The past three-year earnings decline for Wuxi Lead Intelligent EquipmentLTD (SZSE:300450) likely explains shareholders long-term losses

Wuxi Lead Intelligent Equipment CO.,LTD. (SZSE:300450) shareholders should be happy to see the share price up 18% in the last month. But that doesn't change the fact that the returns over the last three years have been disappointing. Tragically, the share price declined 64% in that time. Some might say the recent bounce is to be expected after such a bad drop. After all, could be that the fall was overdone.

On a more encouraging note the company has added CN¥3.9b to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

See our latest analysis for Wuxi Lead Intelligent EquipmentLTD

We don't think that Wuxi Lead Intelligent EquipmentLTD's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last three years, Wuxi Lead Intelligent EquipmentLTD saw its revenue grow by 15% per year, compound. That's a fairly respectable growth rate. So some shareholders would be frustrated with the compound loss of 18% per year. To be frank we're surprised to see revenue growth and share price growth diverge so strongly. It would be well worth taking a closer look at the company, to determine growth trends (and balance sheet strength).

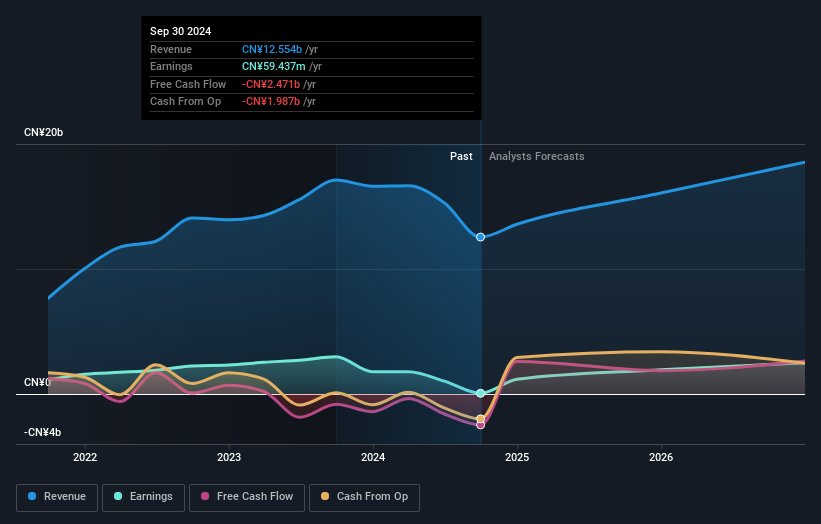

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Wuxi Lead Intelligent EquipmentLTD is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Wuxi Lead Intelligent EquipmentLTD will earn in the future (free analyst consensus estimates)

A Different Perspective

Wuxi Lead Intelligent EquipmentLTD shareholders are up 13% for the year (even including dividends). But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 5% per year, over five years. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Wuxi Lead Intelligent EquipmentLTD better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Wuxi Lead Intelligent EquipmentLTD you should be aware of, and 2 of them are a bit concerning.

But note: Wuxi Lead Intelligent EquipmentLTD may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Lead Intelligent EquipmentLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300450

Wuxi Lead Intelligent EquipmentLTD

Develops, manufactures, and sells intelligent equipment in China.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives