As global markets continue to navigate political developments and economic shifts, U.S. stocks have been buoyed by optimism surrounding trade policies and advancements in artificial intelligence, with major indices reaching new highs. In this environment, growth stocks have outpaced their value counterparts, capturing the attention of investors looking for robust opportunities. A key characteristic of a promising stock in such conditions is strong insider ownership, which often signals confidence from those closest to the company's operations and strategy.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 20.5% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.6% |

| Pharma Mar (BME:PHM) | 11.9% | 55.1% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| HANA Micron (KOSDAQ:A067310) | 18.2% | 119.4% |

| Findi (ASX:FND) | 35.8% | 110.7% |

We're going to check out a few of the best picks from our screener tool.

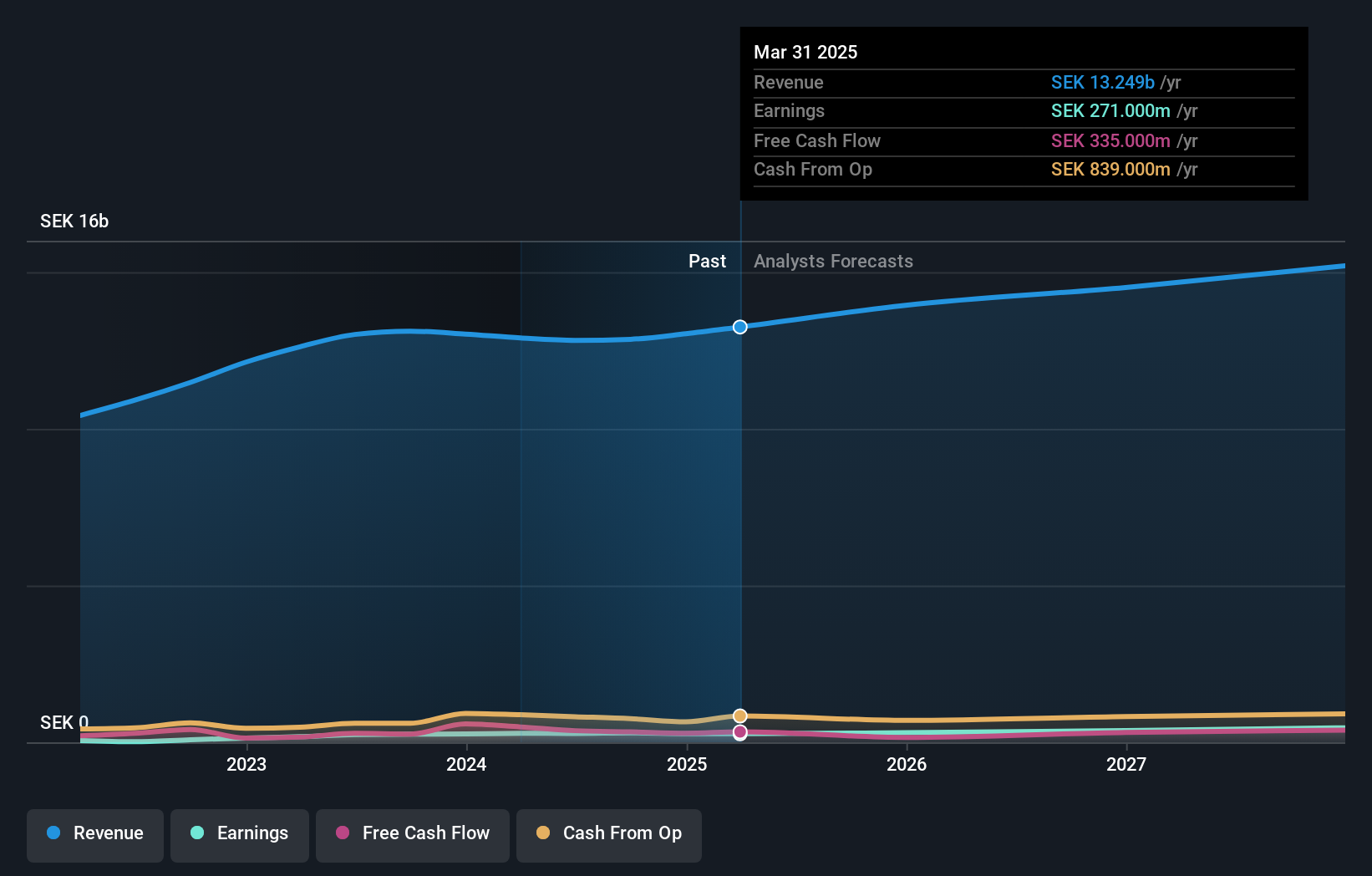

Scandi Standard (OM:SCST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Scandi Standard AB (publ) is engaged in the production and sale of chilled, frozen, and ready-to-eat chicken products across Sweden, Norway, Ireland, Denmark, Finland, Germany, the United Kingdom, rest of Europe and internationally with a market cap of SEK5.45 billion.

Operations: The company's revenue is derived from its Ready-To-Cook segment, which generated SEK9.80 billion, and its Ready-To-Eat segment, contributing SEK2.56 billion.

Insider Ownership: 14.9%

Earnings Growth Forecast: 20.7% p.a.

Scandi Standard's earnings are forecast to grow significantly at 20.7% annually, outpacing the Swedish market average. Revenue growth is also expected to surpass the market, albeit at a slower rate of 5.4%. Despite an unstable dividend track record and high debt levels, insider confidence is evident with substantial buying activity and no significant selling in recent months. The stock trades at 51.3% below estimated fair value but shows low future Return on Equity projections.

- Dive into the specifics of Scandi Standard here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential undervaluation of Scandi Standard shares in the market.

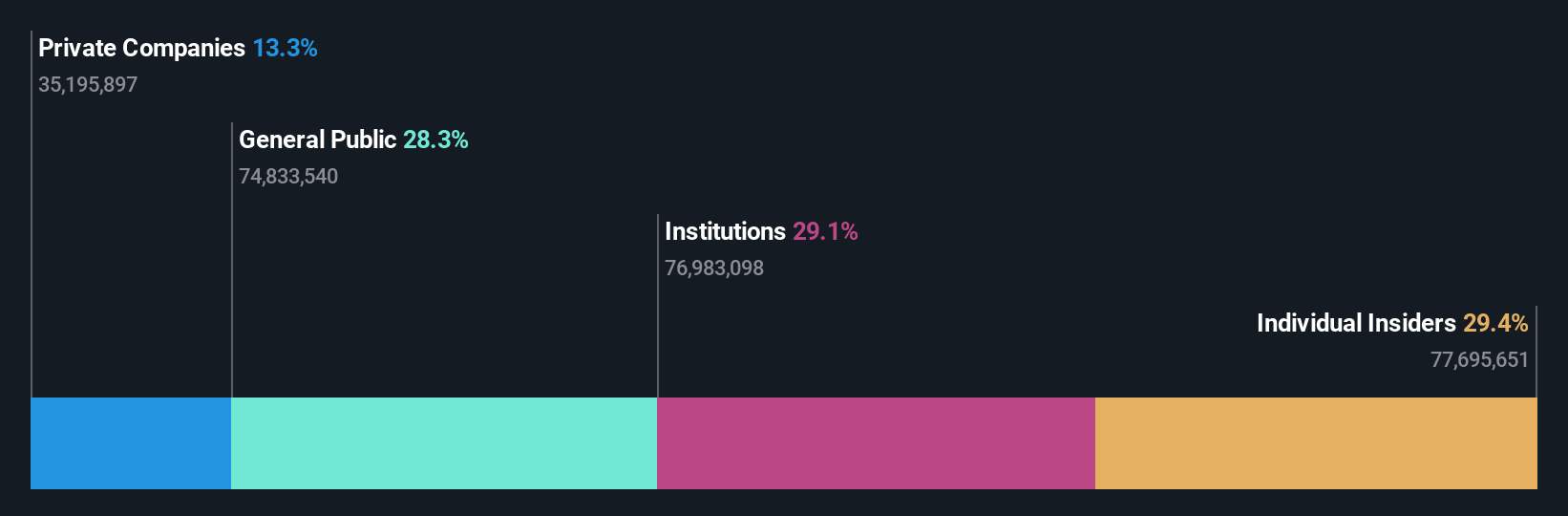

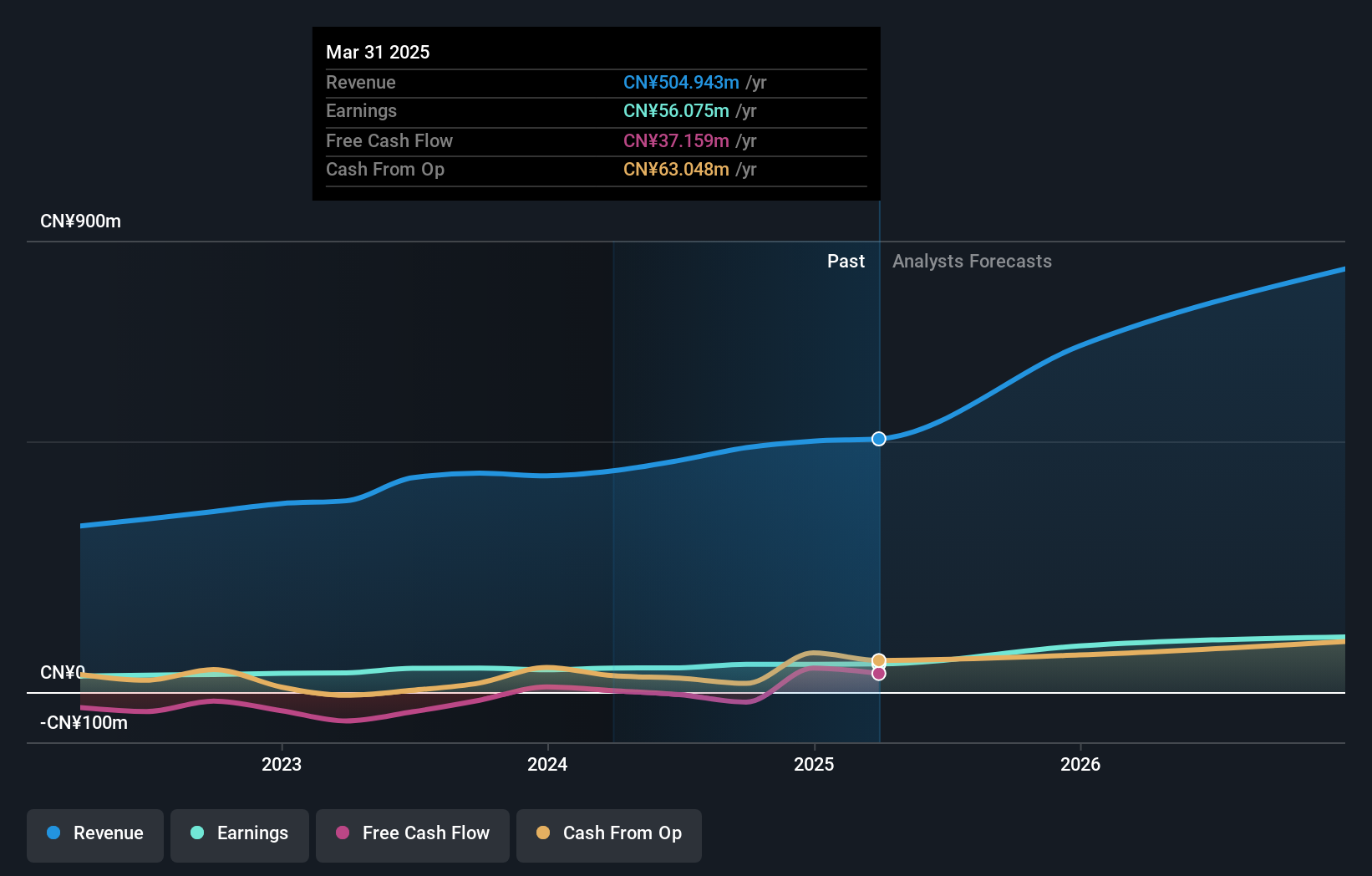

Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Zelgen Biopharmaceuticals Co., Ltd. operates in the biopharmaceutical industry, focusing on the development and commercialization of innovative drugs, with a market cap of CN¥17.42 billion.

Operations: The company's revenue is primarily derived from its pharmaceuticals segment, amounting to CN¥488.45 million.

Insider Ownership: 29.4%

Earnings Growth Forecast: 127.9% p.a.

Suzhou Zelgen Biopharmaceuticals is positioned for substantial growth, with earnings expected to rise 127.93% annually and revenue projected to grow at an impressive 61.5%, outpacing the Chinese market significantly. The company is trading at 56.1% below its estimated fair value, presenting a potential opportunity despite low future Return on Equity forecasts of 16.1%. No recent insider buying or selling activity has been reported over the past three months.

- Get an in-depth perspective on Suzhou Zelgen BiopharmaceuticalsLtd's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Suzhou Zelgen BiopharmaceuticalsLtd's shares may be trading at a premium.

Chongqing Mas Sci.&Tech.Co.Ltd (SZSE:300275)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chongqing Mas Sci.&Tech.Co.,Ltd. offers safety technology equipment and safety information services in China, with a market cap of CN¥4.08 billion.

Operations: The company generates revenue from its safety technology equipment and safety information services in China.

Insider Ownership: 21.8%

Earnings Growth Forecast: 29.1% p.a.

Chongqing Mas Sci.&Tech.Co.Ltd. is poised for robust growth, with earnings projected to increase by 29.15% annually and revenue expected to rise by 23.7%, both surpassing the Chinese market averages. Despite a low future Return on Equity forecast of 10%, the company's insider ownership remains significant, providing potential alignment with shareholder interests. Recent events include a completed share buyback and discussions on capital structure adjustments at a special shareholders meeting in December 2024.

- Click here and access our complete growth analysis report to understand the dynamics of Chongqing Mas Sci.&Tech.Co.Ltd.

- The analysis detailed in our Chongqing Mas Sci.&Tech.Co.Ltd valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Navigate through the entire inventory of 1482 Fast Growing Companies With High Insider Ownership here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688266

Suzhou Zelgen BiopharmaceuticalsLtd

Suzhou Zelgen Biopharmaceuticals Co.,Ltd.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives