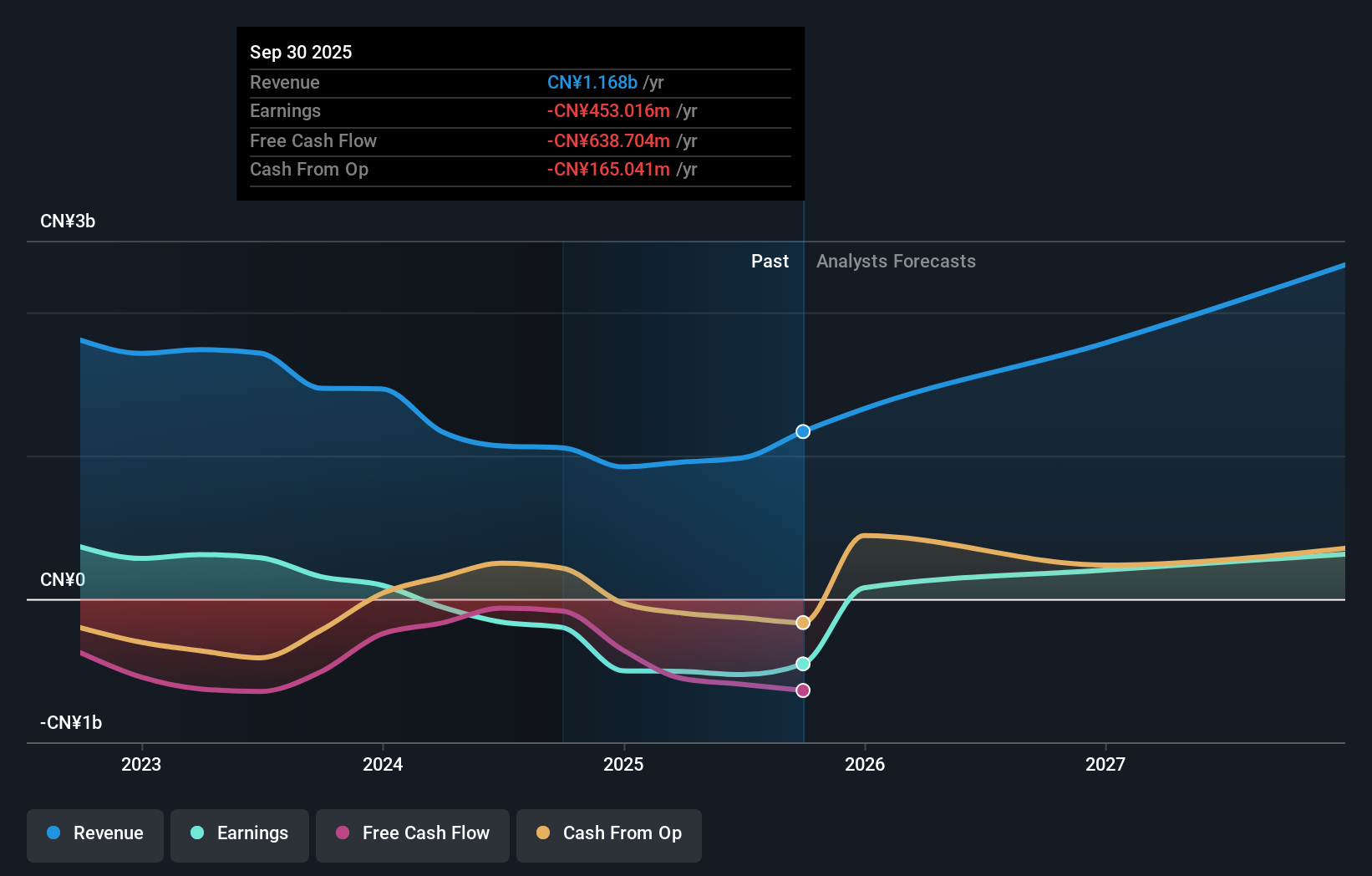

Earnings Growth Forecast: 105.6% p.a.

Beijing Relpow Technology exhibits promising growth potential, with revenue forecasted to grow at 31.8% per year, surpassing market averages. Despite a volatile share price and low expected return on equity of 9.7%, the company is anticipated to become profitable in three years, indicating strong earnings growth prospects. Recent earnings show improved financial performance with reduced net loss, while upcoming stock incentive plans suggest alignment of insider interests and strategic focus on long-term growth.

- Get an in-depth perspective on Beijing Relpow Technology's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Beijing Relpow Technology's shares may be trading at a premium.

Where To Now?

- Navigate through the entire inventory of 638 Fast Growing Asian Companies With High Insider Ownership here.

- Ready For A Different Approach? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002290

Suzhou Hesheng Special Material

Suzhou Hesheng Special Material Co., Ltd.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026