Hanyu Group Joint-Stock Co., Ltd.'s (SZSE:300403) Price Is Right But Growth Is Lacking After Shares Rocket 45%

Hanyu Group Joint-Stock Co., Ltd. (SZSE:300403) shareholders have had their patience rewarded with a 45% share price jump in the last month. Looking further back, the 15% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

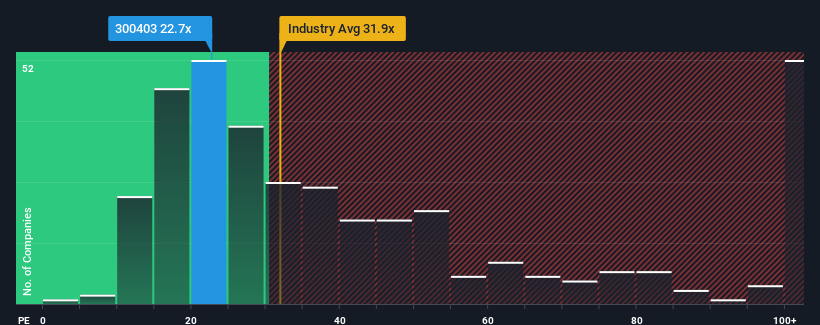

In spite of the firm bounce in price, Hanyu Group's price-to-earnings (or "P/E") ratio of 22.7x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 34x and even P/E's above 64x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Hanyu Group has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Hanyu Group

What Are Growth Metrics Telling Us About The Low P/E?

Hanyu Group's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 10% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 4.1% overall drop in EPS. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 11% per annum during the coming three years according to the two analysts following the company. That's shaping up to be materially lower than the 19% per annum growth forecast for the broader market.

In light of this, it's understandable that Hanyu Group's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Hanyu Group's P/E?

Hanyu Group's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Hanyu Group's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 2 warning signs for Hanyu Group that we have uncovered.

If you're unsure about the strength of Hanyu Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hanyu Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300403

Hanyu Group

Researches, develops, produces, and sells drainage pumps for household appliances in China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives