Some Confidence Is Lacking In AMSKY Technology Co., Ltd (SZSE:300521) As Shares Slide 27%

The AMSKY Technology Co., Ltd (SZSE:300521) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. Still, a bad month hasn't completely ruined the past year with the stock gaining 33%, which is great even in a bull market.

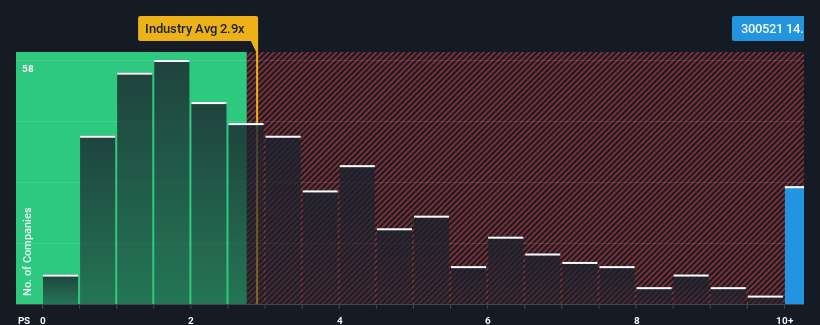

In spite of the heavy fall in price, you could still be forgiven for thinking AMSKY Technology is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 14.8x, considering almost half the companies in China's Machinery industry have P/S ratios below 2.9x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for AMSKY Technology

How Has AMSKY Technology Performed Recently?

With revenue growth that's exceedingly strong of late, AMSKY Technology has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on AMSKY Technology will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For AMSKY Technology?

In order to justify its P/S ratio, AMSKY Technology would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 30% last year. Revenue has also lifted 13% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 22% shows it's noticeably less attractive.

With this information, we find it concerning that AMSKY Technology is trading at a P/S higher than the industry. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From AMSKY Technology's P/S?

AMSKY Technology's shares may have suffered, but its P/S remains high. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of AMSKY Technology revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

You always need to take note of risks, for example - AMSKY Technology has 2 warning signs we think you should be aware of.

If you're unsure about the strength of AMSKY Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300521

AMSKY Technology

Research, develops, manufactures, and sells industrial printing products in China and internationally.

Flawless balance sheet very low.

Market Insights

Community Narratives