As global markets grapple with geopolitical tensions and consumer spending concerns, major indexes have experienced volatility, with the S&P 500 Index reaching record highs early in the week before ultimately declining. Amid this backdrop of uncertainty and fluctuating economic indicators, investors may find value by focusing on stocks with strong fundamentals that demonstrate resilience and potential for growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Central Forest Group | NA | 5.93% | 20.71% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Nippon Sharyo | 59.09% | -1.22% | -12.92% | ★★★★☆☆ |

| Sociedad Eléctrica del Sur Oeste | 42.67% | 8.52% | 4.10% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Chongqing Mas Sci.&Tech.Co.Ltd (SZSE:300275)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Chongqing Mas Sci.&Tech.Co., Ltd. specializes in providing safety technology equipment and safety information services in China, with a market cap of CN¥4.26 billion.

Operations: Chongqing Mas Sci.&Tech.Co., Ltd. generates revenue primarily from its safety technology equipment and safety information services in China. The company has a market cap of CN¥4.26 billion, reflecting its position in the industry.

Chongqing Mas Sci.&Tech.Co.Ltd. has shown promising growth, with earnings increasing by 15.8% over the past year, outpacing the Machinery industry's -0.06%. The company's net debt to equity ratio stands at a satisfactory 14.1%, although it has risen from 8.8% to 18.1% in five years, suggesting a cautious approach to leverage might be needed moving forward. Despite not being free cash flow positive, its interest payments are well covered by EBIT at an impressive 97 times coverage, indicating strong operational performance and financial health amidst recent corporate governance updates and share buybacks totaling CNY25 million for nearly 2.68 million shares repurchased under their current plan.

JiangSu JiuWu Hi-Tech (SZSE:300631)

Simply Wall St Value Rating: ★★★★★★

Overview: JiangSu JiuWu Hi-Tech Co., Ltd. focuses on the research, development, and sale of ceramic membranes, organic membranes, and adsorbents in China with a market capitalization of CN¥2.76 billion.

Operations: JiuWu Hi-Tech generates revenue primarily from the sale of ceramic and organic membranes, as well as adsorbents. The company's financial performance is influenced by its ability to manage production costs and optimize pricing strategies.

JiangSu JiuWu Hi-Tech, a promising player in its sector, has shown impressive earnings growth of 50.7% over the past year, outpacing the Commercial Services industry’s modest 1.7%. The company seems to be trading at an attractive valuation, currently 72.1% below estimated fair value. Despite this growth trajectory, financial results were impacted by a one-off gain of CN¥9.5M in the last year ending September 2024. Notably, its debt to equity ratio improved significantly from 36.4% to just 5.1% over five years, indicating prudent financial management and positioning it well for future growth prospects.

- Click here to discover the nuances of JiangSu JiuWu Hi-Tech with our detailed analytical health report.

Assess JiangSu JiuWu Hi-Tech's past performance with our detailed historical performance reports.

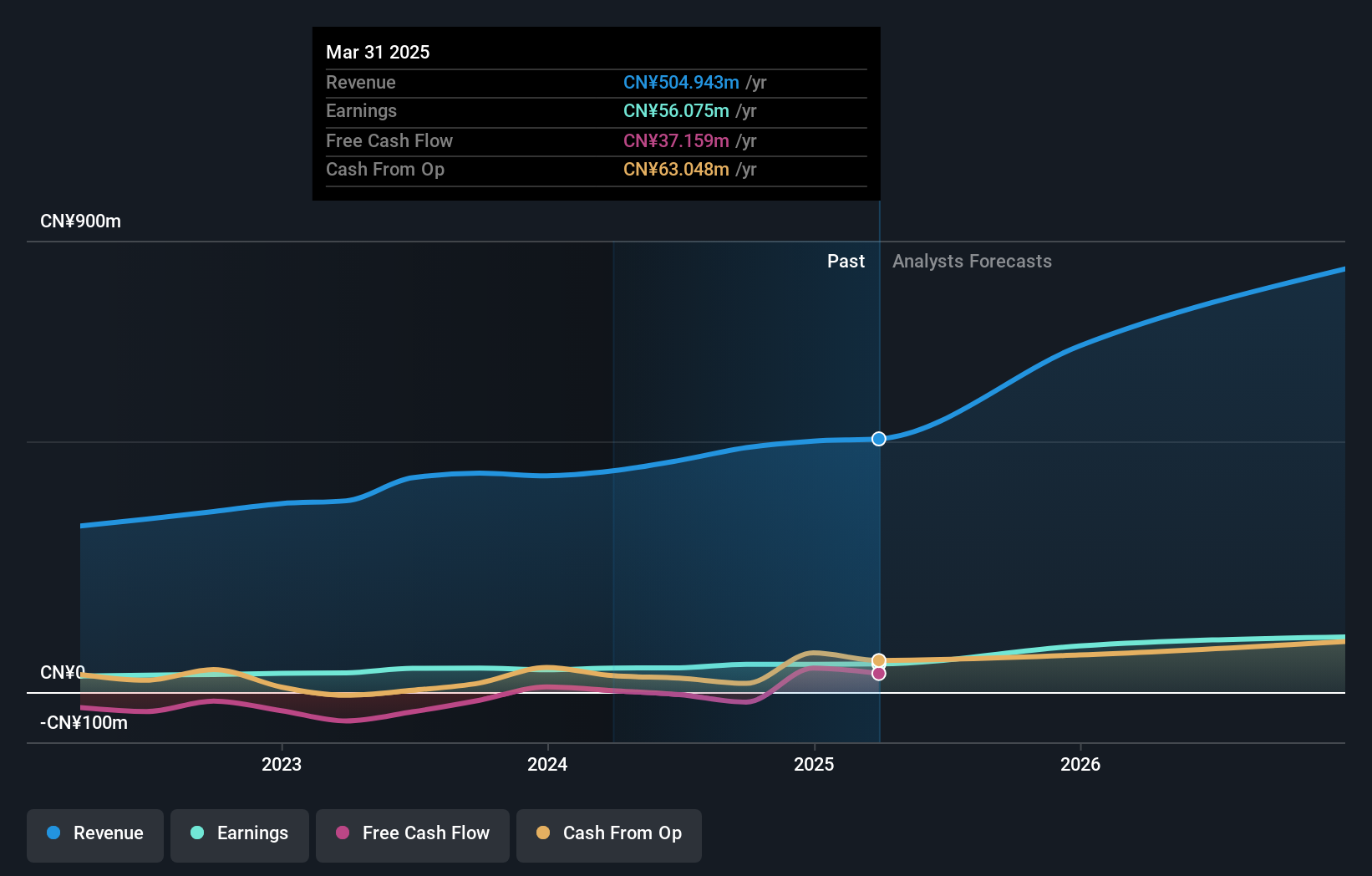

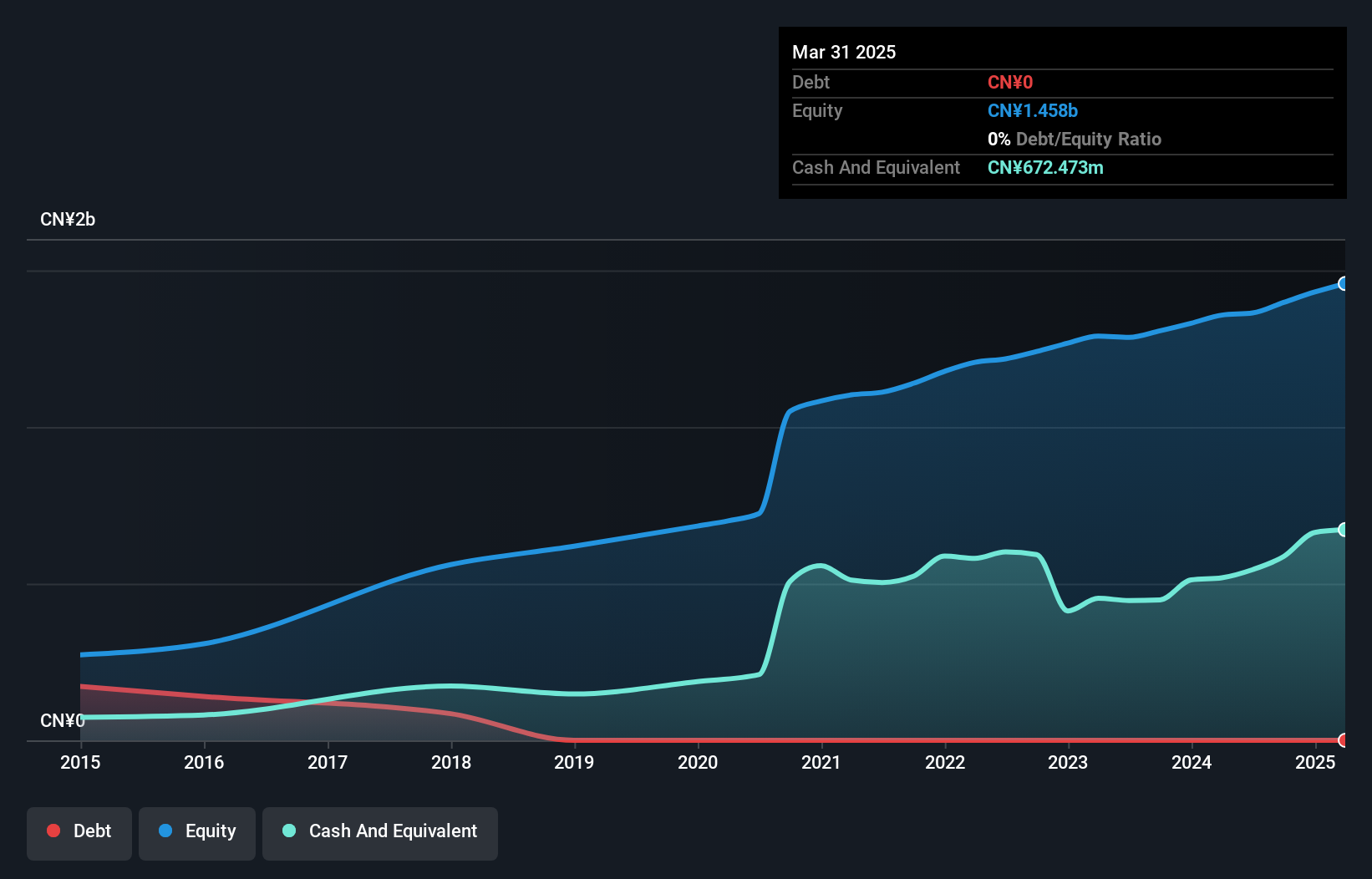

HG Technologies (SZSE:300847)

Simply Wall St Value Rating: ★★★★★★

Overview: HG Technologies Co., Ltd. focuses on the research, development, production, and sale of electrostatic imaging special information products in China, with a market cap of CN¥5.07 billion.

Operations: HG Technologies generates revenue primarily from the sale of electrostatic imaging special information products. The company's net profit margin is 15.2%, indicating its profitability after accounting for all expenses.

HG Technologies stands out with its robust financial health, operating debt-free for the past five years. The company's profitability is evident as it boasts high-quality earnings and a significant 20.8% growth in earnings over the last year, outpacing the Commercial Services industry average of 1.7%. Levered free cash flow has shown an upward trend, reaching US$169.38 million by September 2024, indicating effective capital management despite fluctuations in capital expenditure and working capital changes. These factors suggest HG Technologies is well-positioned within its sector, highlighting potential for continued stability and growth.

- Get an in-depth perspective on HG Technologies' performance by reading our health report here.

Gain insights into HG Technologies' past trends and performance with our Past report.

Summing It All Up

- Click here to access our complete index of 4750 Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300275

Chongqing Mas Sci.&Tech.Co.Ltd

Engages in the research, development, design, production, marketing, operation, and maintenance of technologies and equipment in the field of the Internet of Things and security in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives