- China

- /

- Trade Distributors

- /

- SZSE:300538

Shenzhen Tongyi Industry Co., Ltd.'s (SZSE:300538) 27% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Shenzhen Tongyi Industry Co., Ltd. (SZSE:300538) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 17% share price drop.

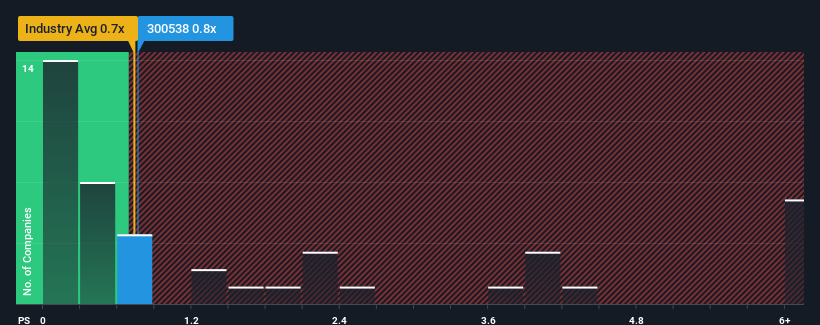

Although its price has dipped substantially, it's still not a stretch to say that Shenzhen Tongyi Industry's price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" compared to the Trade Distributors industry in China, where the median P/S ratio is around 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Shenzhen Tongyi Industry

What Does Shenzhen Tongyi Industry's P/S Mean For Shareholders?

For example, consider that Shenzhen Tongyi Industry's financial performance has been pretty ordinary lately as revenue growth is non-existent. One possibility is that the P/S is moderate because investors think this benign revenue growth rate might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shenzhen Tongyi Industry's earnings, revenue and cash flow.How Is Shenzhen Tongyi Industry's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Shenzhen Tongyi Industry's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period was better as it's delivered a decent 29% overall rise in revenue. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

This is in contrast to the rest of the industry, which is expected to grow by 13% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that Shenzhen Tongyi Industry's P/S is comparable to that of its industry peers. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Final Word

Following Shenzhen Tongyi Industry's share price tumble, its P/S is just clinging on to the industry median P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Shenzhen Tongyi Industry's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Shenzhen Tongyi Industry (1 doesn't sit too well with us!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Shenzhen Tongyi Industry, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300538

Shenzhen Tongyi Industry

Provides chemical and electronic materials in China, the United States, India, and internationally.

Adequate balance sheet low.