Undiscovered Gems in Asia with Strong Fundamentals April 2025

Reviewed by Simply Wall St

Amidst heightened global trade tensions and economic uncertainty, Asian markets have experienced significant volatility, with small-cap stocks facing particular challenges due to recent tariff announcements. In such an environment, identifying stocks with strong fundamentals becomes crucial as they may offer resilience and potential for growth despite broader market pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Imuraya Group | 11.51% | 3.86% | 33.46% | ★★★★★★ |

| DoshishaLtd | NA | 2.43% | 2.36% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | 0.57% | 18.65% | ★★★★★★ |

| Center International GroupLtd | 27.06% | 1.89% | -39.77% | ★★★★★★ |

| Hiconics Eco-energy Technology | NA | 22.02% | 16.46% | ★★★★★★ |

| Suzhou Nanomicro Technology | 7.29% | 23.88% | -2.17% | ★★★★★★ |

| CMC | 1.28% | 2.43% | 10.81% | ★★★★★☆ |

| INCAR FINANCIAL SERVICE | 33.47% | 34.52% | 40.92% | ★★★★★☆ |

| Shanghai Haixin Group | 0.77% | 1.60% | 8.25% | ★★★★★☆ |

| Hollyland (China) Electronics Technology | 3.46% | 13.95% | 11.27% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Guangdong Jinming Machinery (SZSE:300281)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangdong Jinming Machinery Co., Ltd. specializes in the manufacturing and sale of plastic film extrusion machinery in China, with a market capitalization of approximately CN¥2.80 billion.

Operations: Jinming Machinery generates revenue primarily from the sale of plastic film extrusion machinery. The company has a market capitalization of approximately CN¥2.80 billion.

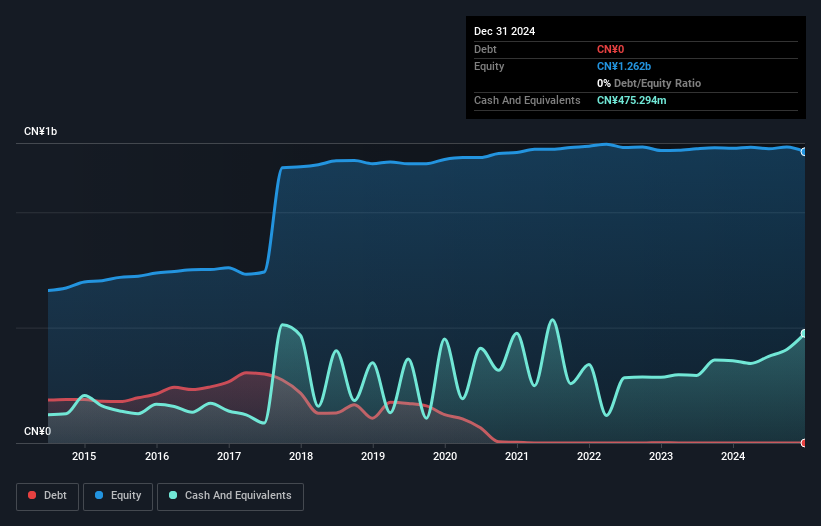

Guangdong Jinming Machinery, a nimble player in the machinery sector, is debt-free with a notable 5.9% earnings growth over the past year, outpacing the industry's 0.3%. Despite a volatile share price recently, it trades at 53% below its estimated fair value. The company reported revenue of CNY 474 million and net income of CNY 7.11 million for 2024, slightly up from last year. A significant one-off gain of CNY 11.8 million influenced its financials for the year ending December 2024. Additionally, it proposed a cash dividend of CNY 0.20 per ten shares for shareholders in March 2025.

- Delve into the full analysis health report here for a deeper understanding of Guangdong Jinming Machinery.

Gain insights into Guangdong Jinming Machinery's past trends and performance with our Past report.

COFCO Technology & Industry (SZSE:301058)

Simply Wall St Value Rating: ★★★★★☆

Overview: COFCO Technology & Industry Co., Ltd. is a scientific and technological company that serves as an agricultural food engineering technology service provider and grain machine products supplier, with a market cap of CN¥5.95 billion.

Operations: COFCO Technology & Industry generates revenue primarily from its agricultural food engineering technology services and grain machine products. The company's net profit margin is 8.5%, reflecting the efficiency of its operations relative to total sales.

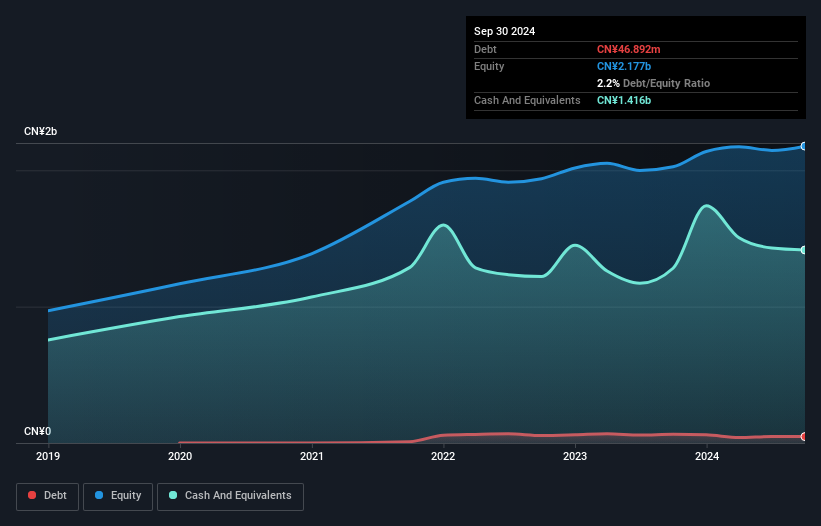

COFCO Technology & Industry, a small player in the Asian market, has shown impressive earnings growth of 26.5% over the past year, outpacing the construction industry's -1.8%. The company is trading at 11.9% below its estimated fair value and boasts high-quality earnings with a debt-to-equity ratio that increased from 0% to 2.2% over five years. Recent board changes include appointing Zhu Laibin and others as non-independent directors, indicating strategic shifts. With free cash flow positive and more cash than total debt, COFCO seems positioned for future growth despite recent share price volatility.

- Click here and access our complete health analysis report to understand the dynamics of COFCO Technology & Industry.

Understand COFCO Technology & Industry's track record by examining our Past report.

HeiwadoLtd (TSE:8276)

Simply Wall St Value Rating: ★★★★★☆

Overview: Heiwado Co., Ltd. is a Japanese company that operates in the retail sector, focusing on food, clothing, and housing-related products, with a market cap of ¥133.79 billion.

Operations: Heiwado generates revenue primarily from its retail segment, which accounts for ¥424.92 billion. The retail surroundings segment contributes an additional ¥56.18 billion to the company's overall revenue.

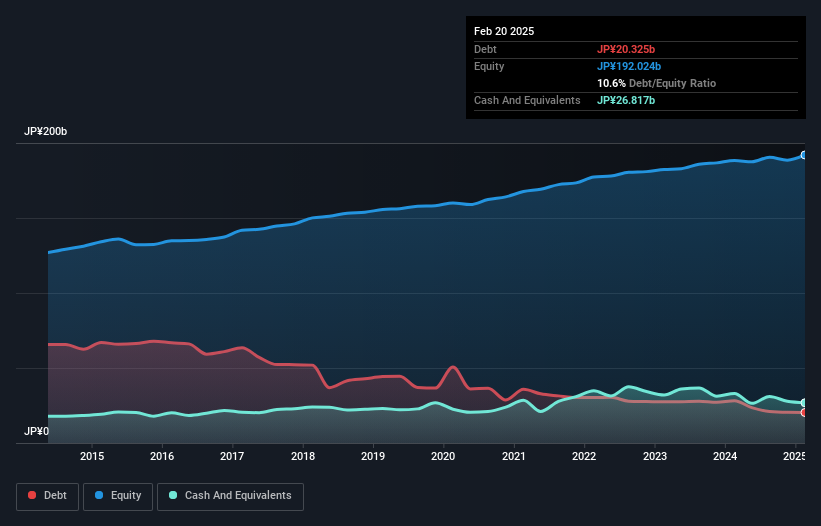

Heiwado Ltd. seems to be making waves with its robust financial health and strategic moves. The company's debt to equity ratio has impressively decreased from 31.6% to 10.6% over five years, indicating prudent financial management. With earnings growth of 58%, it outpaces the industry average of 8.9%, showcasing strong operational performance and high-quality earnings that bolster investor confidence. Recent board decisions, including a proposed merger with Yell Co., Ltd., reflect an ambition for expansion, while maintaining dividends at ¥33 per share signals a commitment to shareholder returns amidst growing revenues projected at ¥456 billion for the year ahead.

- Take a closer look at HeiwadoLtd's potential here in our health report.

Evaluate HeiwadoLtd's historical performance by accessing our past performance report.

Seize The Opportunity

- Dive into all 2592 of the Asian Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300281

Guangdong Jinming Machinery

Manufactures and sells a range of plastic film extrusion machineries in China.

Flawless balance sheet slight.

Market Insights

Community Narratives