- Taiwan

- /

- Semiconductors

- /

- TPEX:4749

Undiscovered Gems Featuring 3 Top Small Caps with Strong Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rising inflation and volatile Treasury yields, U.S. stock indexes are climbing toward record highs, with growth stocks leading the charge despite small-cap stocks lagging behind major indices like the S&P 500. In this environment of economic uncertainty and shifting market dynamics, identifying undiscovered gems among small-cap stocks requires a keen eye for companies with robust fundamentals and potential resilience in challenging conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Powertip Image | 0.57% | 10.95% | 29.26% | ★★★★★★ |

| Ad-Sol Nissin | NA | 7.54% | 9.63% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Fauji Foods | 62.10% | 30.05% | 58.43% | ★★★★★★ |

| Kenturn Nano. Tec | 45.38% | 9.73% | 28.94% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Hollyland (China) Electronics Technology | 3.46% | 13.95% | 11.27% | ★★★★★☆ |

| Pizu Group Holdings | 48.10% | -4.86% | -19.23% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Jintuo Technology (SHSE:603211)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jintuo Technology Co., Ltd. specializes in the research, development, production, and sale of aluminum alloy precision die castings with a market capitalization of approximately CN¥5 billion.

Operations: Jintuo Technology generates revenue through the production and sale of aluminum alloy precision die castings. The company has a market capitalization of approximately CN¥5 billion.

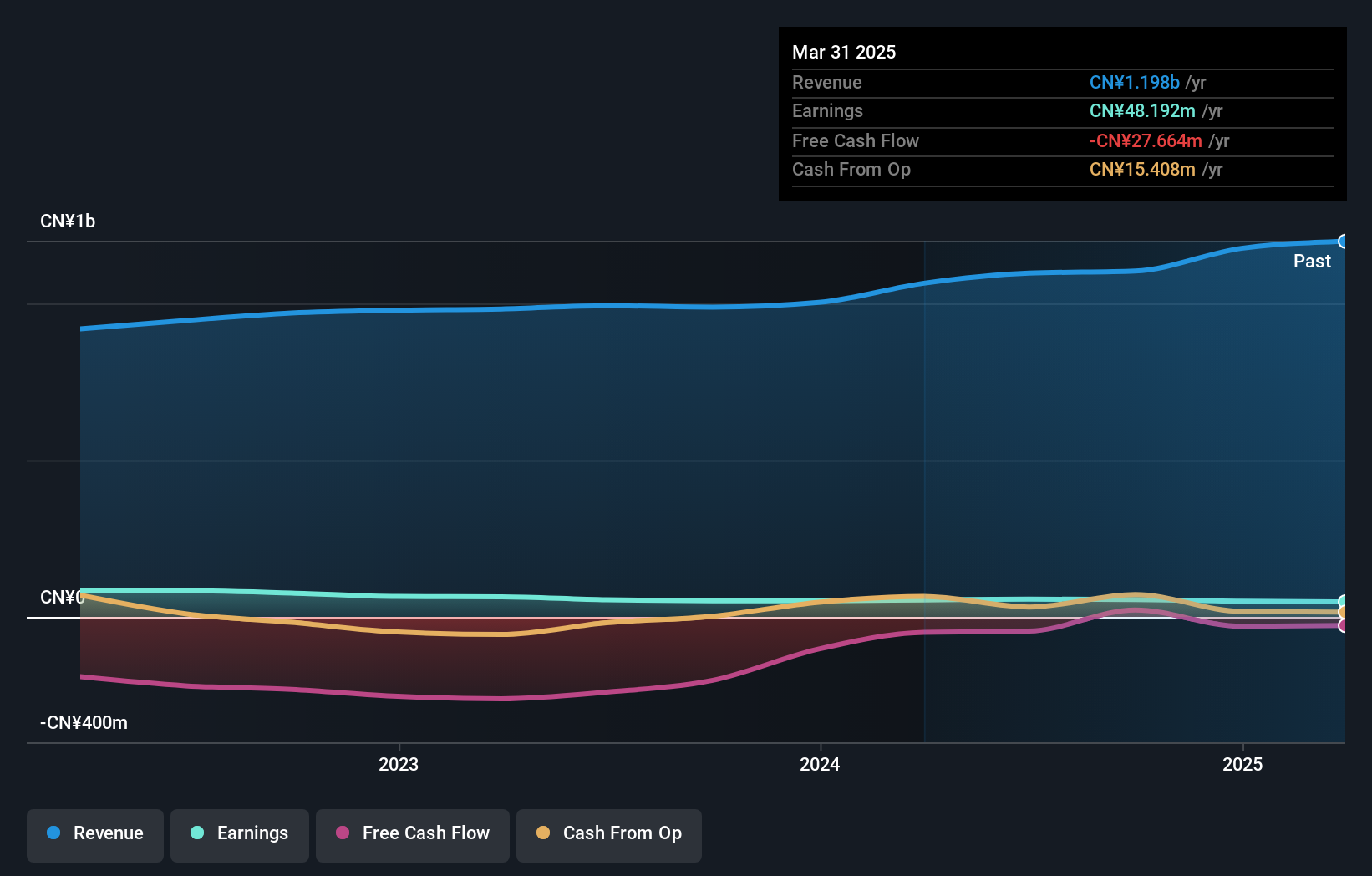

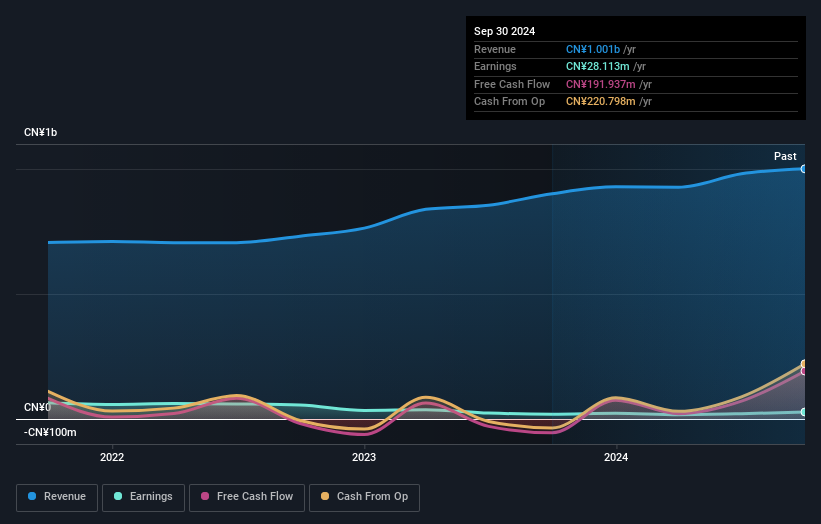

Jintuo Technology, a nimble player in the market, has outpaced its industry with a notable 7.8% earnings growth over the past year, compared to the Metals and Mining sector's -2.3%. Despite this achievement, its net debt to equity ratio rose from 29.9% to 36.6% over five years but remains satisfactory at 26.4%, indicating prudent financial management. The company's EBIT covers interest payments comfortably at 5.8 times, reflecting robust operational efficiency amidst a volatile share price environment recently observed over three months. With high-quality earnings reported and free cash flow turning positive as of September 2024 (US$22 million), Jintuo seems poised for continued resilience in its niche market space.

Jiangsu Newamstar Packaging MachineryLtd (SZSE:300509)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangsu Newamstar Packaging Machinery Co., Ltd specializes in the research, development, manufacturing, and sale of beverage packaging machinery both in China and internationally, with a market cap of CN¥2.53 billion.

Operations: Newamstar generates revenue primarily from the sale of beverage packaging machinery, with significant operations in both domestic and international markets. The company reported a gross profit margin of 35.67%, reflecting its ability to manage production costs relative to sales.

Jiangsu Newamstar, a dynamic player in the packaging machinery sector, is making waves with its recent financial performance. Over the past year, earnings surged by 44%, outpacing the broader machinery industry that saw a slight contraction. Despite this growth, its debt to equity ratio has climbed from 7 to 34 over five years, suggesting increased leverage. Interestingly, it trades at a significant discount of 89% below estimated fair value. This company also boasts more cash than total debt and has achieved profitability despite some volatility in share price recently. With these factors combined, Jiangsu Newamstar offers an intriguing investment proposition within its niche market segment.

Advanced Echem Materials (TPEX:4749)

Simply Wall St Value Rating: ★★★★★☆

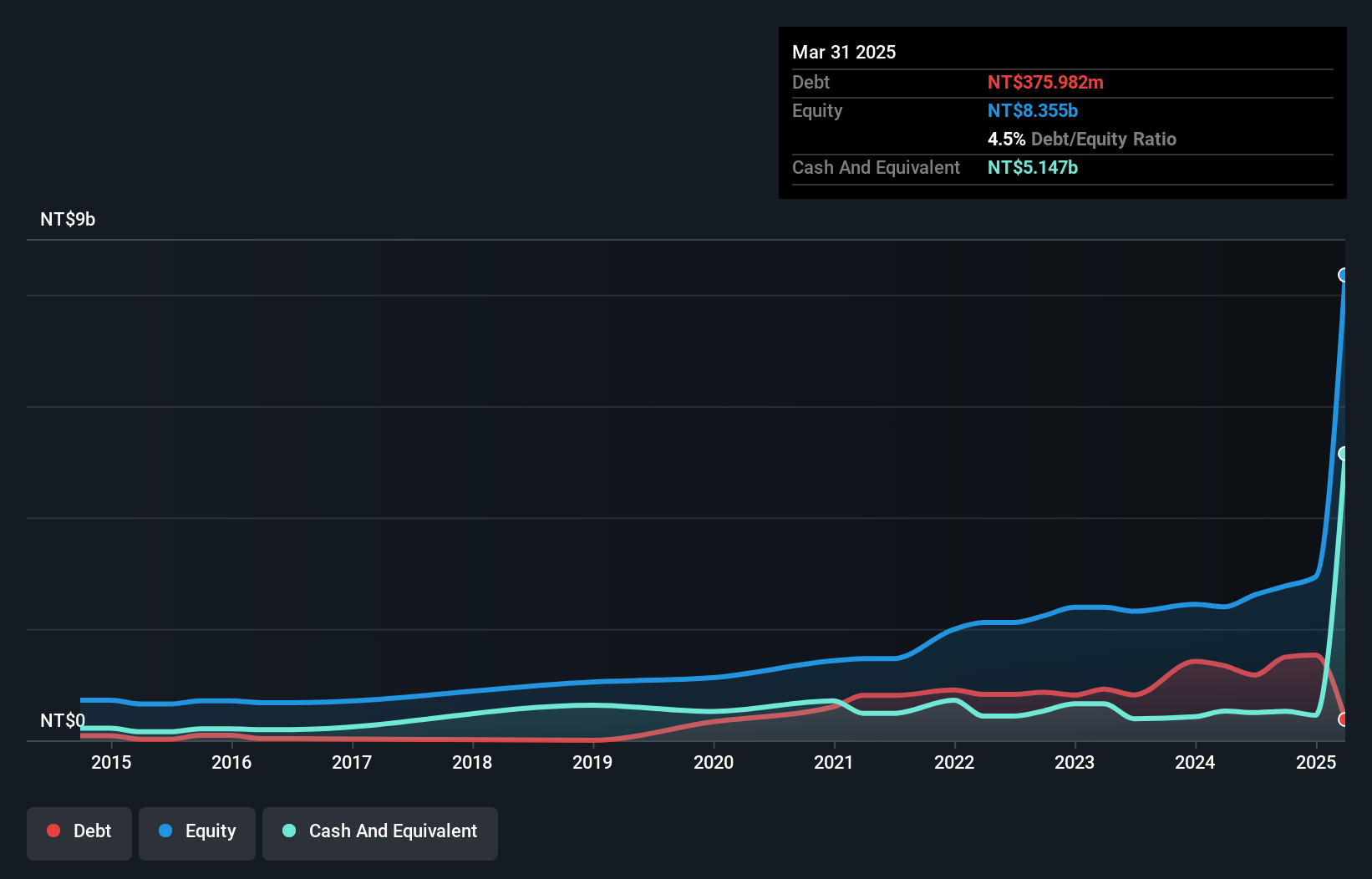

Overview: Advanced Echem Materials Company Limited specializes in the development and manufacturing of specialty chemical materials for semiconductor and display applications in Taiwan, with a market capitalization of NT$51.26 billion.

Operations: The company generates revenue primarily from electronic components and parts, amounting to NT$2.99 billion.

Advanced Echem Materials, a smaller player in the semiconductor industry, has shown impressive earnings growth of 72.5% over the past year, outpacing the industry's 5.9%. Despite its volatile share price recently, it maintains a satisfactory net debt to equity ratio of 35.1%, indicating balanced leverage. The company’s interest payments are comfortably covered by EBIT at a multiple of 68.3x. Recent capital activities include completing a follow-on equity offering worth TWD 4.94 billion (approximately US$163 million), which could bolster its financial position and support projected revenue growth of nearly 29% annually in coming years.

Taking Advantage

- Click this link to deep-dive into the 4713 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:4749

Advanced Echem Materials

Develops and manufactures special chemical materials for semiconductor and display applications in Taiwan.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives