- China

- /

- Electrical

- /

- SZSE:300286

Cautious Investors Not Rewarding Acrel Co.,Ltd.'s (SZSE:300286) Performance Completely

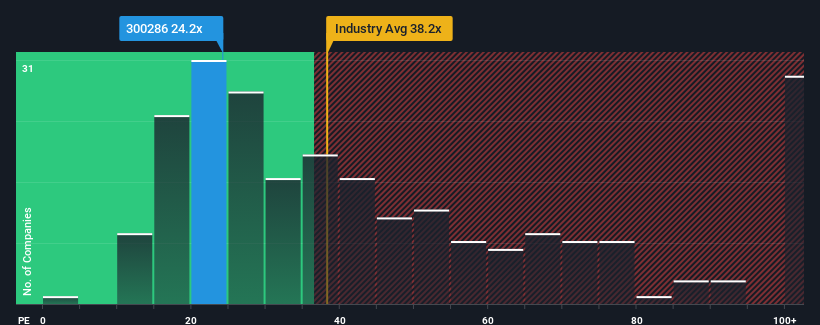

Acrel Co.,Ltd.'s (SZSE:300286) price-to-earnings (or "P/E") ratio of 24.2x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 37x and even P/E's above 72x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times haven't been advantageous for AcrelLtd as its earnings have been falling quicker than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for AcrelLtd

Does Growth Match The Low P/E?

In order to justify its P/E ratio, AcrelLtd would need to produce sluggish growth that's trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 9.1%. Regardless, EPS has managed to lift by a handy 22% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 63% during the coming year according to the four analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 37%, which is noticeably less attractive.

With this information, we find it odd that AcrelLtd is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of AcrelLtd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for AcrelLtd you should know about.

You might be able to find a better investment than AcrelLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300286

AcrelLtd

Researches, develops, produces, and sells equipment and systems required for energy efficiency management of medium and low voltage for enterprise microgrids in China.

Exceptional growth potential with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives