- China

- /

- Electrical

- /

- SZSE:300407

Subdued Growth No Barrier To Tianjin Keyvia Electric Co.,Ltd (SZSE:300407) With Shares Advancing 26%

Tianjin Keyvia Electric Co.,Ltd (SZSE:300407) shares have continued their recent momentum with a 26% gain in the last month alone. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

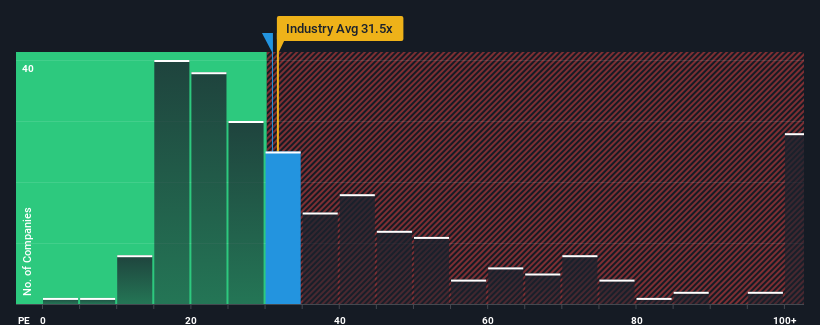

Although its price has surged higher, there still wouldn't be many who think Tianjin Keyvia ElectricLtd's price-to-earnings (or "P/E") ratio of 30.9x is worth a mention when the median P/E in China is similar at about 32x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Tianjin Keyvia ElectricLtd has been doing a decent job lately as it's been growing earnings at a reasonable pace. It might be that many expect the respectable earnings performance to only match most other companies over the coming period, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Tianjin Keyvia ElectricLtd

What Are Growth Metrics Telling Us About The P/E?

Tianjin Keyvia ElectricLtd's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a decent 6.9% gain to the company's bottom line. The latest three year period has also seen a 8.1% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 39% shows it's noticeably less attractive on an annualised basis.

With this information, we find it interesting that Tianjin Keyvia ElectricLtd is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

What We Can Learn From Tianjin Keyvia ElectricLtd's P/E?

Its shares have lifted substantially and now Tianjin Keyvia ElectricLtd's P/E is also back up to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Tianjin Keyvia ElectricLtd currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

You always need to take note of risks, for example - Tianjin Keyvia ElectricLtd has 2 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Tianjin Keyvia ElectricLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300407

Tianjin Keyvia ElectricLtd

Engages in the research and development, production, and sales of electrified railway and urban rail transit traction power supply systems in China.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives