Shenzhen Yinghe Technology Co., Ltd's (SZSE:300457) Shares Not Telling The Full Story

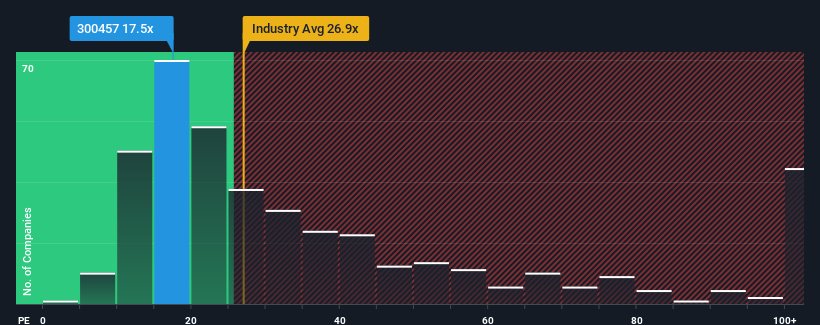

Shenzhen Yinghe Technology Co., Ltd's (SZSE:300457) price-to-earnings (or "P/E") ratio of 17.5x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 29x and even P/E's above 54x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Shenzhen Yinghe Technology as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Shenzhen Yinghe Technology

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Shenzhen Yinghe Technology's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 15% last year. The latest three year period has also seen an excellent 909% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 34% each year as estimated by the eight analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 25% each year, which is noticeably less attractive.

In light of this, it's peculiar that Shenzhen Yinghe Technology's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Shenzhen Yinghe Technology currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 1 warning sign for Shenzhen Yinghe Technology you should be aware of.

If these risks are making you reconsider your opinion on Shenzhen Yinghe Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300457

Shenzhen Yinghe Technology

Engages in the research and development, production, and sale of lithium-ion battery automation equipment in China.

High growth potential with excellent balance sheet.