Some Confidence Is Lacking In Jouder Precision Industry (Kunshan) Co., Ltd. (SZSE:300549) As Shares Slide 34%

The Jouder Precision Industry (Kunshan) Co., Ltd. (SZSE:300549) share price has fared very poorly over the last month, falling by a substantial 34%. Longer-term shareholders would now have taken a real hit with the stock declining 5.8% in the last year.

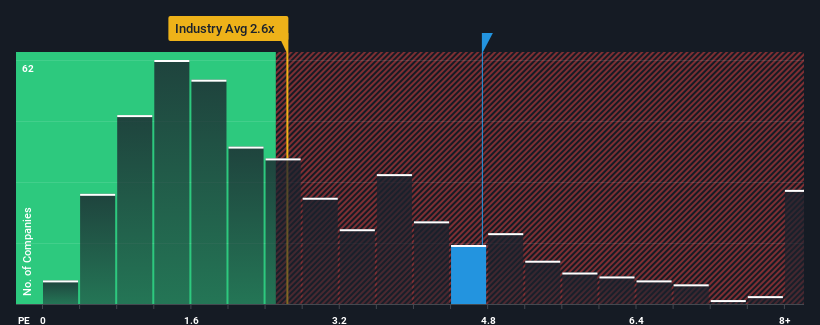

Even after such a large drop in price, when almost half of the companies in China's Machinery industry have price-to-sales ratios (or "P/S") below 2.6x, you may still consider Jouder Precision Industry (Kunshan) as a stock not worth researching with its 4.7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Jouder Precision Industry (Kunshan)

What Does Jouder Precision Industry (Kunshan)'s P/S Mean For Shareholders?

For instance, Jouder Precision Industry (Kunshan)'s receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Jouder Precision Industry (Kunshan), take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Jouder Precision Industry (Kunshan)'s Revenue Growth Trending?

Jouder Precision Industry (Kunshan)'s P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 9.7% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 24% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's alarming that Jouder Precision Industry (Kunshan)'s P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Jouder Precision Industry (Kunshan)'s P/S

Even after such a strong price drop, Jouder Precision Industry (Kunshan)'s P/S still exceeds the industry median significantly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Jouder Precision Industry (Kunshan) revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Jouder Precision Industry (Kunshan) (2 are a bit unpleasant) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Jouder Precision Industry (Kunshan), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300549

Jouder Precision Industry (Kunshan)

Jouder Precision Industry (Kunshan) Co., Ltd.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives